Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 03, 2023

Mainland China's resurgent service sector growth and near-record confidence fuel economy hopes for 2023

As hoped, looser COVID-19 restrictions have boosted service sector activity in mainland China, adding to hopes that resurgent economic growth will be seen in early 2023 and fueling speculation of diminished global recession risks. Even more encouraging was a surge in business confidence to the highest for 12 years, suggesting that growth will accelerate further providing current COVID-19 related labour shortages alleviate in the coming months. Price pressures remain muted, and the outlook for inflation remains dependent on future trends in demand and labour availability.

Confidence and activity rise amid loosened COVID-19 restrictions

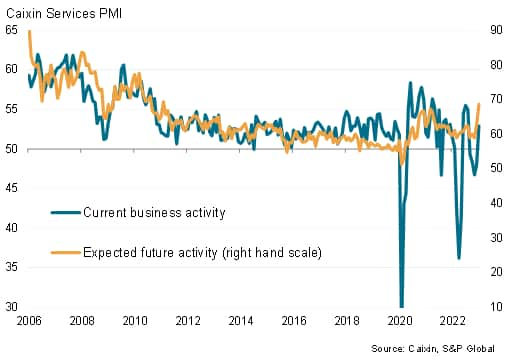

Business activity across China's vast service sector retuned to growth in January following the relaxation of COVID-19 restrictions. The Caixin services PMI output index, compiled by S&P Global, hit 52.9, rising above the 50.0 no change level to indicate an expansion of activity for the first time since last August.

China services: current and expected output

Companies widely cited the additional freedoms created by the unwinding of COVID-19 health restrictions as having boosted business levels, driving in particular a resurgence in new business inflows after four months of continual decline, which had been blamed primarily on the Omicron outbreak.

There was an even more noteworthy impact of the reopening of the economy on business confidence. Service sector companies' expectations of output growth in the coming 12 months surged to the highest since February 2011, surpassing prior peaks seen after previous COVID-19 waves, reflecting the move away from the government's prior zero-covid stance.

The data therefore suggest that the pace of economic growth is on course to accelerate in the first quarter of 2023 after flatlining in the final quarter of 2022, according to official GDP data.

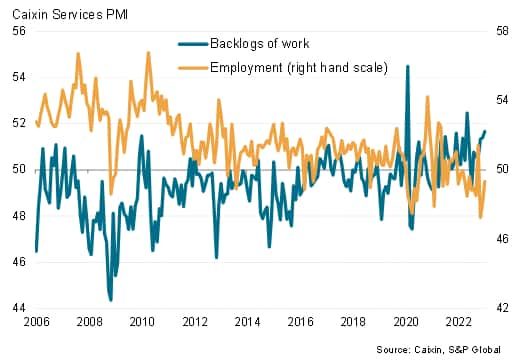

Backlogs of work rise sharply as hiring constrained by health issues

The pandemic nevertheless continued to constrain businesses. Notably, staff absences due to illness contributed to a slight fall in service sector workforce numbers. The combination of a rise in sales and the lack of labour meant backlogs of work rose sharply, posting the third-largest increase ever recorded by the survey. the fastest seen since May 2022.

China services: employment and backlogs of work

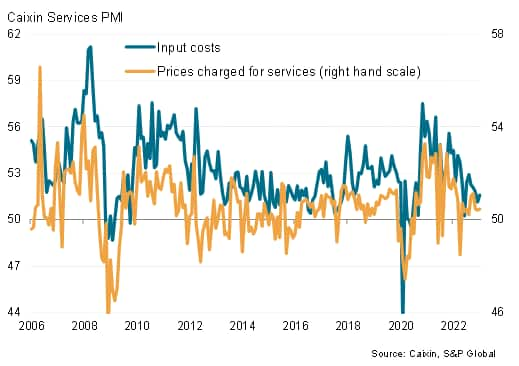

Price pressures remain muted

The rate of input cost inflation meanwhile picked up for the first time in five months in January, but the resulting rise in costs remained weaker than the survey's long run average. Average prices charged by service providers continued to rise only slightly as a result, hinting at a sustained low-inflation environment. However, the survey data suggest there is a risk that any further constraining of activity due to COVID-19 amid stronger demand in the coming months could help build pricing power, pushing up inflation.

China services: prices and costs

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinas-resurgent-service-sector-growth-feb23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinas-resurgent-service-sector-growth-feb23.html&text=Mainland+China%27s+resurgent+service+sector+growth+and+near-record+confidence+fuel+economy+hopes+for+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinas-resurgent-service-sector-growth-feb23.html","enabled":true},{"name":"email","url":"?subject=Mainland China's resurgent service sector growth and near-record confidence fuel economy hopes for 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinas-resurgent-service-sector-growth-feb23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mainland+China%27s+resurgent+service+sector+growth+and+near-record+confidence+fuel+economy+hopes+for+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinas-resurgent-service-sector-growth-feb23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}