Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 08, 2023

Modest deterioration in global trade conditions persists in August

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

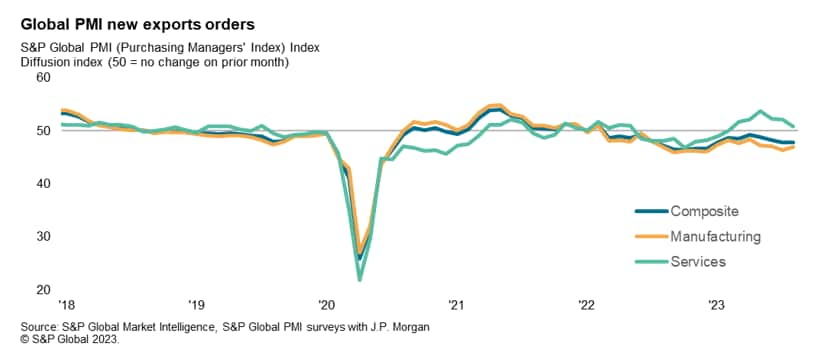

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated an eighteenth successive monthly deterioration in global trade midway into the third quarter of 2023. Rising slightly to 47.9 in August from 47.8 in July, the seasonally adjusted PMI New Export Orders Index signalled that global trade continued to contract at a modest pace. This extended the worst prolonged period of global trade since the financial crisis.

Slower decline in goods trade accompanied by near-stalling of services exchange

Falling exports within the manufacturing sector continued to lead the trade deterioration in August. However, while goods trade shrank at a slower rate, services exports grew at the slowest pace in the ongoing sequence of expansions. The convergence of performance led to the gap between manufacturing and services export indices shrinking to the smallest in four months.

Globally, manufacturing new export orders extended the period of contraction that commenced March 2022. That said, the pace of downturn eased from July to match the rolling 12-month average, signalling that the rate of goods trade decline lowered from an elevated state. This was attributed to shallower contractions of consumer and intermediate goods export orders. Investment goods exports meanwhile dipped at the sharpest pace on record, barring the pandemic downturn. The latest deterioration in investment goods new orders and new export orders does not bode well for the broader manufacturing outlook.

The steepest downturn in goods exports by more detailed sub-sectors was recorded for industrial goods sectors including construction materials and machinery & equipment. This was followed by falling trade in 'raw materials' such as paper & timber products. Globally, the destocking trend continued to exert pressure on manufacturing sector performance, but the reduction in global investment spending appears to be the one picking up pace and is concerning given its broader implications for capex intentions.

Meanwhile, service providers continued to see their new export business rise, although only marginally. Services new export business expanded worldwide at the slowest pace in the current six-month sequence of growth. This embodied the sustained fading of the post-pandemic travel boon into the third quarter. Furthermore, the impact of past interest rate rises continued to negatively affect consumers' willingness to spend and constrain services exports' performance over the latest survey period.

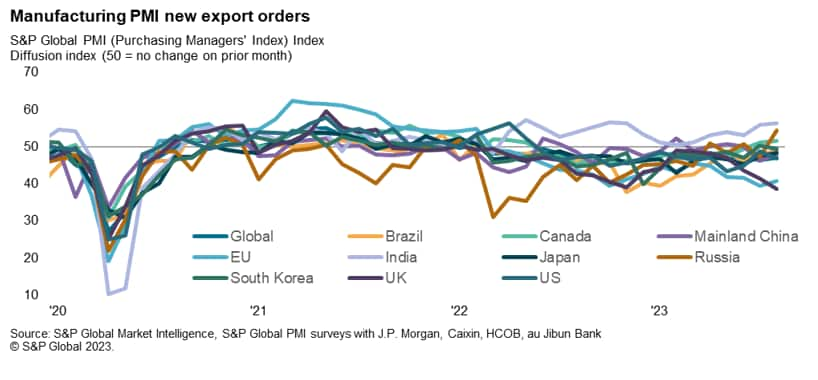

By region, both developed and emerging markets recorded lower trade activities in August. Mild declines in emerging market manufacturing and services export orders led to a second consecutive month of deterioration in overall trade conditions in the region. Developed markets saw a sharper fall in overall new export orders, though this was driven entirely by weaker goods trade as the exchange of services remained in expansion, albeit only fractionally.

Downturn in trade remain steepest in Europe

The majority of top 10 economies monitored continued to report lower trade activity over August. This was measured across both goods and services. The decline was led by the EU, where export orders fell at one of the fastest rates on record, barring the pandemic period. Detailed sector data revealed that the contraction in goods trade in the EU, while having eased from July, remained faster than that for services, which worsened in August.

The UK followed closely behind the EU, recording the most pronounced fall in new export orders since November 2022. Absent the COVID-19 pandemic, incoming new orders for goods from abroad slipped in the UK at the sharpest pace since the GFC. Services exports in the UK remained in growth but at the slowest rate in eight months, reflective of the unfavourable economic climate on the back of tightening financial conditions.

The US meanwhile saw a renewed contraction in export orders brought about by a shaper downturn within the manufacturing sector, though growth in foreign demand for US services also slowed markedly. Japan was the resulting best performer amongst the four major developed economies, reporting the slowest decline in trade performance as the contraction in goods trade eased while foreign interest in services from Japan remained solid.

India export orders growth at fastest pace in nine years

Looking at the major emerging markets, India continued to be the best performer in August, with new export orders rising at the fastest pace in the nine-year period since export data collection began for the survey (September 2014). Both manufacturing and service sectors in India saw solid growth in new work from abroad. This was followed by Russia, with export orders having returned to growth thanks to faster services growth and renewed expansion in foreign orders for goods.

In contrast, Brazil and Mainland China experienced persistent declines in new export orders, albeit at slower rates compared to July. Brazil saw continued improvements in the service sector offset by lower goods export orders in August. On the other hand, mainland China's services trade dipped for the first time in the year-to-date, joining its manufacturing sector in contraction.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-deterioration-in-global-trade-conditions-persists-in-august-sep23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-deterioration-in-global-trade-conditions-persists-in-august-sep23.html&text=Modest+deterioration+in+global+trade+conditions+persists+in+August+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-deterioration-in-global-trade-conditions-persists-in-august-sep23.html","enabled":true},{"name":"email","url":"?subject=Modest deterioration in global trade conditions persists in August | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-deterioration-in-global-trade-conditions-persists-in-august-sep23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Modest+deterioration+in+global+trade+conditions+persists+in+August+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-deterioration-in-global-trade-conditions-persists-in-august-sep23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}