Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 03, 2018

PMI rises to six-month high as Japan's economic upturn regains momentum

- At 53.1 in April, composite PMI hits the highest since October 2017

- Domestic demand drives upturn while export sales growth eases

- Rising costs continue to push companies to raise selling prices

The Japanese economy expanded at the strongest rate for six months at the start of the second quarter, according to survey data, allaying concerns of slowing business activity. April PMI data also suggest that the overall pace of growth will likely remain robust in the months ahead.

Solid start to second quarter

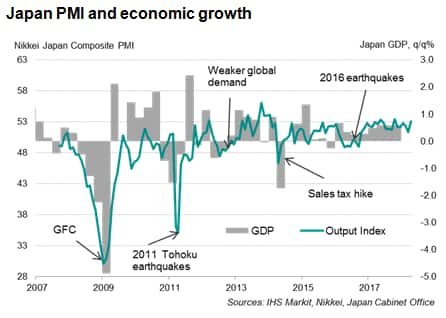

The Nikkei Japan Composite PMI™ Output Index rose from 51.3 in March to 53.1 in April, marking the strongest rate of improvement in the health of the economy since October of last year. The latest reading was indicative of quarterly GDP rising at a solid 0.8% rate at the beginning of the second quarter.

Accelerating growth in new business inflows and rising backlogs of unfinished work suggest that the expansion in output has more room to run. However, Japanese firms were less optimistic about longer-term prospects for output. While still positive, the survey's gauge of business expectations eased to an eight-month low.

Domestic-driven pick-up

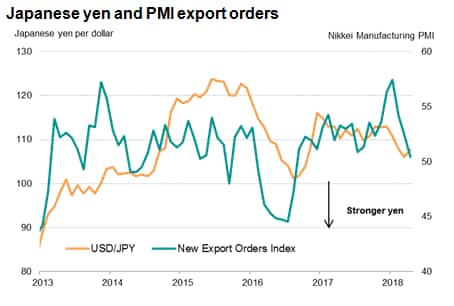

April's surveys showed factory output growth picking up to the fastest for three months, while services business activity rose at the strongest rate since last October. The faster growth in business activity was matched with stronger increases in new business in both sectors, hinting that domestic demand is playing a key role in driving growth. Notably, goods export sales showed the smallest rise since the current trend of rising exports began in September 2016, suggesting that a stronger yen so far this year has hurt external demand. The yen is still up over 3% against the US dollar despite the recent depreciation.

Price pressures

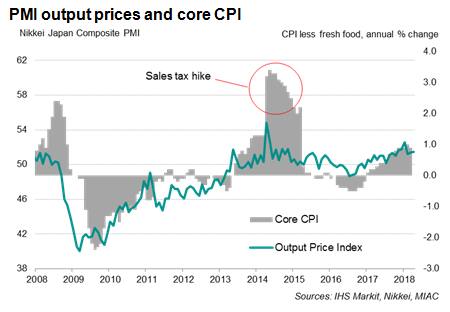

With the current upturn having now been running for over six consecutive quarters (according to the PMI), demand is exceeding supply. This has led to pressure on supply chains, which has in turn driven up input costs as vendors strive to manage demand through the pricing mechanism.

Manufacturers consequently continued to report strong cost pressures during April, with anecdotal evidence revealing increased prices for fuel and metals in particular. Service providers also faced rising input prices, particularly from wage inflation and higher fuel costs. While overall input cost inflation eased further from January's peak, it remained solid.

Monetary policy

Robust demand conditions continued to allow companies to raise selling prices to preserve margins. However, while encouraging, historical comparisons suggest that the ongoing rise in price pressures indicated by the PMI surveys remains slower than what the Bank of Japan would like.

At 0.9% in March, the core consumer inflation rate (the central bank's preferred gauge) remained well below the BOJ's 2% target despite aggressive policy easing, highlighting the difficulties policymakers face in re-inflating the economy.

The stubbornly low inflation rate led the BOJ to remove its target date for reaching the inflation goal at the recent monetary policy meeting. Governor Kuroda pointed to the deflation mind-set of the Japanese consumer as a key reason for subdued inflationary pressure. This suggests that Japan's ultra-accommodative monetary settings will stay for the time being.

Bernard Aw, Principal Economist, IHS

Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-upturn-regains-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-upturn-regains-momentum.html&text=PMI+rises+to+six-month+high+as+Japan%27s+economic+upturn+regains+momentum+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-upturn-regains-momentum.html","enabled":true},{"name":"email","url":"?subject=PMI rises to six-month high as Japan's economic upturn regains momentum | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-upturn-regains-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+rises+to+six-month+high+as+Japan%27s+economic+upturn+regains+momentum+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-economic-upturn-regains-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}