Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 12, 2023

Monthly PMI Bulletin: April 2023

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

Global business activity growth accelerated at the end of the first quarter of 2023, allaying concerns of imminent recession in the global economy. A common thread running through the majority of the national PMI surveys was the extent to which growth was driven by the service sector. By contrast, manufacturing output barely rose for a second month running.

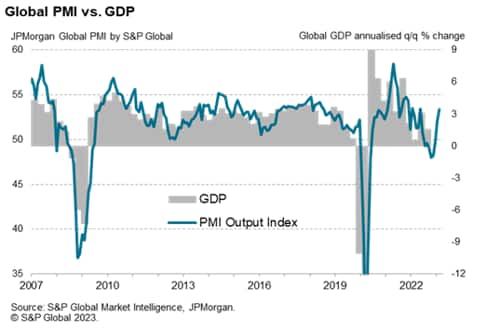

At 53.4, the J.P.Morgan Global PMI Output Index - produced by S&P Global - rose from 52.1 to signal two months of accelerating economic growth following a six-month contractionary period. The latest reading is broadly indicative of worldwide GDP rising at a quarterly annualized rate of 3.0%.

India reported the fastest expansion, while Spain and Italy also posted above-average growth. Although below-average growth was recorded in Japan, France, Germany and the US, in all cases the rate of expansion accelerated due to reviving service sector activity. Measured overall, services sector growth accelerated globally to the fastest since December 2021.

Manufacturing output, on the other hand, barely rose. And survey evidence points to a rise in production that has been driven by improving supply chains and backlogs of work rather than new factory orders, which continued to fall.

Digging deeper into the services data, growth in March has been in part linked to rising travel and tourism business, as well as reviving financial services activity. This raises questions about the sustainability of these key area of support to global growth, given the further tightening of monetary policy, an ongoing cost of living squeeze and banking sector stress.

Global price pressures meanwhile moderated, as input costs rose at the slowest rate for 28 months. While manufacturing input cost inflation has eased to below the long-run trend, service sector input cost inflation remains far above the long-run average.

March also saw a marked increase in the number of companies reporting that employment is being reduced due to pressure to cut costs. The incidence of cost-cutting fuelled job losses has in fact risen to its highest in two years.

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2023.html&text=Monthly+PMI+Bulletin%3a+April+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2023.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: April 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+April+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}