Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 06, 2024

Global PMI signals lowest inflation rate since October 2020

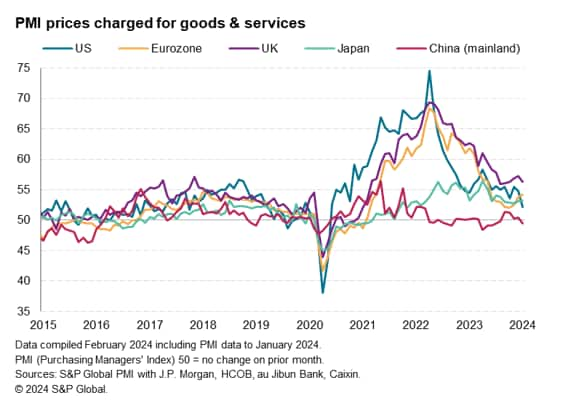

Average prices charged for goods and services rose globally at the slowest rate since October 2020, according to the January worldwide PMI surveys, signaling a cooling of worldwide inflation. Service sector price increases slowed, though some stickiness was observed for goods prices, the latter linked in part to higher shipping costs amid supply chain delays. However, the overall rate of inflation also remains somewhat elevated by historical standards due to wage pressures continuing to run above pre-pandemic levels.

The surveys also indicated some regional variations, with a marked cooling of inflation in the US contrasting with stubbornly elevated inflation in the UK and eurozone. A fall in prices in mainland China meanwhile pointed to increased deflation risks.

Global prices rise at slowest rate since late 2020

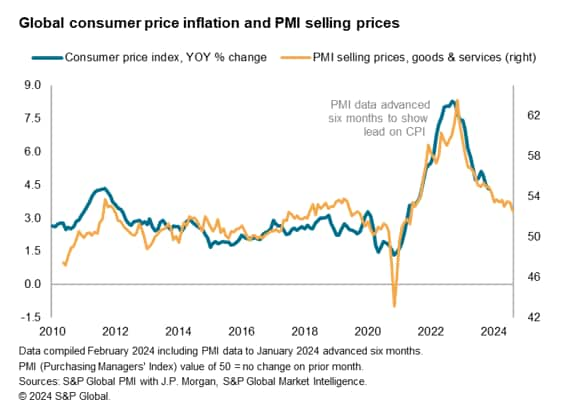

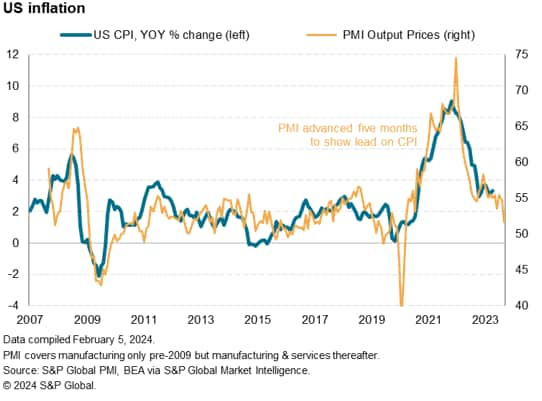

S&P Global's PMI surveys, covering approximately 30,000 companies across 40 economies, brought further good news on the fight against inflation at the start of 2024. Average prices charged for goods and services rose globally at the slowest rate since October 2020. The further decline in the index is consistent with global consumer price inflation cooling further in the coming months from the 4.3% annual rate seen in November.

However, although down almost a full index point from 53.5 in December to 52.6, the latest index reading remains hotter than the ten-year pre-pandemic average of 51.2, pointing to inflation remaining somewhat elevated by historical standards.

The leading-indicator properties of the PMI means the surveys correctly anticipated the cooling of global inflation in 2023, which has fallen since peaking at 8.3% back in September 2022. Some further progress in bringing inflation down is signaled for the coming months, to just above 3%, though that compares with a pre-pandemic ten-year average of 2.6%.

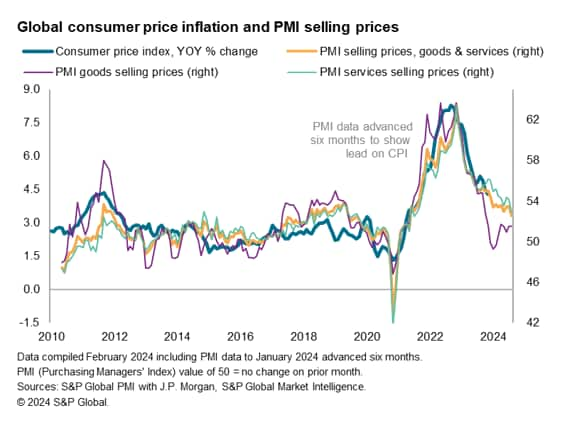

While a further moderation of service sector selling price inflation was recorded globally by the PMI in January, which is now running at its lowest for three years (albeit still above its pre-pandemic 10-year average), the rate of goods selling price inflation remained unchanged in January to thereby limit the overall disinflationary signal from the PMI.

