Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 03, 2018

Near-stagnant exports push global manufacturing PMI to 11-month low

- Global PMI slips to lowest since July 2017

- Global exports show smallest rise for 23 months

- Input cost and selling price inflation rates reach seven-year high

Worldwide manufacturers reported the weakest rise in export orders for two years in June, contributing to the slowest improvement in business conditions for almost a year. Concerns about escalating trade wars also pushed business confidence down to a 19-month low. Prices meanwhile rose at the fastest rate for seven years, widely blamed on supply shortages, higher oil prices and tariffs.

Manufacturing PMI at 11-month low

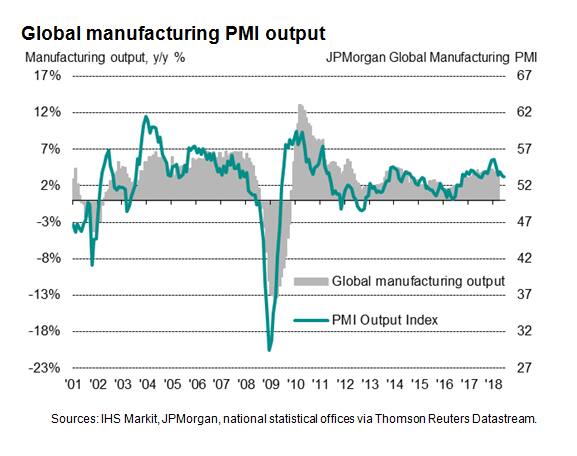

The headline JPMorgan Global Manufacturing PMI, compiled by IHS Markit, fell from 53.1 in May to 53.0 in June, its lowest since July of last year.

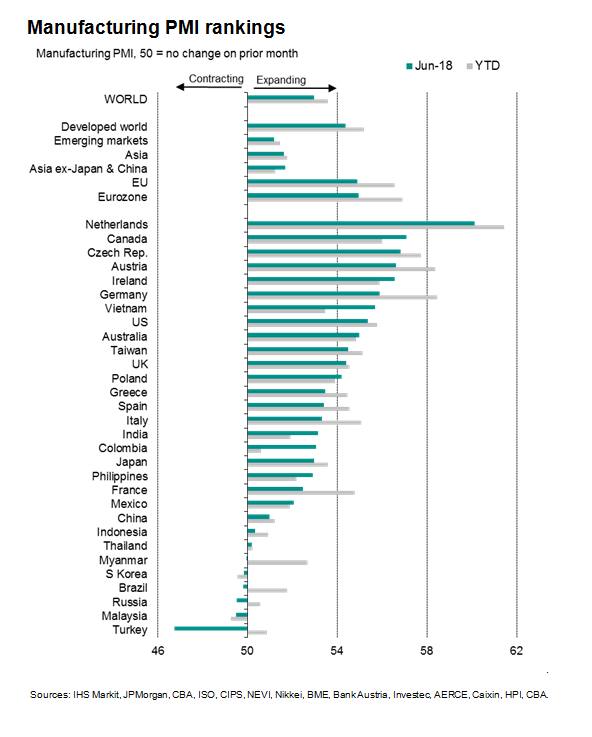

Five of the 30 countries covered by the global manufacturing PMI reported a deterioration in business conditions, up from four in May, all of which fall into our classification of emerging markets, though by far the steepest decline was again recorded by Turkey.

Five of the top six manufacturing nations were European, led by the Netherlands. At second place, Canada was the top performing non-European country, followed by Vietnam in seventh place.

Despite the decline, the latest output index reading remained at a level broadly consistent with global factory production rising at an annual rate of around 4% (at market exchange rates). However, with new orders expanding at the slowest rate for just over one and a half years, production growth could deteriorate in coming months unless demand revives.

