Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 09, 2023

Inflation trends diverge as service sector growth spurt drives global growth to 16-month high

A further acceleration of services sector growth pushed the pace of global expansion to a 16-month high in April, according to the S&P Global PMI surveys based on data provided by over 27,000 companies. All major economies reported robust service sector growth, in all cases outperforming manufacturing which consequently remained broadly stalled on a global basis.

Resurgent post-pandemic demand for services has diverted spending from manufacturing, meaning bottlenecks have eased in the goods-producing sector but increased among service providers. Inflationary forces have likewise shifted as a result of these demand-supply imbalances, with the rate of inflation for goods falling further in April but reviving in the services sector.

The outlook for growth and inflation therefore rests to a large extent on the duration of this revival of service sector spending, notably among consumers, which will inevitably be tested by various headwinds.

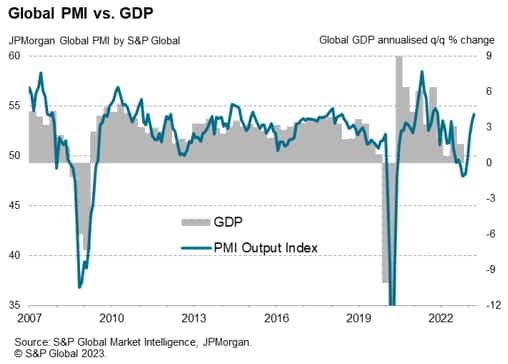

Global output growth hits fastest since 2021

The Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - rose for a fifth straight month in April from 53.4 in March to 54.2, climbing to its highest since December 2021. The current reading is broadly consistent with annualized quarterly global GDP growth of approximately 4%, representing a strong start to the second quarter.

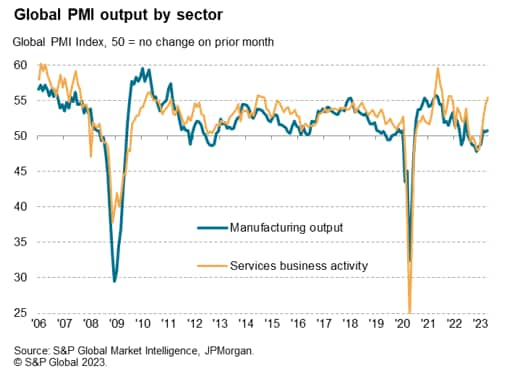

Widening divergence as faster services output contrasts with sluggish manufacturing

It was notable, however, that the expansion was again largely a reflection of resurgent service sector activity. While services output growth hit the fastest since November 2021, only a modest gain was recorded for manufacturing output. The resulting divergence between the performance of the two sectors was one of the widest on record.

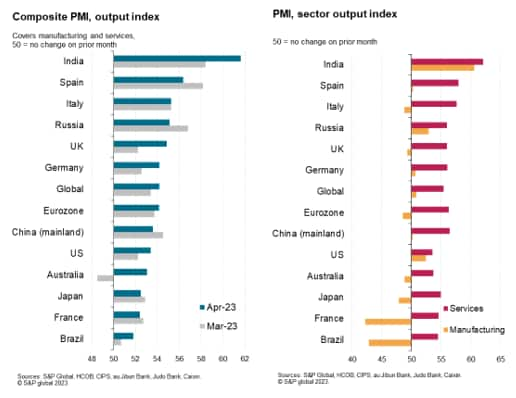

The outperformance of services relative to manufacturing was evident in all of the 12 largest economies surveyed in April, in some cases to striking degrees. While all 12 reported growth of service sector activity, only India, Russia, the US and - to only a marginal extent - Germany reported higher manufacturing output.

Global service sector export growth at survey high

There was again an even greater sector divergence in terms of new order inflows, where the gap between services and manufacturing grew for the second month running. While manufacturing new orders fell for a tenth successive month in April, subdued by a further fall in global goods exports, service sector new business inflows grew at the steepest rate for just over a year, with exports registering the largest monthly gain since comparable global data were first available in 2014.

