Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 22, 2023

Global pricing power sinks to two-and-a-half year low as higher interest rates take their toll

Tracking the impact of higher interest rates on inflation is made easier by survey data that reveal the extent to which prices are changing due to demand conditions.

Derived from PMI survey responses, data showing the degree to which pricing power is being affected by demand indicates that higher interest rates are having a material dampening effect on underlying inflationary pressures. Measured globally, demand-led pricing power is now at its weakest for two and a half years, which should feed through to lower inflation in the months ahead barring any external influences on prices.

The biggest effect of the demand squeeze is being seen in manufacturing, but service sector pricing power has also fallen markedly.

Inflation cools, but rate of descent slows

Inflation has come down sharply from the peak seen last year, and should fall further. The latest official data indicate that global consumer prices rose at an annual rate of 5.8% in April, down from a peak of 8.3% in September of last year. A provisional estimate for May, based on early CPI prints in the major economies, puts the annual rate at 5.3%.

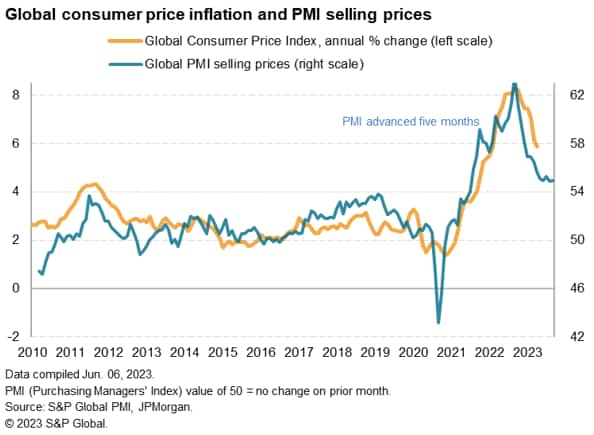

This cooling in the rate of global inflation was widely expected, not least because of base effects from steep price rises in 2022, notably for energy, but also because it was signaled in advance by the business surveys. The Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - tracks both input costs paid by companies as well as their selling prices. These cover both goods and services, and these gauges have been falling. Global input cost growth rose at near record rates in early 2022 and growth of selling prices likewise peaked in April 2022. The latter has, however, hinted at some "stickiness" of inflation. Although the index slipped to a 27-month low in May, it has lost just 0.6 points so far this year. That compares to an 8.4 point drop in the final eight months of last year.

In other words, the rate at which global inflation is falling has almost stalled.

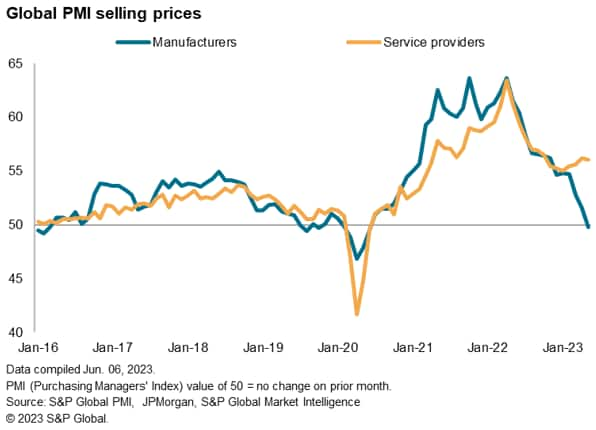

Price stickiness led by service sector

A breakdown of the PMI selling price data shows how this price stickiness is being led by the service sector. While prices charged for goods fell on average in May for the first time in nearly three years, prices levied for services rose at a rate far in excess of anything recorded by the PMI surveys prior to the pandemic, the rate of increase running higher than earlier this year (albeit down sharply from last year's peak).

Reduced pricing power

There is some good news, however, hinting that we could see some of this upward pressure on prices moderate in the months ahead.

