Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 29, 2019

Ontario manufacturing business conditions improve at weakest rate since November 2016

- Headline PMI sinks to near two-and-a-half year low of 50.4

- New Exports Orders Index indicates softer overseas demand

- Manufacturing output charge inflation down notably from mid-2018 peak

Manufacturing business conditions across Ontario improved in April at the weakest rate since November 2016, as manufacturing order books softened amid a downturn in export sales.

At 50.4 in April, down from 51.3 in March, the IHS Markit Purchasing Managers' Index® (PMI®) for Ontario indicated the weakest overall improvement in manufacturing conditions since November 2016. Despite this, operating conditions for Ontario's manufacturers have now improved on a monthly basis for six years. In accordance with the weaker PMI trends, IHS Markit forecasts a -0.1% dip in manufacturing output across Ontario in 2019, down from the 2.2% expansion seen in 2018.

Overseas demand falters

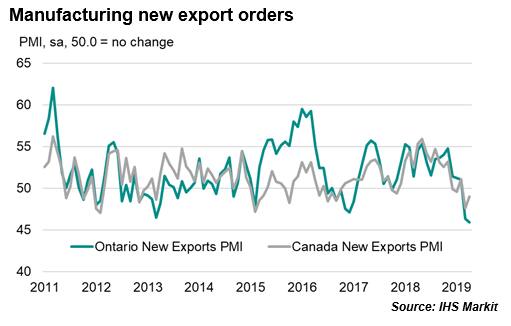

April data highlighted the persistent weakness in overseas demand conditions for Ontario manufacturers, with the largest contraction in export sales since the index began in 2011. Moreover, the rate of decline was sharper than the downturn observed for Canadian manufacturers as a whole.

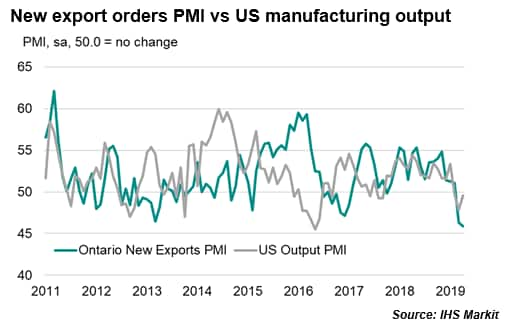

Some provincial manufacturing firms pointed to softening demand conditions among US customers as the principal factor behind the latest fall in overseas demand, and when looking at a comparison against the US manufacturing PMI data we can see that the recent downturn in Ontario's manufacturing export performance has been closely linked to softer US manufacturing conditions.

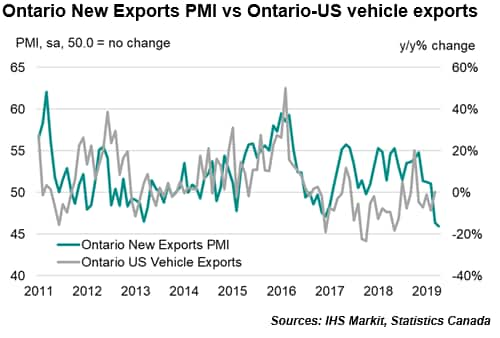

The strong relationship highlights the interdependent manufacturing supply chains across Ontario and the US Great Lakes region. This is especially important when assessing the relative importance of automobile production for Canada's largest province.

The softening of overseas demand conditions and automotive sales in particular has contributed to a worsening outlook for future output among survey contributors, and could be linked to the closure of the GM Oshawa plant in Central Ontario. Latest data from automakers showed a year-on-year drop of 4.6% in new vehicle sales during April1, with February 2018 the last time Canadian sales were up compared to a year ago. On a national level, IHS Markit forecasts total automotive registrations to decline by 2.7% in 2019.

