Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 02, 2018

Malaysian manufacturing growth weakens but optimism hits multi-year high

- Headline Nikkei PMI at lowest since last October

- Faster falls in both output and new orders

- Hiring up and optimism hits highest in over four years

Latest survey data indicate that the health of Malaysia's manufacturing economy weakened further at the start of the second quarter. However, despite the downturn, firms remained optimistic and continued to boost staffing levels, suggesting that business conditions could improve over the coming 12 months.

Weak start to second quarter...

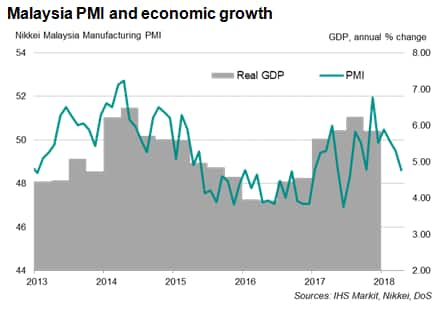

The Nikkei Malaysia Manufacturing PMI™ fell from 49.5 in March to 48.6 in April, indicating a third successive monthly decline in the health of the sector. The latest reading was the lowest since October last year, suggesting the rate of deterioration has accelerated at the start of the second quarter.

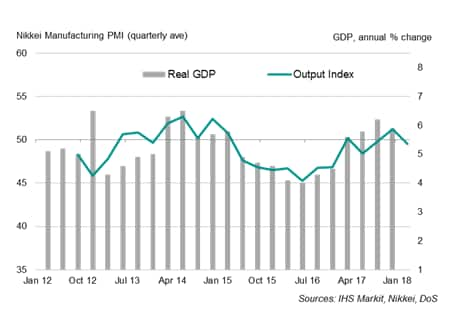

PMI-implied GDP estimates1 suggest that the April survey data are indicative of annual GDP growth of just below 5%, down from an estimated 5.2% in the first quarter.

Output volumes shrank further to show the largest slide in production for nine months, in line with waning demand for Malaysian products. The drop in new business inflows was the third consecutive monthly decline and the steepest since July 2017. Export sales also fell. Lower new order volumes meant manufacturers cut back on purchasing activity and tapped existing stocks of inputs to meet production requirements.

...but optimism at four-and-a-half year high

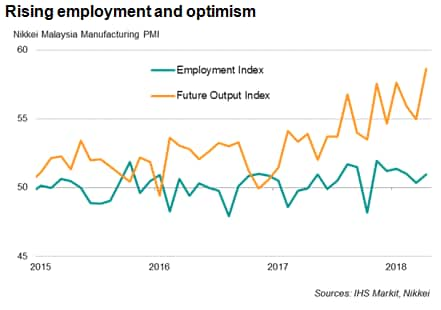

While the near-term prospects for the manufacturing sector deteriorated, longer-term expectations were seen as more positive. Malaysian manufacturers remained optimistic about the 12-month outlook for production. The PMI's gauge of business expectations in fact rose to the highest for four-and-a-half years in April.

Firms commonly mentioned that higher sales forecasts and new product models are expected to underpin future growth.

Greater business confidence boosted hiring. Higher employment was reported for a sixth month running during April.

Rising prices

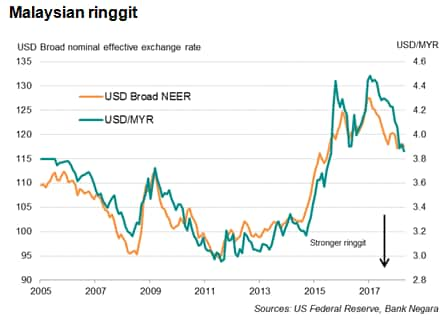

Manufacturers raised their factory gate prices again in April, and at the fastest rate for seven months, as raw material costs continued to climb. The rate of growth of input costs remained marked, though noticeably lower than the 2017 average. A strengthening exchange rate has helped to contain imported inflation to some extent. The ringgit has appreciated nearly 6% against the dollar since the start of the year.

1In the case of Malaysia, using the PMI Output Index against GDP, instead of headline PMI, improves the correlation to over 80%. Source: Using PMI survey data to nowcast Malaysia's GDP (2018).

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-manufacturing-growth-weakens-but-optimism-hits-multiyear-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-manufacturing-growth-weakens-but-optimism-hits-multiyear-high.html&text=Malaysian+manufacturing+growth+weakens+but+optimism+hits+multi-year+high+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-manufacturing-growth-weakens-but-optimism-hits-multiyear-high.html","enabled":true},{"name":"email","url":"?subject=Malaysian manufacturing growth weakens but optimism hits multi-year high | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-manufacturing-growth-weakens-but-optimism-hits-multiyear-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Malaysian+manufacturing+growth+weakens+but+optimism+hits+multi-year+high+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-manufacturing-growth-weakens-but-optimism-hits-multiyear-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}