Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 15, 2024

Global PMI signals faster economic growth amid steady price gains

Global PMI rises for fourth straight month to hit eight-month high

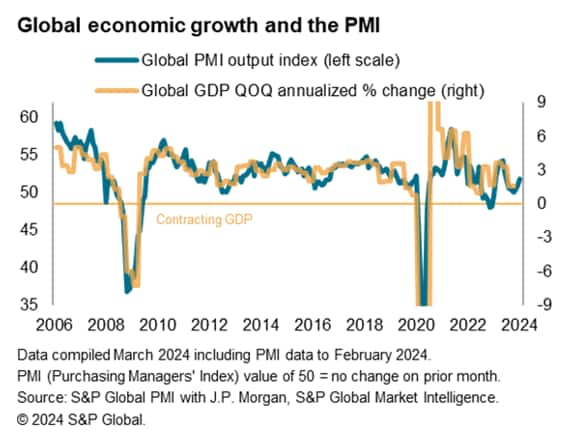

S&P Global's PMI surveys indicated that the global economy gained further growth momentum in February. At an eight-month high of 52.1, against 51.8 in January, the headline PMI covering manufacturing and services over 40 economies has now risen for four consecutive months. The gathering upturn points to an encouraging start to the year, albeit with the PMI remaining below the survey's long-run average of 53.2.

India leads global expansion but developed world's revival gathers pace

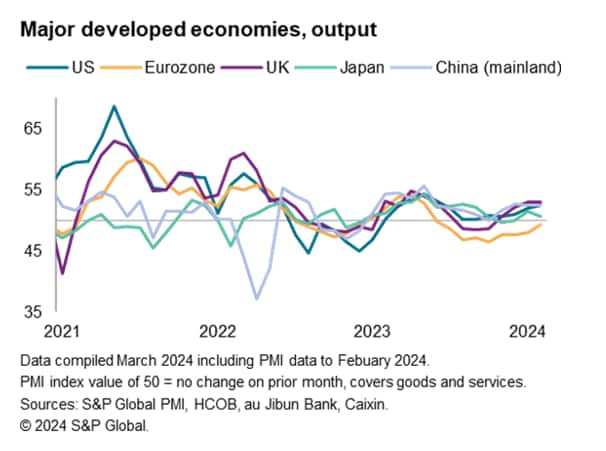

Business activity in the developed world rose at the fastest rate for eight months, increasing for a second month after five months of decline. Although growth slowed in Japan, Australia returned to growth and rates of expansion hit nine- and eight-month highs in the UK and US respectively. Downturns meanwhile moderated in both the eurozone and Canada, with composite PMIs at eight- and five-month highs respectively.

Emerging market growth meanwhile slipped only slightly lower to record the second fastest expansion seen over the past eight months. India continued to record the strongest growth by some margin, and growth accelerated sharply to a 19-month high in Brazil. Steady but subdued growth was also seen in mainland China, though Russia's rate of expansion slipped to a 13-month low.

All major industries report rising global output for first time since July 2022

By sector, all eight major sub-industries tracked by the PMI expanded globally for the first time since July 2022 to signal an increasingly broad-based upturn.

A return to growth of basic material producers, linked in part to reduced destocking by customers, helped the broader manufacturing economy report the fastest global output growth for nine months, and one of the strongest rates seen over the past two years. The service sector nevertheless continued to lead the upturn, expanding at the sharpest rate in seven months. Especially strong growth was recorded globally for consumer and financial services.

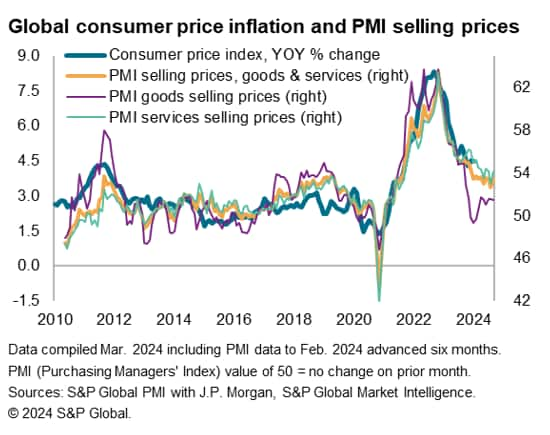

PMI signals stubborn global price inflation

Although the survey also showed global selling price inflation edging higher, the rate of increase remained among the lowest seen since mid-2021 and well down on the strong rates seen in 2022 and early-2023. The rate of inflation has nevertheless held broadly steady since late last year, pointing to a stubbornly elevated rate of inflation relative to the ten-year pre-pandemic average.

Global services selling price inflation remained especially elevated, accelerating slightly in February, and manufacturers' selling prices rose for a seventh straight month. However, after Red Sea disruptions caused supply delays in January, the impact of shipping disruptions eased in February to hint at only a modest impact so far from the rerouting of ships around Africa on global supply chains and prices.

More insights will be available with the flash March PMI data, published 21 March.

Access the Global Composite PMI press release here.

Access the Global Sector PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-faster-economic-growth-amid-steady-price-gains-mar24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-faster-economic-growth-amid-steady-price-gains-mar24.html&text=Global+PMI+signals+faster+economic+growth+amid+steady+price+gains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-faster-economic-growth-amid-steady-price-gains-mar24.html","enabled":true},{"name":"email","url":"?subject=Global PMI signals faster economic growth amid steady price gains | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-faster-economic-growth-amid-steady-price-gains-mar24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+signals+faster+economic+growth+amid+steady+price+gains+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-faster-economic-growth-amid-steady-price-gains-mar24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}