Fractional decline in output

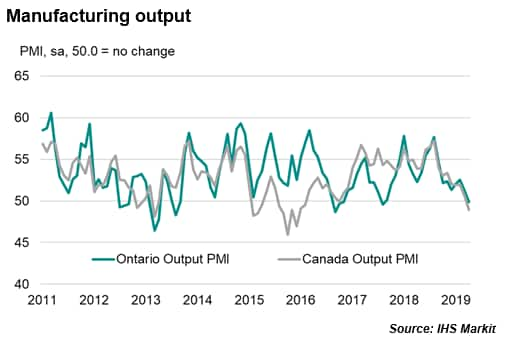

At 49.9 in April, the seasonally adjusted Ontario PMI Output Index indicated the first contraction in manufacturing output since August 2017, but the corresponding index for Canada indicated an even steeper decline.

April's divergence of +1.0 index points above the Canada PMI Output Index is the largest in over a year and marks a turnaround from the averages of -2.3 and -0.4 during 2017 and 2018 respectively.

Customer demand softens

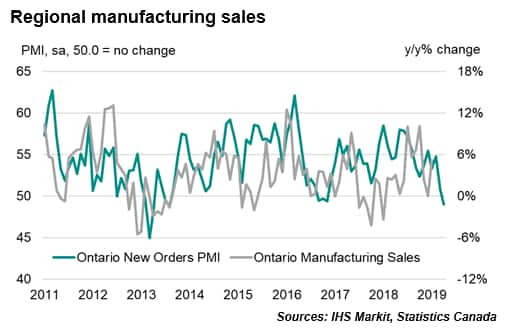

Manufacturing sales appear to be growing at a markedly slower pace, with customer demand softening from its recent peaks in 2018. The PMI New Orders Index implies manufacturing sales are broadly flatlining on a year-on-year basis for Ontario. The rate of manufacturing sales growth has eased notably from the recent highs of around 10% seen in mid-2018.

Easing of selling price inflation

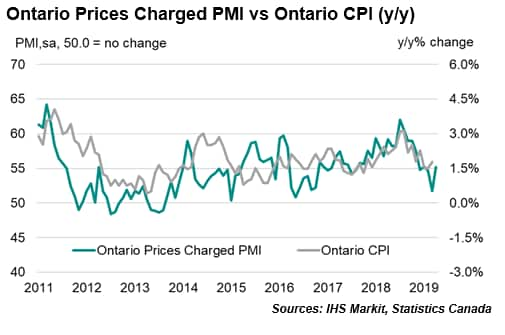

With the weakening of both output and new order trends since the start of 2019, Ontario manufacturing firms have attempted to stimulate demand by slowing their selling price rises. When looking at official data, the rate of consumer price inflation has eased notably from its recent peak in mid-2018.

Moreover, the Ontario PMI Prices Charged Index has tended to provide an indication of coming price pressures, two months ahead of official data and currently signals an underlying CPI rate of around 1.5%.

Summary

The latest PMI data show that manufacturing activity across Ontario is slowing. With weaker readings for new business seen alongside a sharp contraction in export sales, the near-term outlook appears to have softened. Moreover, the recent slowdown in US manufacturing conditions increases the risk that export sales will remain on a downward trajectory for Ontario manufacturers.

That said, there are some bright spots in the marked easing of both input cost and consumer price inflation from the highs seen in 2018. If continued, the weaker rise in purchasing costs could provide scope for price discounting and help bolster prospects for manufacturers throughout 2019.

Canada Manufacturing PMI data for May are available June 3.

1https://canada.autonews.com/retail/april-sales-down-46-consumer-confidence-wanes

Amritpal Virdee, Economist, IHS Markit

Tel: +44 207 064 6460

amritpal.virdee@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fon-mfg-business-conditions-improve-at-weakest-rate-since-nov-16-290519.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fon-mfg-business-conditions-improve-at-weakest-rate-since-nov-16-290519.html&text=Ontario+manufacturing+business+conditions+improve+at+weakest+rate+since+November+2016+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fon-mfg-business-conditions-improve-at-weakest-rate-since-nov-16-290519.html","enabled":true},{"name":"email","url":"?subject=Ontario manufacturing business conditions improve at weakest rate since November 2016 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fon-mfg-business-conditions-improve-at-weakest-rate-since-nov-16-290519.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ontario+manufacturing+business+conditions+improve+at+weakest+rate+since+November+2016+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fon-mfg-business-conditions-improve-at-weakest-rate-since-nov-16-290519.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}