Surge in demand for consumer services

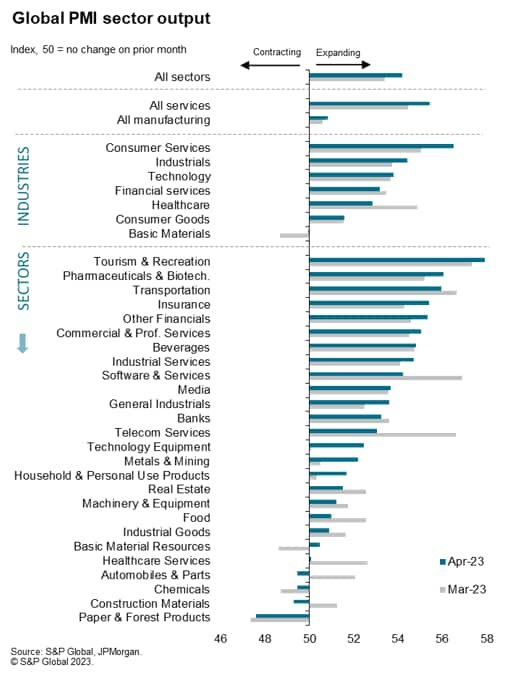

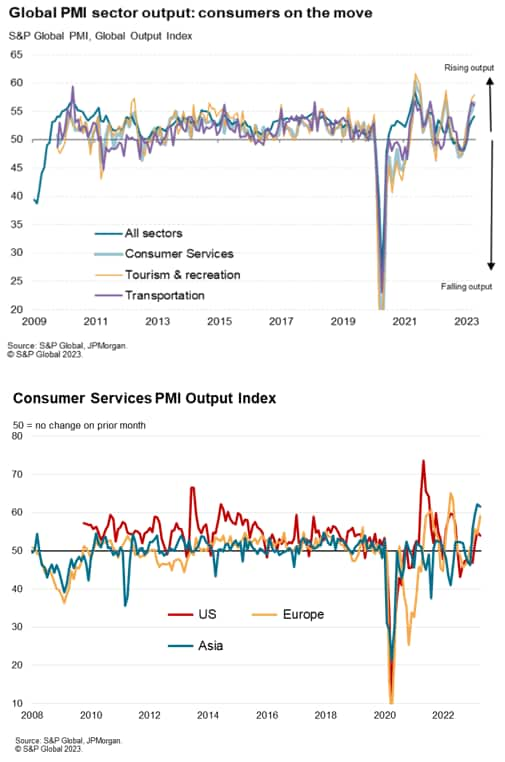

Drill down deeper into the data and the PMI survey showed the global upturn to have been led by resurgent output of consumer services businesses. Drilling down even deeper , one would find the fastest growing sub-sector was tourism & recreation. Transportation activity has also risen especially strongly.

It's notable that, in marked contrast to the rebound in consumer services growth, consumer goods output rose only modestly in April, albeit improving on the stalled picture seen in March.

The data therefore point to a switching of spend towards consumer services, linked to greater demand for travel, tourism, and recreational activities. This leisure surge can be in turn traced to the reopening of the global economy after the pandemic, with 2023 being the first year of unrestricted global travel. Furthermore, with 2023 also having seen the removal of COVID-19 containment measures in mainland China, it is perhaps not surprising to see Asia reporting a stronger consumer services upswing in recent months, though noteworthy growth is also evident in Europe and, to a lesser extent, the US.

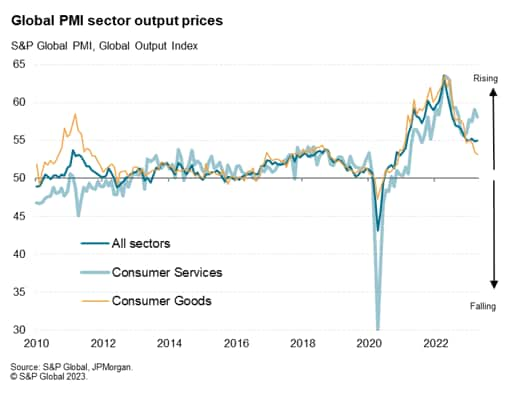

Diverging price trends for consumer goods and services

The divergent demand conditions manifested themselves in varying price pressures in the two sectors. While global selling price inflation for consumer goods slowed in April to the lowest since November 2020, growth of average rates charged for consumer services has re-accelerated in recent months compared to the slower rates seen at the turn of the year. Although still running in well below last year's highs and easing slightly in April, service sector inflation remains far higher than anything recorded prior to the pandemic since comparable global PMI data were available in 2009.

