Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 31, 2018

Global Economic Preview: Week of 3 September 2018

- Worldwide PMI surveys

- US non-farm payrolls and wage growth

- Canada, Australia and Malaysia policy meetings

Highlights of the coming week include the global release of August PMI data, adding further insight into worldwide economic growth, hiring and price trends, as well as the US employment report.

Monetary policy decisions are meanwhile seen in Canada, Australia and Malaysia, though all are expected to see no change in interest rates.

Other notable releases include second quarter GDP updates for the Eurozone, Australia and South Korea, US and German factory orders data, and industrial production numbers for Germany, France and Brazil.

PMI survey updates

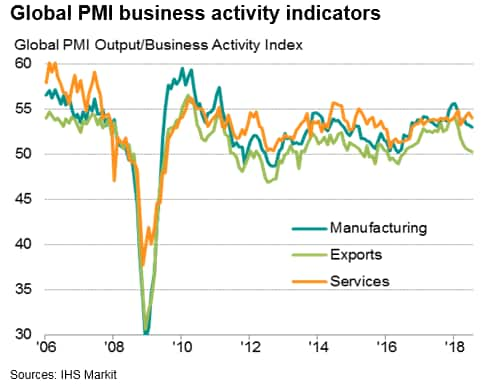

The global PMI surveys will be scrutinised for signs that developing trade wars are damaging global growth, and in particular if a recent weakening of export performance is feeding through to the service sector, July's PMI data showed that global economic growth slowed to a four-month low, yet remaining indicative of global GDP rising at a solid annual rate of approximately 2.5% (at market exchange rates).

While both service sector and manufacturing growth rates weakened in July, the former has remained relatively buoyant, but goods producers have reported a near-stagnation in trade flows, registering the smallest expansion in new export orders for two years. Anecdotal evidence from the surveys often linked the export slowdown to tariffs and trade war worries, which also helped push future expectations to the lowest since November 2016, hinting that the pace of global expansion could wane further in coming months.

The survey data will also be eyed for signs of inflationary pressures. Average prices charged for goods and services meanwhile rose globally in July at the joint-fastest rate since comparable PMI data were first available in 2009.

UK monetary policy in spotlight

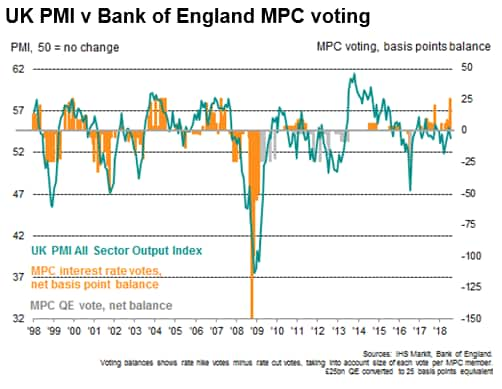

With flash PMI survey data for the US, Eurozone and Japan already released, the UK PMI data will be eagerly awaited - especially in the light of the recent Bank of England rate hike. The Monetary Policy Committee decided to raise interest rates for only the second time in a decade, despite the July PMI surveys showing signs of the pace of economic growth slowing and price pressures easing. Stronger PMI numbers will vindicate the Banks' decision, but any further weakening could bring the judgement on the rate hike into question.

US employment report

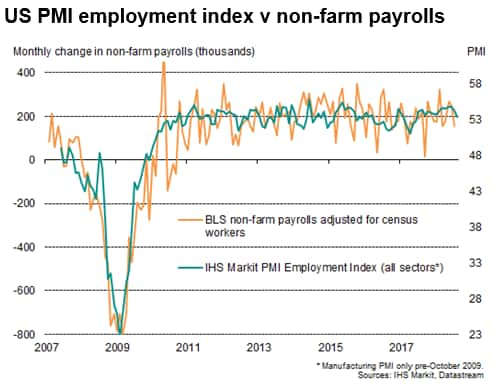

The week rounds off with the US employment report. With the pace of Fed tightening in focus, and the strength of the dollar a growing concern for many emerging markets, the labour market data will no doubt help steer policy guidance and hence the Greenback. Judging by survey evidence, such as the August flash PMI surveys, another healthy non-farm payroll gain of 180k is to be expected. However, more crucial to policymakers will be wage growth. While the July report showed the economy adding jobs at a healthy clip of 157,000, analysts generally saw the need for restraint from the Fed as pay inflation held at 2.7%.

Download the article for a full diary of key economic releases.

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-3-september-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-3-september-2018.html&text=Global+Economic+Preview%3a+Week+of+3+September+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-3-september-2018.html","enabled":true},{"name":"email","url":"?subject=Global Economic Preview: Week of 3 September 2018 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-3-september-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Economic+Preview%3a+Week+of+3+September+2018+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-3-september-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}