Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 07, 2018

Negotiating the value trade

Research Signals - July 2018

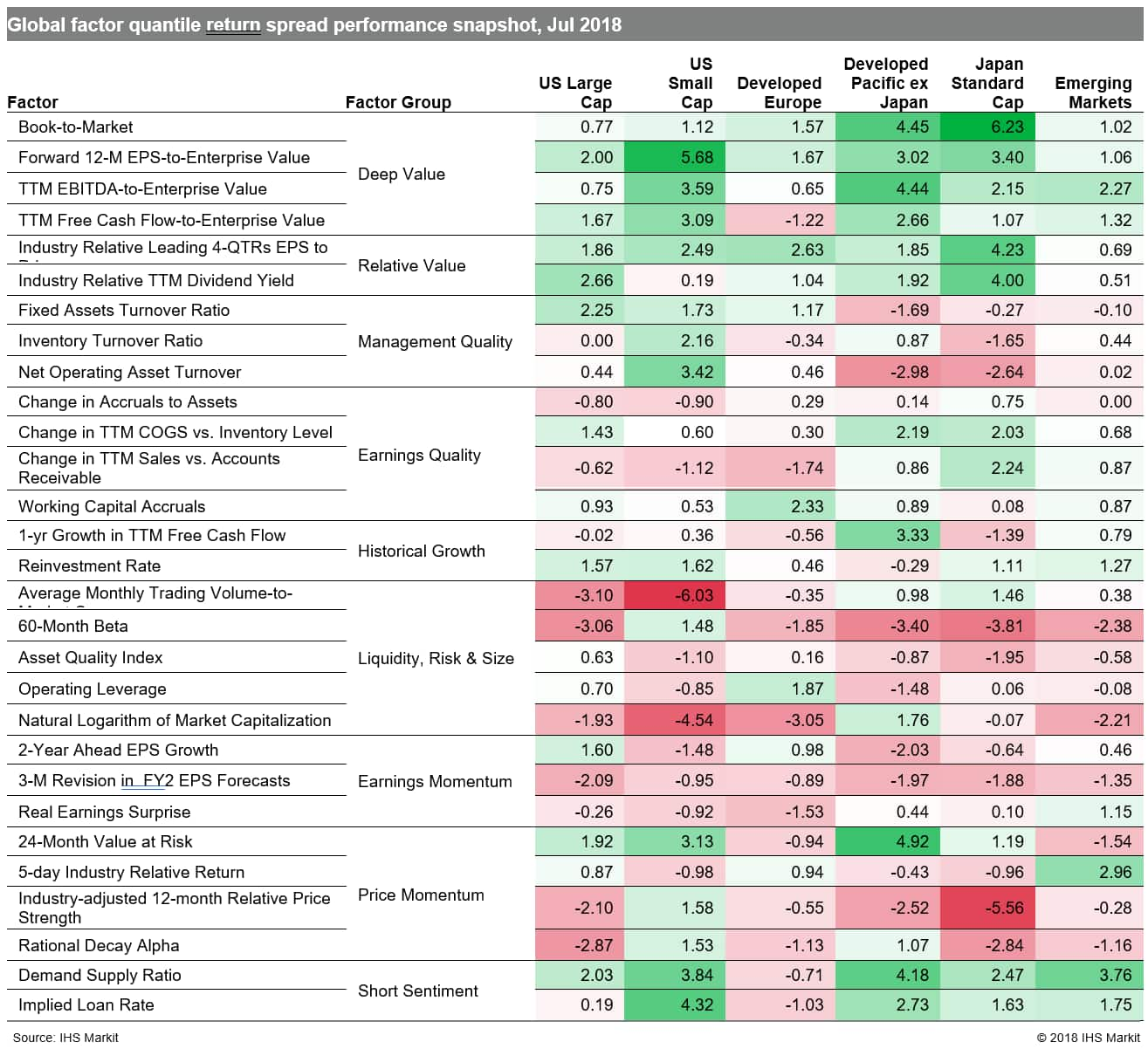

Trade tensions between the world's two largest economies have weighed on sentiment across global equity markets for several months and continue to drive markets, as valuation and securities lending indicators were strong performing signals across most of our coverage universes, while price momentum lagged (Table 1). In the meantime, investors hope for positive trade negotiations and carefully watch for the impact on relatively strong earnings and PMI data across US and European markets, as global manufacturing slowed again in July, with the J.P. Morgan Global Manufacturing PMI™ posting its lowest reading for one year.

- US: Investors shied away from high risk names measured by 24-Month Value at Risk, while small caps underperformed, particularly the microcaps, as confirmed by Natural Logarithm of Market Capitalization

- Developed Europe: Small caps also underperformed in European markets, along with overvalued names captured by Industry Relative Leading 4-QTRs EPS to Price

- Developed Pacific: Book-to-Market was a highly rewarded indicator, especially in Japan which experienced a 15.9 percentage point swing in spread performance since May

- Emerging markets: TTM EBITDA-to-Enterprise Value and Demand Supply Ratio were positive signals, while Rational Decay Alpha spread performance was negative

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnegotiating-the-value-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnegotiating-the-value-trade.html&text=Negotiating+the+value+trade+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnegotiating-the-value-trade.html","enabled":true},{"name":"email","url":"?subject=Negotiating the value trade | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnegotiating-the-value-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Negotiating+the+value+trade+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnegotiating-the-value-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}