Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 08, 2023

Monthly PMI Bulletin: September 2023

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

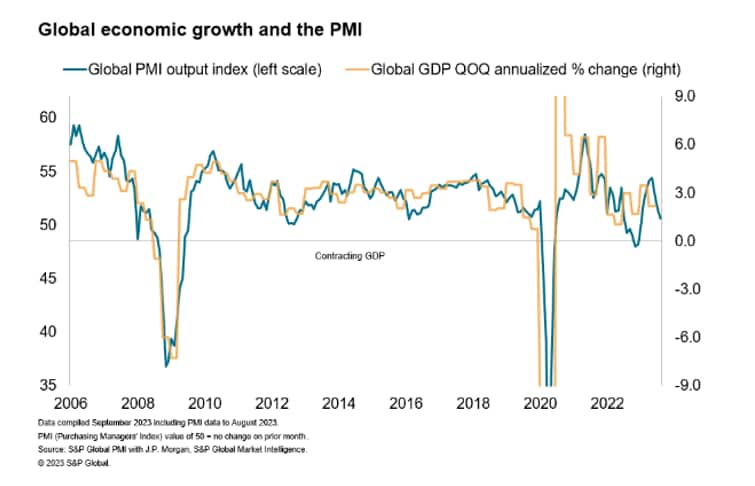

The global economic expansion further decelerated midway into the third quarter, sinking to the slowest in seven months. This is while global selling prices edged lower, though remained elevated by historical standards amid service sector-led stickiness of inflation.

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - posted 50.6 in August, down from 51.6 in July. This is the third straight month in which the rate of expansion declined to now sit at the slowest since the global economy returned to growth in February. The current reading is broadly consistent with an annualized quarterly global GDP growth of just under 1%, which is below the long-run average of 2.9%.

The expansion of output remained exclusive to the service sector as manufacturing output contracted for a third straight month, albeit only marginally. New orders for goods experienced the longest streak of declines on record, matched only by the GFC, leading to the continued deterioration in production. Destocking and weakness in global trade remained the key drivers for the latest developments, although some signs of the global destocking trend peaking may offer some relief in the coming months.

Meanwhile, the service sector remained in expansion, but the rate of growth continued to trend lower to the weakest since January. Waning service sector growth momentum is partly attributed to softer consumer services conditions as the recent travel surge fades.

As a result of the latest cooling demand developments, selling prices, measured across both goods and services, rose at a slower rate over the latest survey period. The rate of selling price inflation nevertheless suggest that global CPI could stay elevated in the coming months at around the 4% mark, lacking signs of any convincing declines from around present levels. As such, we will be watching how persistent the 'stickiness' in inflation may be with the next round of flash September PMIs from September 22.

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-september-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-september-2023.html&text=Monthly+PMI+Bulletin%3a+September+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-september-2023.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: September 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-september-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+September+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-september-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}