Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 08, 2020

IHS Markit Daily Global Market Summary - 8 April 2020

US equity markets ended today on a positive note, as declines in the growth rate of new COVID-19 infections in the US and additional reassurances from last month's FOMC meeting minutes helped drive a rally in US equities and the third consecutive day of declines in US government bonds.

Americas

1. US equity markets were the best performers globally today; Russell 2000 +4.6%, S&P/DJIA +3.4%, and Nasdaq +2.6%.

2. Today's release of last month's Federal Reserve meetings indicated that Fed officials reacted with growing alarm to market disruptions prompted by the spreading coronavirus pandemic in March, prompting them to cut interest rates at two emergency meetings and signal plans to leave them unchanged until the economy recovered from its sudden stop. (WSJ)

3. The Fed signaling plans in last month's minutes to leave rates unchanged at the current levels for as long as necessary was potentially one of the key drivers for the second leg of today's US equity market rally that began shortly after the 2:00pm ET release of the report:

4. 10yr US govt bonds +5bps/0.77% yield and 30yr bonds +8bps/1.38% yield.

5. Crude oil +10.2%/$26.05 per barrel and Brent Crude +2.1%/$33.52 per barrel as of 4:38pm ET.

6. In total, IHS Markit estimates that as of 6 April, at least 94% of global gasoline demand is now located in countries or regions under major curtailment or full shutdown. The most significant global change over the last week is the movement in the US, where many states implemented severe restrictions after weeks of relatively minor responses. 15 states—including the top 10 consumers Texas, Florida, Georgia, and Pennsylvania—entered shutdown, bringing the total to 42 states representing 94% of US gasoline demand. (IHS Markit Energy Advisory's Roger Diwan)

7. Mexico's government has officially asked the US and Canada to grant the auto industry extra time to adjust to the new United States Mexico Canada Agreement (USMCA) rules; the new treaty could go into place on 1 July 2020. he Mexico auto lobby, AMIA, said on 6 April that 90 days is not enough time for carmakers to adapt supply chains to meet rules of origin requirements, and has urged postponement to January 2021. (IHS Markit AutoIntelligence's Stephanie Brinley)

8. EU and US procurement teams appear to be increasingly embroiled in a bidding war to secure access to scarce supplies of mainland Chinese-manufactured medical equipment and PPE. For now, this is confined mainly to the arena of PPE and intensive care unit (ICU) equipment, including ventilators, rather than ICU medicines or COVID-19 drug candidates. (IHS Markit Life Science's Ewa Oliveira da Silva and Eóin Ryan)

9. Almost a third of U.S. apartment renters didn't pay any of their April rent during the first week of the month, according to new data to be released Wednesday by the National Multifamily Housing Council and a consortium of real-estate data providers. The data indicates that 69% of tenants paid all or a portion of their rent between April 1 and 5, which is modestly lower compared with 81% in the first week of this March and 82% in April 2019. (WSJ)

10. Due to the extraordinary disruptions from the coronavirus, the Federal Reserve Board on Wednesday announced that it will temporarily and narrowly modify the growth restriction on Wells Fargo so that it can provide additional support to small businesses. The change will only allow the firm to make additional small business loans as part of the Paycheck Protection Program, or PPP, and the Federal Reserve's forthcoming Main Street Lending Program. (Federal Reserve)

11. The US state of California's Department of Motor Vehicles (DMV) has issued a permit to Nuro for the company to test its driverless delivery vehicles on public roads without a human backup driver, reports Reuters. The permit will allow the company to test its two low-speed autonomous R2 vehicles in nine Bay Area cities. The vehicles can operate at a maximum speed of 25 mph and are only approved to operate in fair weather conditions on streets with a speed limit of 35 mph. (IHS Markit Automotive Mobility's Surabhi Rajpal)

12. Canada's total housing starts declined 7.3% month on month (m/m) to 195,174 units (annualized). The increase in urban single-family starts (up 8.8% m/m) was offset by the plunge in multifamily starts (down 13.4% m/m). The increase in urban single starts was led by Ontario (up 18.7% m/m), Alberta (up 27.1% m/m), and New Brunswick, where single starts soared to the highest levels since May 2010, while the decrease was concentrated in Quebec (down 18.8%) and Manitoba (down 27.2% m/m) following the strong jumps in the previous month. (IHS Markit Economist Chul-Woo Hong)

13. IHS Markit's Maritime and Trade group published its 'The State of Maritime Safety 2020' report today. The report finds that total losses between 2015-19 have largely occurred after vessels foundered [ships that sank as a result of heavy weather, springing of leaks or breaking in two] (301 vessels) or were wrecked or stranded (177 vessels). The rise in extreme weather events and low investment in repair and upkeep of machinery and hull damage (the top cause of ship accidents) following the 2008 and 2016 economic downturns, are allowing preventable incidents to turn into tragedies, according to the report.