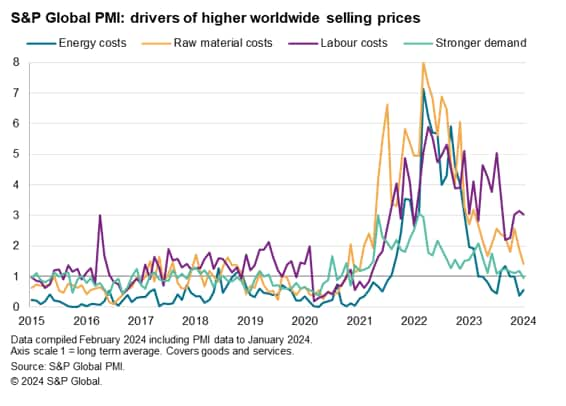

Wage pressures persist

Looking at the factors most widely cited as having driven prices higher globally, labour costs remained the most commonly reported cause in January, with the incidence of wage-push price increases remaining far higher than seen on average in the years preceding the pandemic. The upward pressure from wages is nevertheless running below that seen around the middle of last year.

Energy was meanwhile again the strongest disinflationary price force, and upward pressures from materials sank to a three-year low.

More competition

Demand-pull inflationary forces also weakened, falling slightly below the long run average for the first time since November 2020 to suggest that competitive forces are limiting global pricing power. The disinflationary impact from demand was solely evident in manufacturing, thus, contrasting with a small uplift in services, though even in the latter the upward pressure on prices from demand has slackened notably from this time last year.

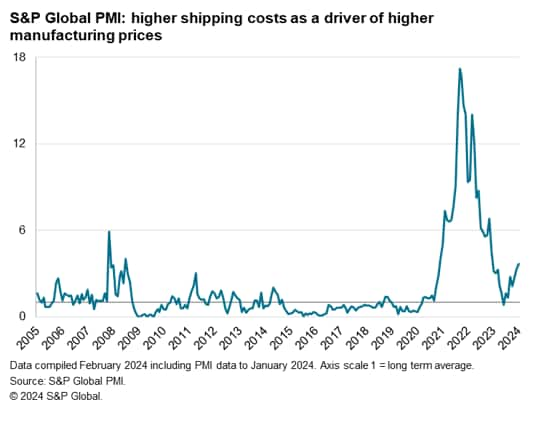

Shipping costs

One area of increased price pressures was that on goods from shipping related issues. Supply delays in the Suez and Panama canals have driven up costs, creating the strongest upward force of manufacturing prices since December 2022. Although far below the inflationary impact seen during the pandemic, the impact of higher shipping prices is high by historical standards and coming at a time that could thwart the progress of inflation towards central banks' 2% targets.

Inflation divergence

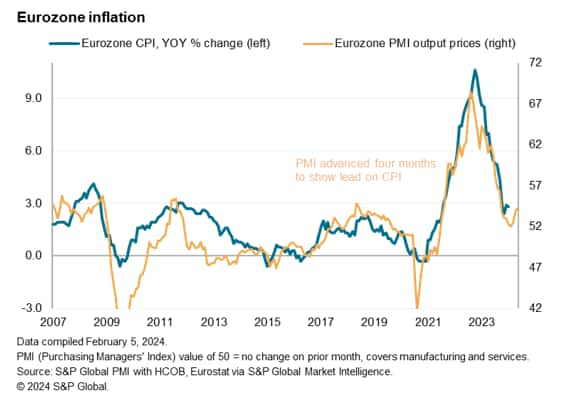

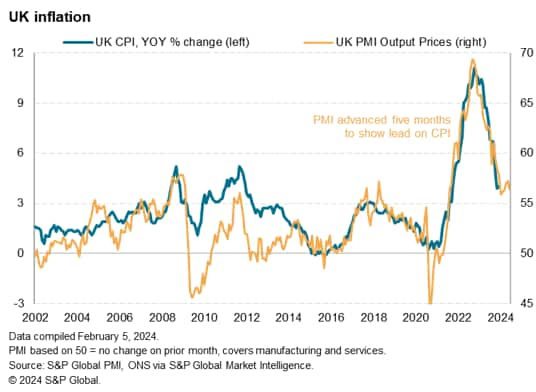

Looking at the price signals sent by the PMI data for various economies, January saw some widening divergences. Most notably, while average prices charged for goods and services in the US rose at the slowest rate since prices began rising in June 2020, eurozone price inflation accelerated for a third successive month to the highest since last May. Selling price inflation in the UK also remained especially elevated compared to the US, and by historical standards, easing only slightly in January from December's five-month high.

While the US PMI selling price gauge has fallen to a level broadly consistent with US consumer price inflation falling below the Fed's 2% target, the comparable signal from the eurozone PMI is just under 3% and in the UK, the index remains stuck at a level consistent with the CPI running above 3%.

Elsewhere the PMI signaled a renewed fall in prices charged for goods and services in mainland China after four months of modest gains, stoking concerns over deflation. Meanwhile, the rate of increase picked up marginally in Japan to a five month high.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-lowest-inflation-rate-since-october-2020-feb24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-lowest-inflation-rate-since-october-2020-feb24.html&text=Global+PMI+signals+lowest+inflation+rate+since+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-lowest-inflation-rate-since-october-2020-feb24.html","enabled":true},{"name":"email","url":"?subject=Global PMI signals lowest inflation rate since October 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-lowest-inflation-rate-since-october-2020-feb24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+signals+lowest+inflation+rate+since+October+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-lowest-inflation-rate-since-october-2020-feb24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}