Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 11, 2020

Monthly Trade Monitor for the top 10 Economies of the World - December 2020

Global trade still below 2019 levels in most of the top economies but gradual improvement endures, stronger recovery only feasible in 2021; new release of the GTA Forecasting model optimistic for both the value and volumes of global trade.

Main Observations:

- Trends observed in the real value of exports by the top 10 economies point to a gradual improvement of the situation in Q3 and Q4. Sharper recovery is predicted for Q1/Q2 of 2021

- China is the only top economy to show consistent growth in exports and recovery already in 2020

- UK seems to be the most adversely affected country in the mid-run which could be due to the impact of Brexit on top of the adverse impact of the COVID-19 pandemic

- The adjusted PMI new exports orders for manufacturing (PMI NExO) readouts for November 2020 are above 50.0 points for all the top 10 states apart from Japan and the global economy as a whole and are pointing to a recovery for the third month in a row

- The new release of the GTA Forecasting model (4 Dec 2020) shows that the real value of global merchandise trade is likely to go down in 2020 to USD 16,382 billion or -13.5% year-on-year

- We predict a year-on-year increase in the real value of global trade by 7.6% in 2021 and 5.2% in 2022. The predicted CAGR for the period 2021-2030 equals 3.5% (and has not changed in comparison to the last release)

- We expect the global trade volume in 2020 to go down to 12.7 billion metric tons and to increase to 13.6 billion metric tons in 2021. Thus, we expect a decrease of approx. 11.2% in the global volume of trade in 2020 and the recovery in the forthcoming years with growth rates of 7.5% year-on-year in 2021 and 4.1% in 2022; the forecasted CAGR for global trade volume stands now at 3.2% for the period 2021-30

- GTA Forecasting model predicts a bit sharper decline in global trade volumes in 2020 followed by an increase in global trade volume in 2021 in between the forecasts of WTO and IMF - closer to the projection of the WTO though

Changes in Exports and Imports of the Top 10 Economies

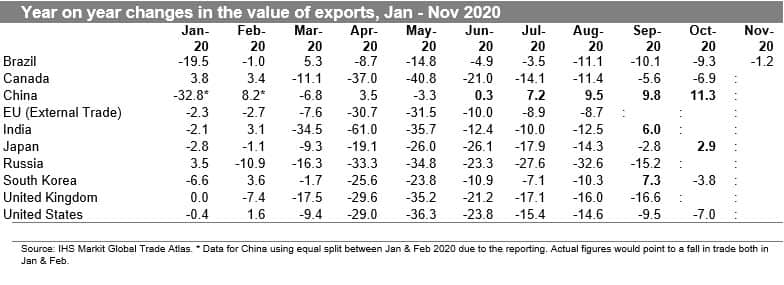

- In September 2020, China, India, and South Korea reported a year-on-year (yoy) increase in the value of exports, it's a particularly good development for India which seemed to be up to this point the most adversely affected from the top economies (please note a massive contraction of 61% yoy in April). for the remaining economies the readouts are negative and range from -2.8% for Japan to -10.0% for Brazil, -15.2% for Russia and -16.6% for the UK.

- The most up-to-date readout is available for the EU's external exports for August 2020 and is equal to -8.7%.

- The UK seems to be the most affected top economy in the medium run but that could be also due to the effects of Brexit. At this stage, it's difficult to predict the results of the negotiations between the UK and EU on the trade-deal - the likelihood of no-deal Brexit is high which could prove to be very harmful to both parties and impact mutual trade from January 2021 onwards.

- In October 2020, all top economies that have reported their data, apart from China and Japan (+2.9% yoy), show a decrease in exports ranging from -3.8% for South Korea, -6.9% for Canada, -7.0% for the US to -9.3% for Brazil. it is worth to point out that South Korea showed a yoy increase of 7.3% in September 2020.

- Chinese exports show a consistent increase over 2019 levels from June 2020 onwards. The yoy increase was close to 10% in August and September 2020 and reached an impressive 11.3% in October 2020.

- The only top economy to have already reported data for November 2020 is Brazil. The readout is pointing to a yoy decrease of only 1.2%. the situation in Brazil is improving from September 2020 onwards.

- Overall, trends observed in the real value of exports for the top 10 economies point to a gradual improvement of the situation in Q3 and Q4 2020. Sharper recovery is predicted for Q1/Q2 of 2021.

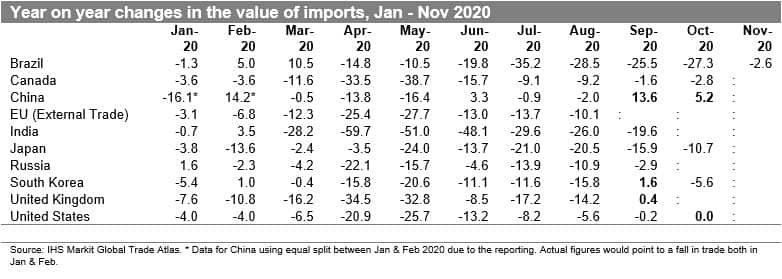

- In September 2020, three economies reported a rebound in imports yoy: China (+13.6%), South Korea (+1.6%), and the UK (+0.4%). The most significant decreases were reported for Japan (-15.9%), India (-19.6%), and Brazil (-25.5%).

- The available readouts for October 2020 show an increase only in the case of China (+5.2%). The value of US imports was equal to their 2019 values for the first month in the year (with a clear upward trend from May 2020 onwards). The worst situation was reported for Brazil -27.3% yoy, interestingly the situation deteriorated in South Korea (similarly to exports).

- Similar to exports, Brazil is reporting a significant yoy improvement in its imports - with a fall of -2.6%.