Europe/Middle East/ Africa

1. Glencore's Zambian unit, Mopani Copper Mines (MCM), yesterday (7 April) announced it would temporarily shut its mines on 8 April due to disruption caused by the coronavirus disease 2019 (COVID-19) pandemic and low copper prices. MCM accounts for about 10% of copper production in Zambia, with copper exports accounting for 70% of the country's total export earnings and 12% of GDP. The Zambian government is highly likely to resort to the courts to prevent a mine shutdown by MCM. However, if the shutdown goes ahead, it will put 11,000 jobs at risk and significantly impact on Zambia's economy, which is already being weighed down by high debt-servicing costs and rapidly eroding foreign-reserves holdings - now well below three months of import coverage. (IHS Markit Country Risk's Theo Acheampong)

2. The CEO of KamAZ, Sergei Kogogin, has stated that he believed the initial effects of the Russian government's 'non-working week' on his company's production output would cost RUB2 billion (USD26.3 million), according to an interview he gave with Rossiya-24 TV Channel. The initial stoppage affecting KamAZ cost the truck-maker a week's worth of production which equated to 1,990 units, according to IHS Markit's latest MHCV EMEA production tracker. (IHS Markit AutoIntelligence's Tim Urquhart)

3. The Prudential Authority Department (PAD) of the South African Reserve Bank (SARB) announced on 6 April that it had lowered the liquidity coverage ratio (LCR) from 100% to 80%. Loans restructured as a result of the impact of the COVID-19 spread will not attract a higher capital charge and the Pillar 2A capital buffer, which is set at 1% of risk-weighted assets, will be reduced to 0%. PAD has also provided specific conditions that will allow banks to dip into their capital conservation buffer, which is set at 2.5% of risk-weighted assets. (IHS Markit Bank Risk's Ana Souto)

4. IHS Markit's Commodities at Sea data indicates that, during the reported week 14, coal shipments from South Africa's Richards Bay Coal Terminal (one of the largest coal export terminals in the world) were calculated at 1.4mt (30-day PACE ~6mt) vs 0.8mt (30-Day PACE ~3.6mt) a week before. The data also indicates that coal shipments from RBCT rebounded to normal levels as it received exemption from the government to operate the terminal. In terms of destination countries, terminal loaded cargoes to India 619kt (30-day PACE~2.7mt), Pakistan 329kt (30day PACE ~ 1.4mt), Vietnam 225kt, Malaysia 75kt, Sri Lanka 63kt, Mauritius 53kt and Kenya 41kt.

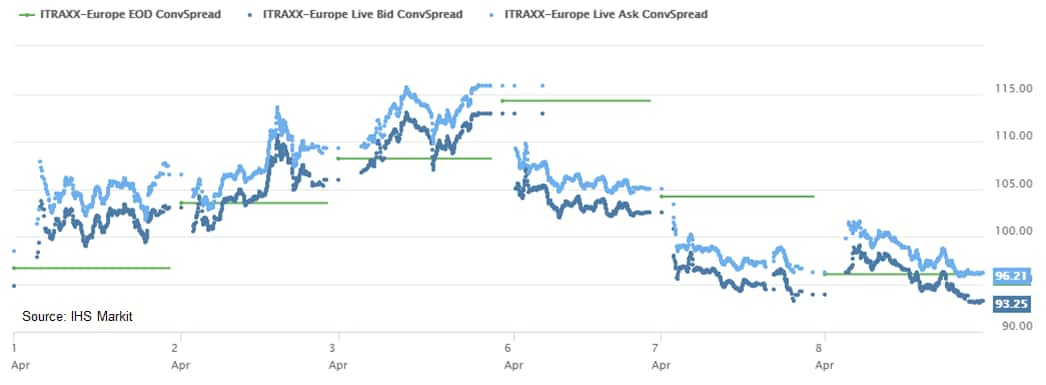

5. IHS Markit's iTraxx Europe Investment Grade CDS index started the day about 2bps wider, but gradually rallied as the day progressed and closed at -1bp/95bps spread:

6. 10yr Italian bonds opened +10bps, as European finance ministers were unable to agree on response to address the economic fallout from the COVID-19 pandemic, but then rallied shortly after the NY markets opened to end the day at +5bps/1.65% yield:

7. 10yr European govt bonds closed mixed; UK -3bps, Germany/France flat, and Spain +4bps.

