Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2018

Malaysia manufacturing PMI hints at Q3 upturn after slower Q2

- August Nikkei PMI rises to a nine-month high

- Growth in new orders seen for first time since January

- Manufacturers step up purchasing activity

The latest PMI data set the scene for Malaysia's manufacturing sector to see its strongest quarterly performance since late-2014, allaying to some extent concerns about slower growth after a disappointing second quarter.

Other PMI sub-indices hinted at the possibility of stronger growth in September, as well as showing signs of easing cost inflation midway through the third quarter.

Stronger third quarter

The Nikkei Malaysia Manufacturing PMI™ rose to 51.2 in August from 49.7 in July, representing the first improvement in the health of the sector since January. The latest reading took the average for the third quarter so far (50.4) to the highest for nearly four years.

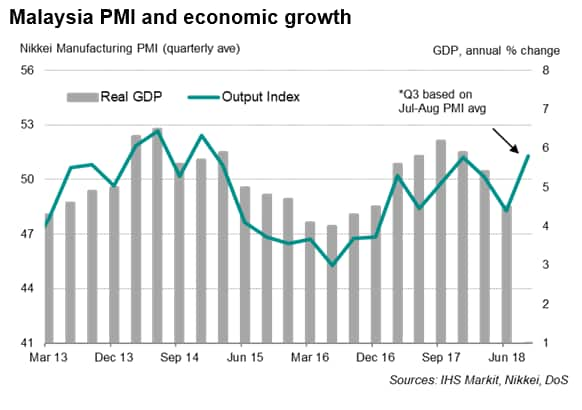

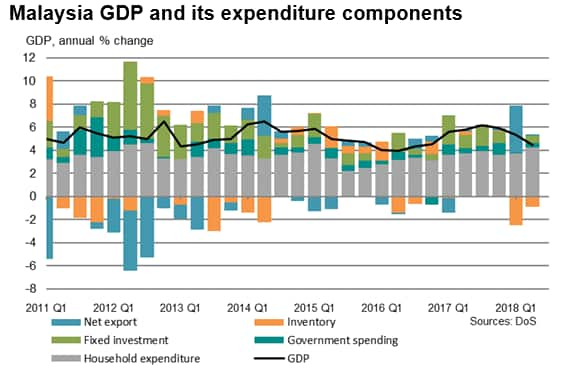

The survey data had signalled well in advance the slowdown in second quarter GDP, which came in noticeably weaker at a 4.5% annual rate (down from 5.4% in the first quarter). The latest PMI readings are therefore encouraging, suggesting a rebound in growth momentum in the third quarter.

Analysis of the PMI Output Index, which exhibits a near-80% correlation with GDP growth, indicates that the average reading for the third quarter so far is consistent with an annual GDP rate of just below 6%.

Outlook

The latest survey also showed improved growth prospects. Manufacturers reported a rise in new orders for the first time in seven months during August, with the rate of expansion being the fastest since November of last year. Job creation also continued for a third straight month, while business confidence improved to a four-month high. Anticipating greater production requirements, firms raised purchasing activity and built up their input inventories.

However, anecdotal evidence brought warning signs that could threaten the upturn in the manufacturing sector. There were reports of customers placing orders ahead of the re-introduction of the Sales and Services Tax (SST), which replaces the Goods and Services Tax (GST). Firms that were anticipating lower future output often noted that the SST is likely to curb demand.

Trade frictions and SST

Further challenges also come from the deteriorating global trade picture, meaning the outlook for exports continued to darken. Having risen marginally in July, export sales were broadly stagnant in the middle of the third quarter, partially reflecting softer global trade conditions. Survey evidence pointed to rising trade tensions as a key concern of Malaysian manufacturers.

Furthermore, the rollout of the SST in September could hurt export competitiveness. Unlike the GST, which is levied at the consumer (and therefore on consumption within the country), SST is charged at the factory level. This implies that goods producers must pay the tax regardless of whether products are consumed domestically or exported, suggesting that the SST could in fact represent a tax on exports.

Slower cost increases

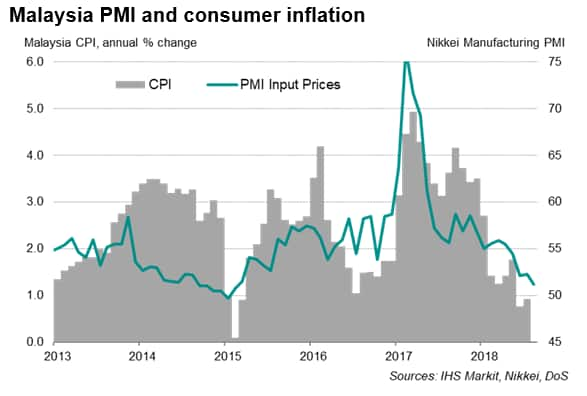

On the price front, the disinflationary impact of the GST removal continued to be felt across the manufacturing sector in August. Input cost inflation eased further to the weakest in three-and-a-half years. At the same time, manufacturers raised selling prices only marginally, with inflation remaining well below the 2017 average.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Bernard Aw, Principal Economist, IHS

Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-manufacturing-pmi-hints-at-q3-upturn-after-slower-q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-manufacturing-pmi-hints-at-q3-upturn-after-slower-q2.html&text=Malaysia+manufacturing+PMI+hints+at+Q3+upturn+after+slower+Q2+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-manufacturing-pmi-hints-at-q3-upturn-after-slower-q2.html","enabled":true},{"name":"email","url":"?subject=Malaysia manufacturing PMI hints at Q3 upturn after slower Q2 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-manufacturing-pmi-hints-at-q3-upturn-after-slower-q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Malaysia+manufacturing+PMI+hints+at+Q3+upturn+after+slower+Q2+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-manufacturing-pmi-hints-at-q3-upturn-after-slower-q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}