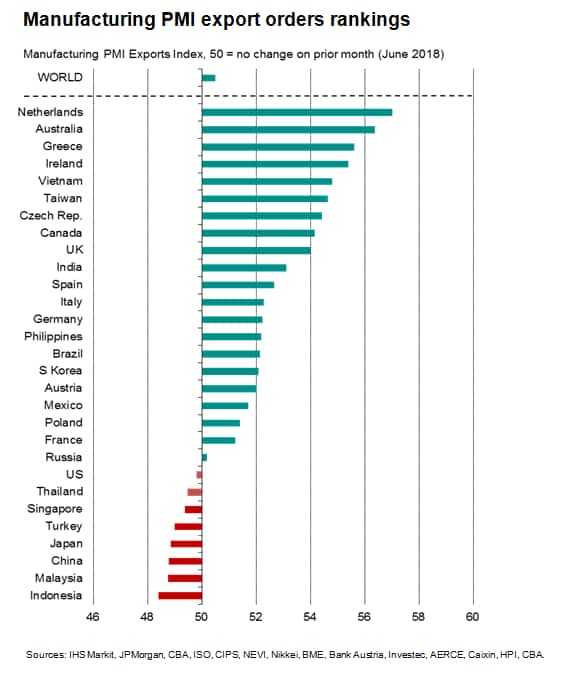

Near-stagnation of global trade

Growth in total new orders has fallen steadily since the start of the year, and rose to the weakest extent since November 2016 in June. The waning of growth of demand was to a large extent the result of a further slowing in global trade flows. New export orders rose only marginally in June, registering the smallest rise seen since the latest export rally began two years ago.

Business expectations about the year ahead meanwhile slipped for a third successive month, down to the lowest since November 2016. In many countries, reduced optimism reflected increasingly widespread concerns regarding the impact of trade wars and tariffs.

The deterioration in export performance was broad-based: while developed world exporters reported a modest increase in trade, the export rise was the smallest for 22 months. Emerging market producers meanwhile saw exports fall for a third successive month, signalling the toughest export phase seen for these countries in one and a half years.

Of the eight nations reporting a drop in exports in June (up from seven in May), the list notably included the US, China and Japan.

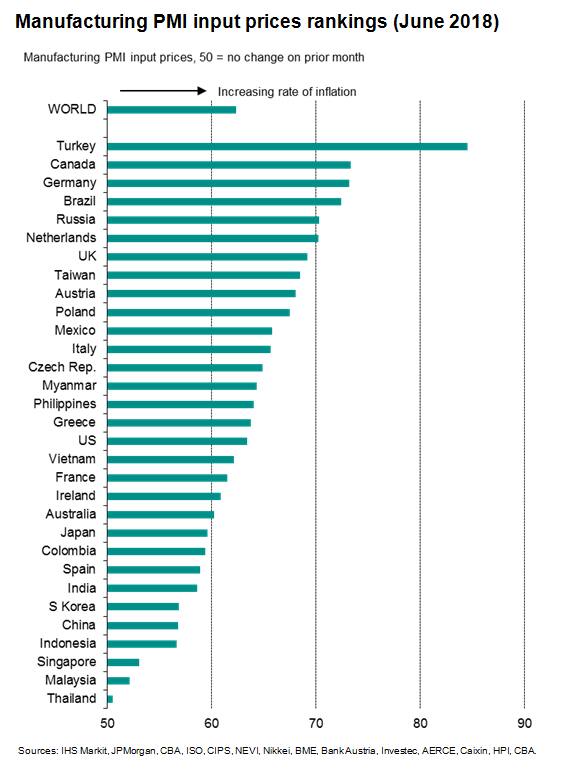

Prices rise at steepest rate for seven years

The June survey also brought news of a further escalation of price pressures. Average prices charged by manufacturers worldwide grew at the fastest rate since May 2011 as firms sought to pass higher costs onto customers.

Average input prices likewise showed the joint-largest monthly rise since May 2011, commonly linked to higher oil prices as well as signs of tariffs pushing up steel and aluminium costs.

Suppliers were generally reported to have been enjoying more pricing power amid strong demand for inputs. Suppliers' delivery times, a key gauge of supply chain price pressures, continued to lengthen to the greatest extent seen over the past seven years.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnear-stagnant-exports-push-global-manufacturing-pmi-to-11month-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnear-stagnant-exports-push-global-manufacturing-pmi-to-11month-low.html&text=Near-stagnant+exports+push+global+manufacturing+PMI+to+11-month+low+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnear-stagnant-exports-push-global-manufacturing-pmi-to-11month-low.html","enabled":true},{"name":"email","url":"?subject=Near-stagnant exports push global manufacturing PMI to 11-month low | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnear-stagnant-exports-push-global-manufacturing-pmi-to-11month-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Near-stagnant+exports+push+global+manufacturing+PMI+to+11-month+low+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnear-stagnant-exports-push-global-manufacturing-pmi-to-11month-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}