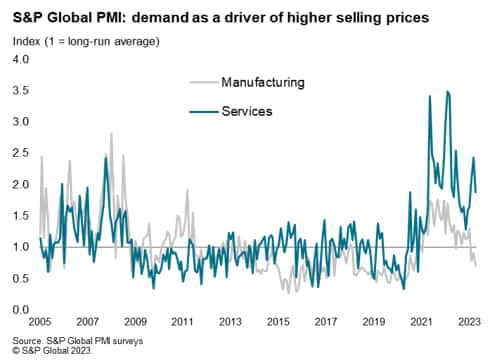

Greater pricing power for service providers

Analysis of the reasons cited by PMI respondents for higher selling prices reveals the role that demand is playing in driving diverging inflationary trends. The number of cases of higher demand being seen as the facilitator of increased prices has fallen sharply in the manufacturing sector, dropping below the long run average in April to sink to the lowest since September 2020. But in the service sector, barring the pandemic, the last time global service sector demand-pull inflation forces were as strong as seen in recent months was 2008.

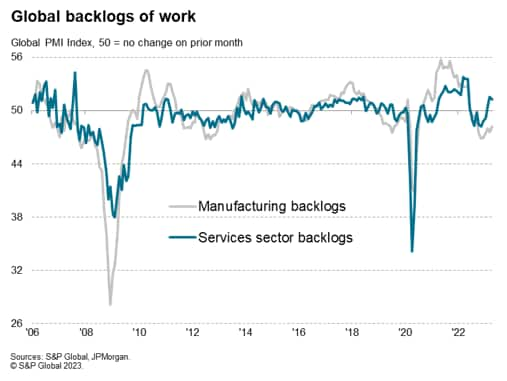

The divergence in pricing power is similarly explained by variations in backlogs of work. Backlogs reflect the amount of orders that companies have received which they have not been able to complete and provide or ship to customers. In manufacturing, component shortages led to an unprecedented accumulation of such outstanding orders, but recent supply chain improvements - combined with deteriorating demand - mean these backlogs are now falling. In the service sector, backlogs also rose during the pandemic, linked in most cases to a lack of available labour. However, whereas manufacturers are now reporting lower backlogs, service sector companies are struggling to cater to the post-pandemic surge in consumer demand for activities such as travel and tourism. Hence service sector backlogs are now rising again.

Thus, backlogs tell us that demand for services is rising faster than supply, pushing prices up. In manufacturing, the reverse is now the case. Hence inflation pressures have moved from goods to services.

Outlook

It now remains to be seen how long this surge in consumer services demand can persist for, as this will inform us of the stickiness of inflation.

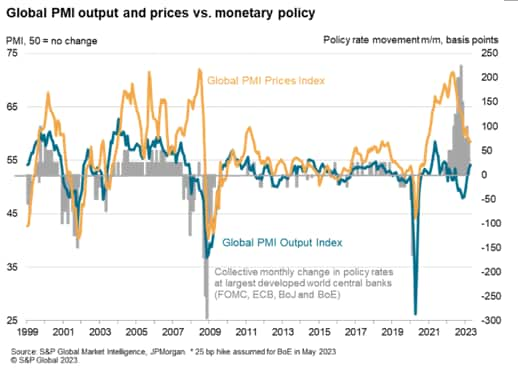

With interest rates continuing to rise both in Europe and the US in May, there are clear downside risks to consumer spending as we move in to the second half of the year. Tightening financial conditions are also expected to lead to further credit market headwinds as we head through the year.

More encouragingly, interest rates will have likely peaked as we enter the second half of the year, as will have inflation rates. But policymakers stress the likelihood of interest rates remaining high for a prolonged period, and the damage from inflation on the cost of living will be felt for some time.

One upside is that the inventory cycle in manufacturing should become more supportive of growth in the third and fourth quarters. The second half of the year may therefore see a shift in in spending back to goods from services, albeit from a likely reduced overall pot of spending.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-trends-diverge-as-service-sector-growth-spurt-drives-global-growth-to-16month-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-trends-diverge-as-service-sector-growth-spurt-drives-global-growth-to-16month-high.html&text=Inflation+trends+diverge+as+service+sector+growth+spurt+drives+global+growth+to+16-month+high+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-trends-diverge-as-service-sector-growth-spurt-drives-global-growth-to-16month-high.html","enabled":true},{"name":"email","url":"?subject=Inflation trends diverge as service sector growth spurt drives global growth to 16-month high | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-trends-diverge-as-service-sector-growth-spurt-drives-global-growth-to-16month-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Inflation+trends+diverge+as+service+sector+growth+spurt+drives+global+growth+to+16-month+high+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-trends-diverge-as-service-sector-growth-spurt-drives-global-growth-to-16month-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}