8. European equity markets closed mixed, with France +0.1% the best performer in the region; Italy/Germany -0.2%, UK -0.5%, and Spain -0.7%.

Asia-Pacific

1. Singapore has announced a near total lockdown after reporting a surge in new cases over the past few days. Total infections have jumped more than 60% in the past week to 1,623, including 120 on Sunday and 142 on Wednesday, a record for a single day for Singapore. (FT)

2. The Indian government yesterday (7 April) confirmed a partial lifting of its export bans on hydroxychloroquine and paracetamol, which were implemented in response surging global demand for these medicines due to the coronavirus disease 2019 (COVID-19) pandemic. According to Agence France-Presse (AFP), the Indian foreign ministry said in a press release that the government now authorizes the export of hydroxychloroquine and paracetamol "in an amount suitable for all our neighboring countries which depend on our production capacities", and added that, "We will also provide these essential medicines to certain nations particularly affected by the pandemic." (IHS Markit Life Science's Sacha Baggili)

3. Japan's private machinery orders (excluding volatiles), a leading capex indicator, rose by 2.3% month on month (m/m) in February following a 2.9% m/m rise in January. The upward trend is unlikely to be sustainable, as the au Jibun Bank Japan Composite Purchasing Managers' Index (PMI) dropped sharply to 36.2 in March 2020 from 47.0 in February 2020, signaling that private-sector output declined at the sharpest rate since April 2011. (IHS Markit Economist Harumi Taguchi)

4. Japan's current-account surplus rose by 21.2% year on year (y/y) to JPY3.2 trillion (USD29.0 billion) on a non-seasonally adjusted basis and by 46.2% month on month (m/m) to JPY2.4 billion on a seasonally adjusted basis. The increase was largely due to a 179.3% y/y (JPY585 billion) rise in the trade surplus, mainly because of a drop in imports (down 14.6% y/y) driven by a decline in imports from mainland China, which was caused by delays in ending the Lunar New Year holidays and measures to contain the COVID-19 virus. However, weak external demand and strict controls on landing in Japan will probably suppress trade and service revenues. (IHS Markit Economist Harumi Taguchi)

5. Mitsubishi is to furlough its 6,500 full-time and temporary workers at three domestic factories over production stoppages due to the COVID-19 virus outbreak, according to a report by Nikkei citing sources close to the matter. Most of the workers are likely to receive up to 80% of their pay, claims the report. <span/>(IHS Markit AutoIntelligence's Tarik Arora)

6. China will set up 46 new cross-border e-commerce pilot zones on top of 59 existing ones, according to the State Council executive meeting on 7 April chaired by Premier Li Keqiang. Policymakers consider cross-border e-commerce as a potential new growth driver, which could help the trade sector to recover from the epidemic shock. In 2019, cross-border e-commerce imports and exports increased 38.3% y/y to CNY186.21 billion (USD26.6 billion), accounting for nearly 6% of total goods trade, which grew at a much slower pace of 3.4% y/y during the same period. (IHS Markit Economist Lei Yi)

7. Suzuki has announced that it will suspend production operations at its Rayong plant in Thailand, where it produces the Celerio, Ciaz, and Swift models, from 6 to 28 April because of a lack of components, as well as to support the government's order for social distancing. Suzuki will also suspend operations at its engine plant during the period. Separately, Mazda and Ford, which had originally suspended operations at their plants in Thailand from 27 March to 19 April, have now extended these suspensions until 26 April to protect workers' health. (IHS Markit AutoIntelligence's Jamal Amir)

8. APAC equity markets closed mixed, with Japan +2.1% being the best performer in the region; China -0.2%, India -0.6%, Australia/South Korea -0.9%, and Hong Kong -1.2

You'll frequently see data snaps in these reports from our web-based pricing portal, Price Viewer. Please contact data.delivery@ihsmarkit.com today to ask about complimentary access. .

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-global-market-summary--8-april-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-global-market-summary--8-april-2020.html&text=S%26P+Global+Daily+Global+Market+Summary+-+8+April+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-global-market-summary--8-april-2020.html","enabled":true},{"name":"email","url":"?subject=S&P Global Daily Global Market Summary - 8 April 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-global-market-summary--8-april-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+Daily+Global+Market+Summary+-+8+April+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-global-market-summary--8-april-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}