Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 01, 2019

Manufacturing stock build raises alarm for future production

- Manufacturing PMI dips as stock building eases, but worries mount for future production

- Exporters of inputs see EU supply chain shift

- Staff hiring hit by uncertainty

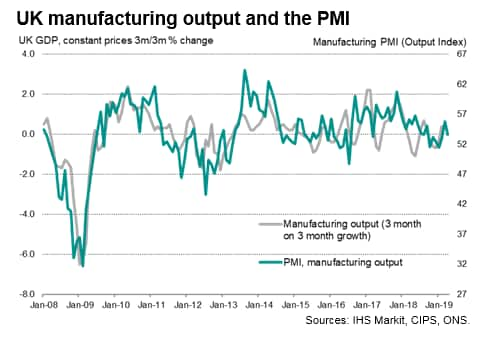

The IHS Markit/CIPS UK Manufacturing PMI indicated that output growth slowed in April, despite some firms reporting a boost to production from pre-Brexit stock building. Worse may be to come, as forward-looking indicators suggest production could fall in coming months as the inventory build unwinds and supply chains shift. Hiring has already been hit as a result.

The survey's output index fell from a 10-month high in March, partly because fewer customers built up safety stocks ahead of a potentially disruptive Brexit, though many companies continued to report that stock piling helped drive production higher. One-in-five companies that reported an increase in production in April attributed the rise to Brexit related stock piling. However, that was down from one-in-three in March.

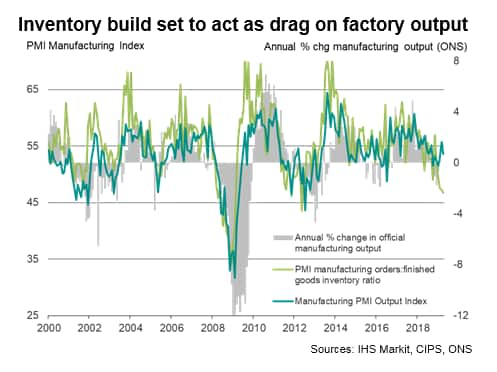

The worry is that the unwinding of recent inventory building is likely to act as a drag on production growth in coming months, as illustrated by the forward-looking new orders to inventory ratio. A record increase of stocks in recent months has coincided with a dearth of new orders, pushing the orders-inventory ratio to its lowest since May 2012, and its third-lowest since the height of the global financial crisis in early-2009. At current levels, the ratio points to a marked downturn in production.

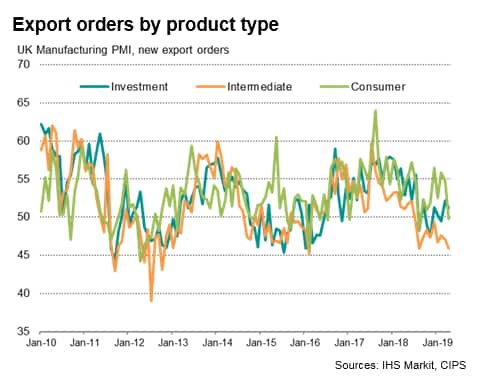

However, not all sectors have benefited equally from the Brexit-related stock build. UK producers of consumer goods and investment goods (such as equipment and machinery) have seen a Brexit boost from stock piling by overseas customers, thereby lifting exports in recent months (albeit with some tail-off seen in April). In contrast, exports of intermediate goods (products used as inputs by other companies) have fallen continuously since the middle of last year, in part due to EU customers now sourcing from non-UK EU suppliers.

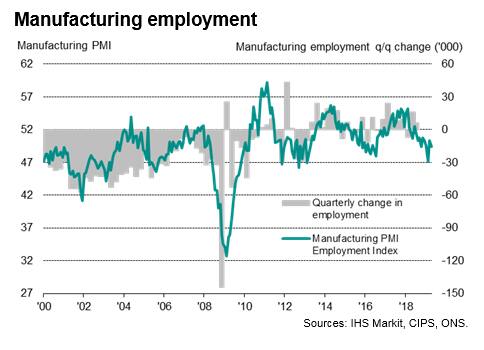

The employment index from the manufacturing PMI is another point of concern, suggesting factories have pulled back markedly on hiring over the past year. Having signalled buoyant jobs growth this time last year, the survey is now consistent with the official measure of manufacturing payroll numbers falling.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-stock-build-raises-alarm-for-future-prod-010519.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-stock-build-raises-alarm-for-future-prod-010519.html&text=Manufacturing+stock+build+raises+alarm+for+future+production+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-stock-build-raises-alarm-for-future-prod-010519.html","enabled":true},{"name":"email","url":"?subject=Manufacturing stock build raises alarm for future production | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-stock-build-raises-alarm-for-future-prod-010519.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+stock+build+raises+alarm+for+future+production+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-stock-build-raises-alarm-for-future-prod-010519.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}