Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 07, 2022

Monthly PMI Bulletin: April 2022

The following is an extract from IHS Markit's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

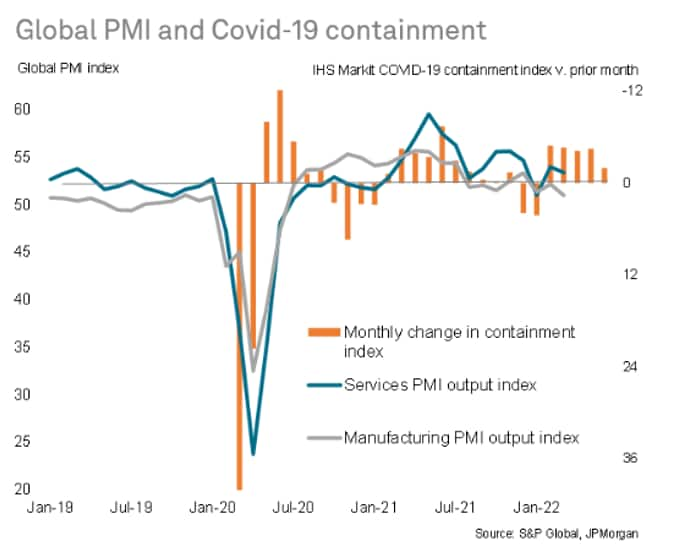

The global economy expanded for a twenty-first straight month* in March, according to the JPMorgan Global PMI™ (compiled by S&P Global), but the rate of growth eased to the slowest since January on the back of intensifying inflationary pressures, supply chain issues and geopolitical tensions.

Both manufacturing and services output growth slowed, though services maintained the lead. The easing of COVID-19 containment measures that were previously tightened in the face of the Omicron variant's spread continued to benefit the service sector in particular, keeping the rate of expansion above that of manufacturing. Amongst the developed countries, the US and UK saw composite PMI output growth accelerate with COVID-19 restrictions down to pandemic-lows in March. In comparison, growth in the eurozone had been dampened by the Ukraine war and tighter health restrictions than seen in the US and UK.

Meanwhile global manufacturing growth lost further momentum, with the JPMorgan Manufacturing PMI™ (compiled by S&P Global) falling to a one-and-a-half year low in March. The negative consequences of the Ukraine war and new COVID-19 related disruptions, especially in China, included the intensification of supply chain delays, heightening of price pressures and a renewed fall in global trade flows. Business confidence was also hard hit by the recent developments. With the Ukraine war continuing to bring about uncertainties and mainland China widening the COVID-19 curbs into April, the effects on businesses may well extend into coming months, which we will be tracking through the upcoming PMI figures.

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2022.html&text=Monthly+PMI+Bulletin%3a+April+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2022.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: April 2022 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+April+2022+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-april-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}