Prospects for the Forthcoming Months

- The adjusted manufacturing PMI new exports orders for manufacturing (PMI NExO) readouts for November 2020 are above 50.0 points for all the top 10 states apart from Japan and are pointing to a global recovery for the third month in a row.

- Our prior concerns over the readouts in China and the US in recent months have been unwarranted, November 2020 brought about an improvement with PMI NExO at 50.48 for the US, 53.30 for China (mainland), and 51.72 for the world as a whole. However, we have to note that the PMI NExO dropped in comparison to October's readouts for several other key economies: the EU (-3.13 points), Canada (-2.70), Japan (-1.36), and India (-0.37).

- The PMI NExO readouts for manufacturing point to optimism for the forthcoming months - December 2020 and January 2021.

- The trend in the PMI NExO is clear and consistent showing a gradual improvement in market confidence from May onwards. Global PMI NExO is at the level of 51.72 in November 2020 (51.24 in October).

- The real GDP growth forecasts from IHS Markit Comparative World Overview (published on 17 November 2020) point to a recession in most of the top economies throughout 2020 and Q1 of 2021, apart from China (recovery already in Q2 2020).

- Growth in real GDP for the world as a whole will be equal to -2.2% yoy for Q3 and -2.2% for Q4 of 2020, with a rebound in Q1 2021 to +2.4% and a strong growth impulse of +8.8% only in Q2 2021.

The new release of the GTA Forecasting model

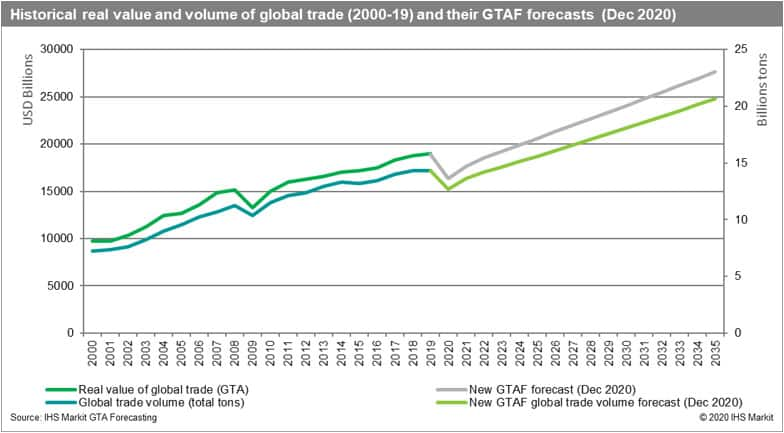

The new release of the GTA Forecasting model from 4th December 2020 accommodated the most recent macroeconomic forecasts of the IHS Markit Global Link Model, the actual data for the first two quarters of 2020 from the Global Trade Atlas for all monthly reporting states, and updated COVID-response factors. Please note that it covers all trading partners and thus is not restricted to the top ten economies of the world.

The GTA Forecasting model shows that global merchandise trade is likely to go down in 2020 to USD 16,382 billion or -13.5% year-on-year (it represents a slight downward adjustment from the values predicted in the last release - USD 16,672 billion or by 12.2% yoy).

Our estimated contraction in global trade value for the entire 2020 is close to the results reported by the OECD and IMF and close to the estimated optimistic scenario of the WTO from April 2020.

We predict a year-on-year increase in the real value of global trade of 7.6% in 2021 and 5.2% in 2022. The predicted CAGR for the period 2021-2030 equals 3.5% (and has not changed in comparison to the last release).

In terms of volumes, we now expect global trade in 2020 to go down to 12.7 billion metric tons and to increase to 13.65 billion metric tons in 2021 and 14.2 billion metric tons in 2022. Thus, we expect a decrease of approx. 11.2% in the global volume of trade in 2020 (10.7% in the last release) and the recovery in the forthcoming years with growth rates of 7.5% year-on-year in 2021 and 4.1% in 2022.

The forecasted CAGR for global trade volume stands now at 3.2% in the period 2021-30.

Furthermore, the forecasted fall in global trade volume in 2020 (-11.2%) is higher than the fall in 2009 (-7.7%) thus the adverse impact of COVID-19 for global trade volume is larger than the impact of the global financial crisis at least in the short-run.

For comparative purposes, in an updated autumn report, the WTO forecasted a 9.2% decline in the volume of world merchandise trade this year, followed by a 7.2% rise in 2021. IMF projections from October show a decrease of -10.4% in 2020 and a growth of 8.3% in 2021. Therefore, the GTA Forecasting model predicts a bit sharper decline in 2020 followed by an increase in global trade volume in 2021 in between the forecasts of WTO and IMF - closer to the projection of the WTO though.

Looking globally, our forecast is close to the "optimistic" scenario for the development of world merchandise trade published by the World Trade Organization in April 2020.

The forecasts should be treated with a large degree of caution. Several scenarios are still possible. Economic developments will critically depend on the shape of the pandemic curve and the severity of containment efforts taken globally and by individual states. The recent analysis performed by the GTA Forecasting team showed that COVID-19 impacted bilateral trade flows adversely and in a statistically significant manner. This effect on global trade endures from March 2020 onwards.

This column is based on data from IHS Markit Maritime & Trade Global Trade Atlas (GTA).

The full version of this article is available on the Connect platform for IHS Markit clients with subscription to GTA/GTA Forecasting.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-top-10-world-economies-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-top-10-world-economies-december-2020.html&text=Monthly+Trade+Monitor+for+the+top+10+Economies+of+the+World+-+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-top-10-world-economies-december-2020.html","enabled":true},{"name":"email","url":"?subject=Monthly Trade Monitor for the top 10 Economies of the World - December 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-top-10-world-economies-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+Trade+Monitor+for+the+top+10+Economies+of+the+World+-+December+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-top-10-world-economies-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}