Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Jun 13, 2019

Mixed outlook for FTSE 100 dividends

- Excluding the effect of a stronger US dollar, payouts would only increase 1.8% to £86.1bn; 48% of FTSE 100 dividends in 2019 are based in dollar terms.

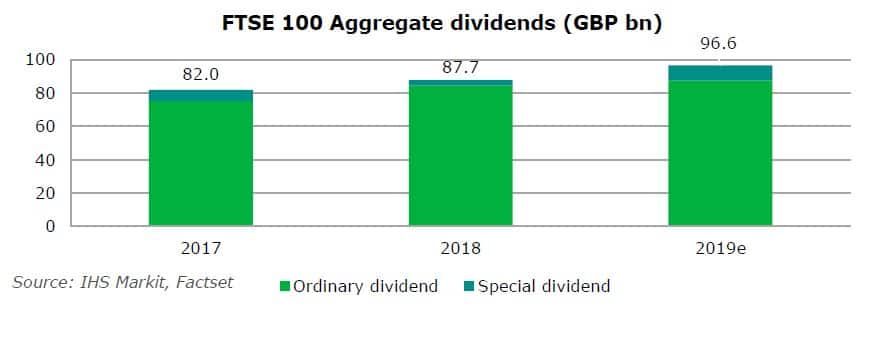

- Special dividends will reach a multi-year high of £9bn, driven by Rio Tinto and BHP Group. Including special dividends, FTSE 100 payouts should reach £96.6bn in 2019, up 10%.

- The three sectors showing highest dividend growth are Media (+27%), Retail (+18%) and Banks (+13%). Telecommunications are expected to decline by 36% due to Vodafone's cut. Utilities are expected to reduce payout in 2020.

The recent dividend cuts from Vodafone, SSE and Marks & Spencer and anticipated reductions from Centrica, TUI AG and easyJet highlight how the outlook for FTSE 100 dividends has been mixed. Vodafone, which has been one of the top paying dividend stocks in the index for many years, recently cut its dividends by 40%, effectively losing its position in top 10 table. The utility sector is also expected to distribute lower dividends than traditionally expected, caused by cuts from Centrica and SSE. We are forecasting ordinary payouts from FTSE 100 companies to grow by 3.7% to £87.7bn (+10% to £96.6bn when including special dividends).

By sector, Media is expected to lead the payout increase (+27%), bolstered by a higher number of RELX shares in the index, followed by Retail (+18%) driven by the strong increase of Tesco's dividends. UK Banks are the third greatest contributor (+14%), thanks to the RBS's dividend resumption.

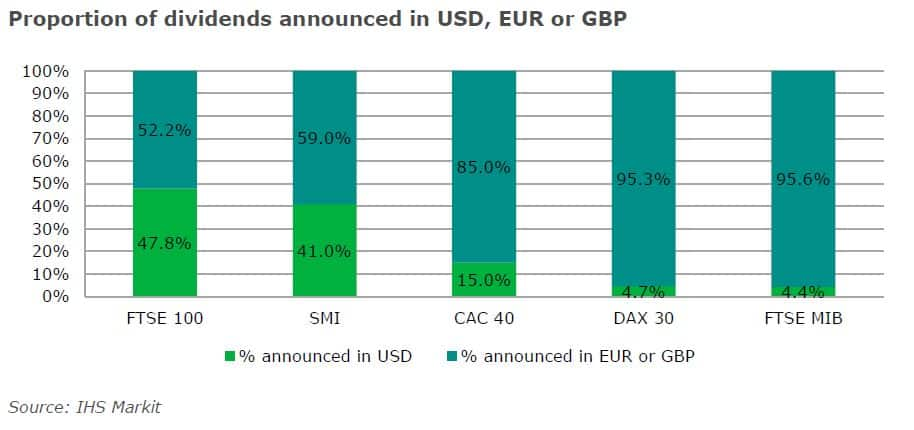

The appreciation of US dollar against sterling underpinned a significant part of the projected growth in payouts, demonstrating how volatility in the exchange rate can affect dividend outlook. On a constant currency basis, we are expecting companies to pay £86.1bn, up 1.8%. The average yield among FTSE 100 companies is 4.7%.

The strength of the greenback has a strong influence on FTSE 100 as seven out of the top 10 payers within the FTSE 100 index base their dividends on the dollar, though investors receive dividends in pounds. These seven companies - Royal Dutch Shell, HSBC Holdings, BP, Rio Tinto, AstraZeneca, Glencore and BHP Group - represent 42% of the projected dividends for 2019, and therefore, any strengthening of the dollar would have a favourable effect on the dividends from these companies, which in turn lift dividends from FTSE 100.

The strength of the greenback has a strong influence on FTSE 100 as seven out of the top 10 payers within the FTSE 100 index base their dividends on the dollar, though investors receive dividends in pounds. These seven companies - Royal Dutch Shell, HSBC Holdings, BP, Rio Tinto, AstraZeneca, Glencore and BHP Group - represent 42% of the projected dividends for 2019, and therefore, any strengthening of the dollar would have a favourable effect on the dividends from these companies, which in turn lift dividends from FTSE 100.

To access the report, please contact dividendsupport@ihsmarkit.com

Kevin Soyer, CFA, Associate Director at IHS Markit

Chong Jun Wong, CFA, Senior Research Analyst at IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-outlook-for-ftse-100-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-outlook-for-ftse-100-dividends.html&text=Mixed+outlook+for+FTSE+100+dividends+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-outlook-for-ftse-100-dividends.html","enabled":true},{"name":"email","url":"?subject=Mixed outlook for FTSE 100 dividends | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-outlook-for-ftse-100-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mixed+outlook+for+FTSE+100+dividends+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-outlook-for-ftse-100-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}