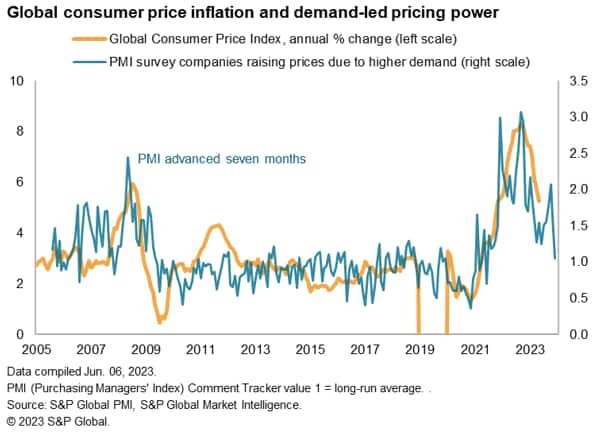

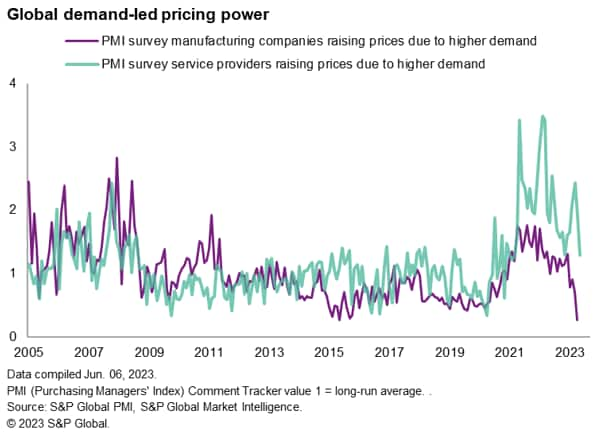

In addition to tracking whether input prices and selling prices changed at each company during the month, the PMI survey also asks respondents to report any factors that contributed to this change. These responses can be analysed over time to reveal the extent to which different forces are acting on inflation. Our chart below, for example, graphs the degree to which companies have been able to raise selling prices due to high demand.

Having hit unprecedented highs during the pandemic, the inflationary pressure from demand has cooled sharply in recent months, dropping in May to its lowest since November 2020. Charting this "PMI Comment Tracker" gauge of demand-led pricing power against global consumer prices suggests CPI could fall sharply in the months ahead. Note that the gauge is charted with a seven-month lead against CPI in this chart.

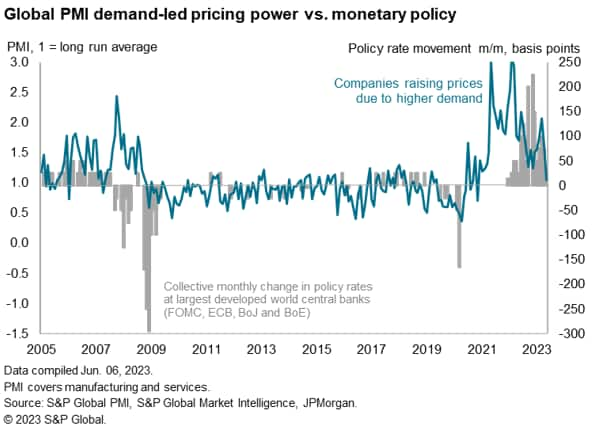

This weakening of demand-led pricing power can be linked to higher interest rates as the world's major central banks have tightened monetary policy aggressively over the past year (see chart). In fact, this measure of demand-led pricing power demonstrates the main conduit of monetary policy for taming inflation.

The survey data can also be broken down into manufacturing and services. Here we can observe how the greatest impact of weakened demand on pricing power is evident in manufacturing, though an impact is also visible in services. However, while demand-led pricing power in manufacturing is now down to the lowest seen since comparable data were available in 2005, pricing power due to high demand remains somewhat elevated by historical standards in services.

Monthly monitoring

The monthly monitoring of the changing influences on inflation will be essential in determining the likely future path of inflation and therefore policy rates. As well as the demand-led pricing power metrics, PMI responses also reveal the degrees to which other factors such as labour costs, energy costs, raw material prices and shipping costs are affecting inflation around the world.

Email us at economics@spglobal.com and ask for more inflation regarding our PMI Comment Trackers.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pricing-power-sinks-to-twoandahalf-year-low-as-higher-interest-rates-take-their-toll-June2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pricing-power-sinks-to-twoandahalf-year-low-as-higher-interest-rates-take-their-toll-June2023.html&text=Global+pricing+power+sinks+to+two-and-a-half+year+low+as+higher+interest+rates+take+their+toll+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pricing-power-sinks-to-twoandahalf-year-low-as-higher-interest-rates-take-their-toll-June2023.html","enabled":true},{"name":"email","url":"?subject=Global pricing power sinks to two-and-a-half year low as higher interest rates take their toll | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pricing-power-sinks-to-twoandahalf-year-low-as-higher-interest-rates-take-their-toll-June2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+pricing+power+sinks+to+two-and-a-half+year+low+as+higher+interest+rates+take+their+toll+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pricing-power-sinks-to-twoandahalf-year-low-as-higher-interest-rates-take-their-toll-June2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}