Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 24, 2020

North American IG Credit

Fed announcement reaction & context

- IG credits rally on announcement of Fed purchases

- Oil & Gas sector lags on emerging credit risk

- CDX Investment Grade tightens

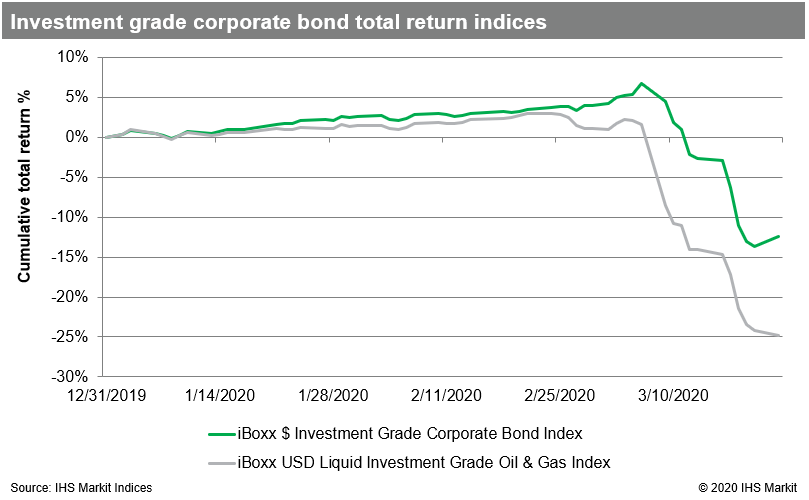

USD investment grade corporate bonds rallied on Monday following the Fed's announcement of their emergency action to support financial markets and the economy during the coronavirus pandemic. The iBoxx $ Liquid Investment Grade Index (IBOXIG) returned 1.41% for the day; within IBOXIG, AAA-rated debt, Telcom issuers and long duration had the largest reaction to the announcement. Despite the Fed reaction rally, the IG index has a -15.66% return so far in March.

AAA-rated corporate debt returned 4.18% on Monday, while returning -8.95% MTD. Telcom names returned 3.45% Monday, versus -16.03% in March. Corporate bonds in IBOXIG with 10 years or more to maturity returned 3.31%, though have lost 20.51% MTD.

Investment grade Energy issuers continued losses, the only sector in the red on Monday, losing 0.81%. Energy has also been the loss leader for the month, returning -25.63% MTD. Nine issuers in the Energy sector have seen the value of their bonds decline by more than 40% MTD. While some Energy sector issuers have underperformed over emergent credit risks, the sector also contains some of the best performing credits. Three IG Energy issuers have seen their bonds decline by less than 10% MTD; apart from Energy, only 67 other issuers' bonds have declined by less than 10%, 264 issuers fell further MTD.

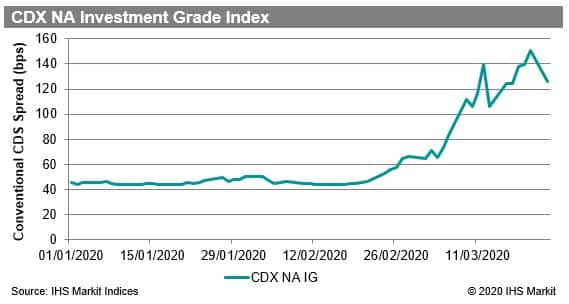

As IG credits rallied, the CDX NA IG index tightened sharply to 125.8bps, reversing the index move from Wednesday to Friday of last week. While the reaction was notable, context is important: the index reached a post-2009 wide on Friday and remains 59bps wider than the end of February. Zooming in on the constituents, 88 single name contracts wider than Friday, 70% of all constituents.

Conclusion:

Investment Grade credits reacted to the Fed announcement, but the relief rally was not consistent across IG issuers and sectors. Many issuers rated investment grade currently face unforeseen stress related to some combination of the COVID-19 economic slowdown and the oil price war. The early going on Tuesday suggests the IG credit rally is extending to a second day, with the CDX IG further tightening to 103bps as of 10 am, with 80% of issuers also tighter day over day.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnorth-american-ig-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnorth-american-ig-credit.html&text=North+American+IG+Credit+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnorth-american-ig-credit.html","enabled":true},{"name":"email","url":"?subject=North American IG Credit | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnorth-american-ig-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=North+American+IG+Credit+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnorth-american-ig-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}