Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Sep 03, 2020

Maritime Compliance Guide 2020 shines light on scrubber, ballast-water management markets

Fewer scrubbers and ballast water management systems (BWMS) will be installed in 2020 due to COVID-19, according to this year's Maritime Compliance Guide, a supplement produced by the Maritime & Trade division of IHS Markit, now available as a complimentary download.

Analysing IHS Markit data, the guide examines how COVID-19 has impacted the way maritime regulations are being enforced and new ones are implemented. In addition, it boasts updated lists of scrubber and ballast water management system OEMs and an overview of how systems work.

The installations of scrubbers and ballast water management systems, for example, have been delayed because shipyards contracted to make these installations were closed earlier in the year.

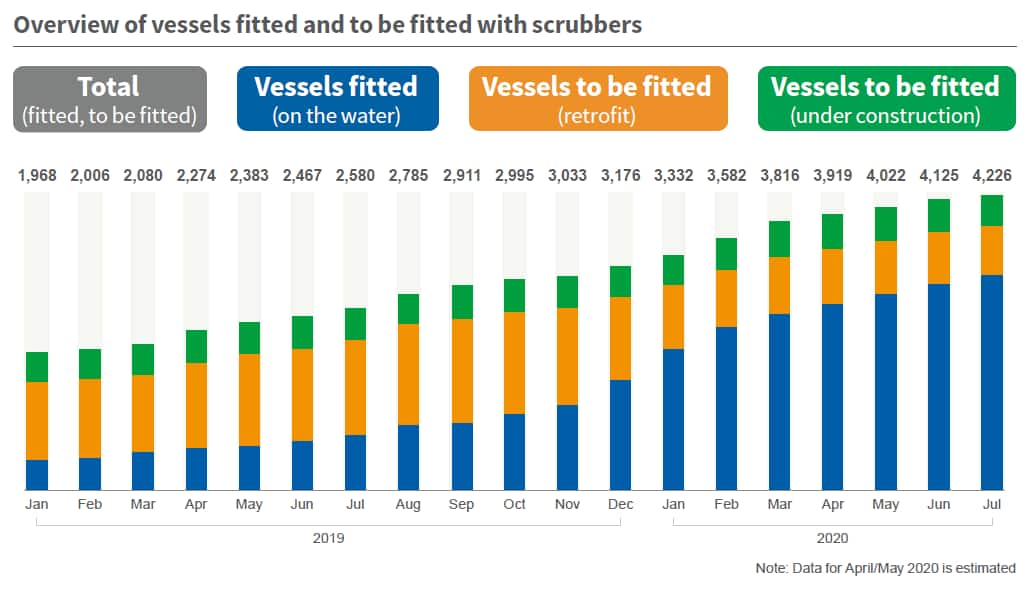

This reshuffled the planned schedule, potentially delaying the quest to reduce emissions. IHS Markit has adjusted its annual scrubber installation forecast from 3,900 to about 3,400 as a result of COVID-19 delays, such as the drop in oil price and rising freight rates in the tanker sector, which result in owners reviewing installations.

Additionally, doubts on the functionality of materials used to build scrubbers are casting a shadow on the process, it is stated in the guide.

Despite the fall in scrubber installations, IHS Markit data also shows a low uptake of non-heavy fuel oil (HFO) propulsion systems for newbuilds. There are only six vessels on order with either auxiliary hydrogen, methanol, or full nuclear engine propulsion.

While there are more than 100 vessels that will have liquefied natural gas propulsion, and approximately 20 will run on liquefied petroleum gas, those types of fuel are still fossil fuels that the industry will need to face in order to reach the IMO 2050 emission reduction goals. Again, this may put a further halt on hopes to drastically cut emissions in the industry.

Consequently, most orders made in 2019 and 2020 revealed that more than 1,000 ships will run on distillates, either low-sulphur HFO or marine gas oil, of which only four are battery hybrids.

This guide not only uses IHS Markit data - illustrated by interactive visualisations - to show the current state of installations for the sulphur emissions cap in the context of COVID-19, but also of IMO-regulated ballast water management systems.

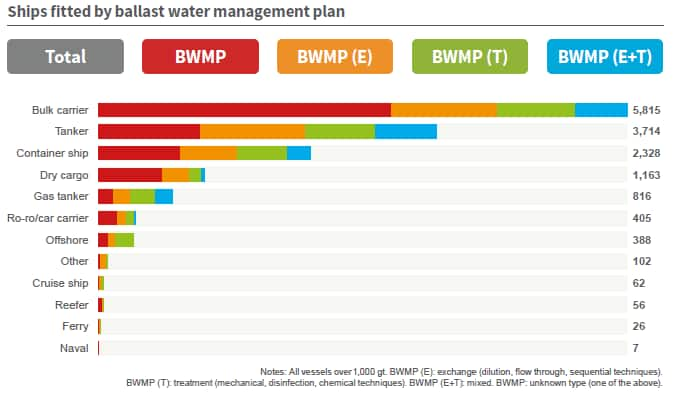

According to IHS Markit, bulk carriers, container ships, and gas tankers score the highest percentage of vessels that have been fitted with BWMSs, with more than 40% of the fleets having a system installed. This is because these vessel types are the most common and the ones with the highest compliance targets of up to 90%.

Tankers follow with 32%, ro-ro and car carriers with 25%, and cruise and dry cargo ships with 12% installation rate. However, IHS Markit data also shows that tankers and dry cargo ships are behind in terms of installations while having comparable fleet sizes to bulk carriers.

Next year's report will show if owners in those sectors were able to catch up with the rest of the industry to comply with maritime regulations.

Download your copy of the Maritime Compliance Guide 2020 for more insights into these major maritime regulations as well as biofouling, data collection on fuel consumption, and the digital transmission of cargo data.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmaritime-compliance-guide-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmaritime-compliance-guide-2020.html&text=Maritime+Compliance+Guide+2020+shines+light+on+scrubber%2c+ballast-water+management+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmaritime-compliance-guide-2020.html","enabled":true},{"name":"email","url":"?subject=Maritime Compliance Guide 2020 shines light on scrubber, ballast-water management markets | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmaritime-compliance-guide-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Maritime+Compliance+Guide+2020+shines+light+on+scrubber%2c+ballast-water+management+markets+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmaritime-compliance-guide-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}