Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 03, 2018

Global manufacturing PMI holds at two-year low as world exports fall for third month running

- Global PMI remains at lowest level since November 2016, optimism slumps to weakest in series history

- Export orders fall for third straight month

- Price pressures and supply constraints ease

- US shows greater resilience than other major economies, Vietnam leads the rankings

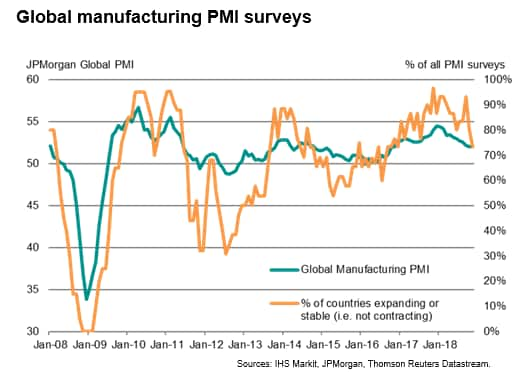

Global manufacturing growth was unchanged from October's 23-month low in November. Exports fell for a third month in a row and the number of countries reporting a deterioration of business conditions rose to the highest since 2016.

In a sign that growth may slow further, optimism about the year ahead meanwhile fell to the lowest for at least six years. Price pressures meanwhile cooled to the least marked for over a year, reflecting softer demand growth for commodities and the falling oil price.

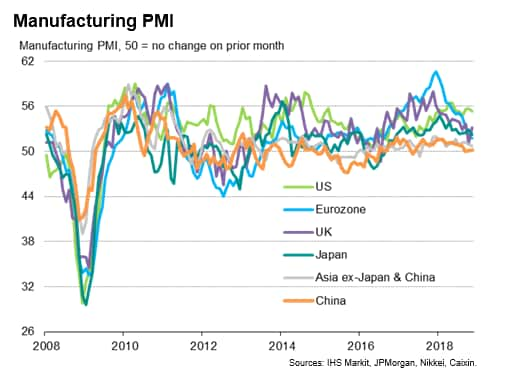

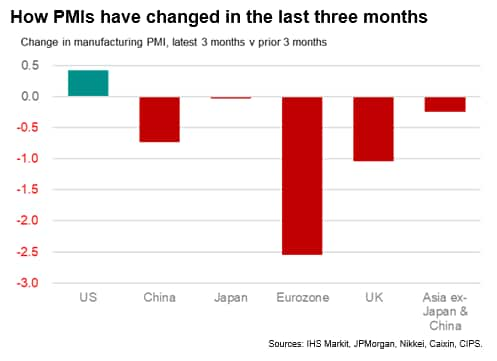

The US stood out from other major economies by displaying greater resilience in terms of its recent manufacturing performance, though Vietnam reported the fastest rate of expansion.

Manufacturing PMI holds at two-year low

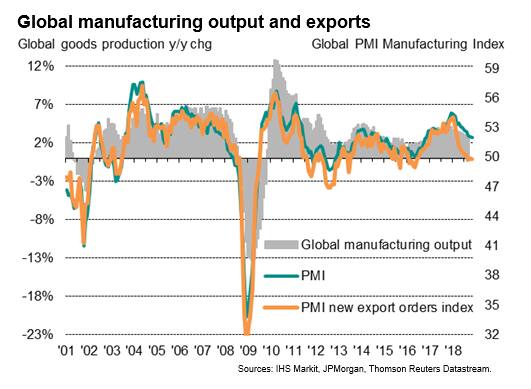

The JPMorgan Global Manufacturing PMI, compiled by IHS Markit, held steady at 52.0 in November, the October reading was the lowest since November 2016. Output growth remained close to October's 28-month low, indicative of worldwide goods production growing at a modest annual rate just above 2%.

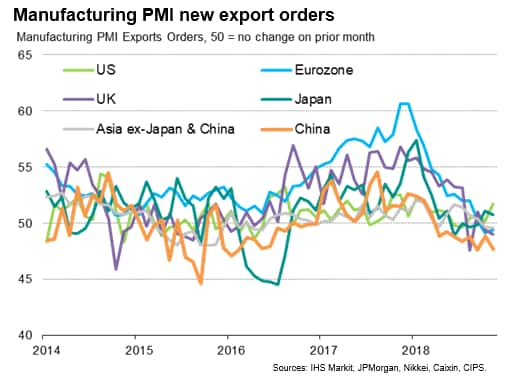

New order growth also remained subdued, rising at a rate unchanged from October's 25-month low. Global export orders, a key bellwether of worldwide trade flows, declined for a third successive month. Although only marginal, the drop in exports represents a marked contrast to the six-and-a-half year high rate of increase seen at the end of last year and coincides with a period of growing global trade tensions, led by the US.

Backlogs of orders meanwhile showed the smallest increase since August 2016, rising only very modestly to suggest that, in general, current global manufacturing capacity was sufficient to cope with recent order book growth.

The rate of factory job creation slipped below the average seen so far this year, principally reflecting the reduced need to expand capacity in the face of weaker order book growth.

Fewer capacity constraints were also evident in supply chains. Although delivery times continued to lengthen on average, the incidence of delays was the lowest since August of last year, linked in part to November seeing the second-smallest rise in purchasing activity by manufacturers over the past two years.

Business expectations for the year ahead meanwhile slid to the lowest since comparable data were first available in mid-2012, reflecting concerns over trade tensions and tariffs, increasingly widespread political uncertainty and worries linked to global financial markets and rising interest rates.

Price pressures lowest since mid-2017

The survey data also indicated that the recent cooler pace of manufacturing growth has been accompanied by weaker price pressures. Average manufacturing input prices registered the smallest monthly rise since August of last year, despite on-going reports of tariffs having driven up costs. Lower oil prices contributed to the slower growth of costs. Average global selling prices also rose at a reduced rate, showing the smallest monthly increase since July of last year.

National data show spreading downturn

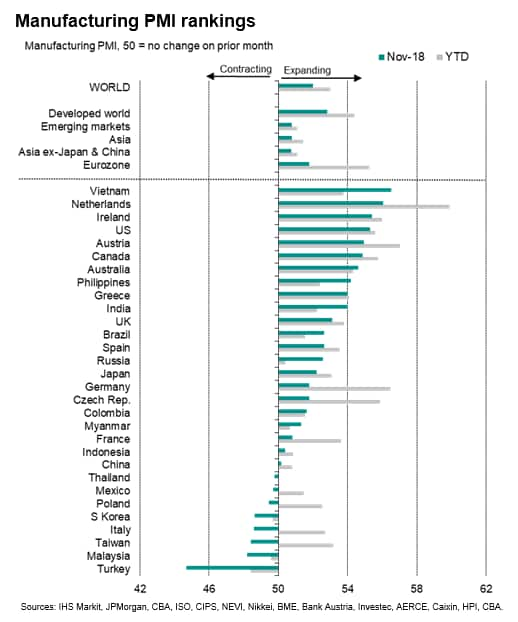

Although the headline PMI held steady in November, the number of countries reporting a deterioration in business conditions rose to the highest since December 2016. Eight of the 30 countries surveyed reported a sub-50 PMI reading, with the worst performance seen in Turkey. By comparisons, this time last year only one country (Colombia) reported a deterioration of business conditions.

US resilience

Vietnam rose to the top of the PMI rankings in November, followed by the Netherlands and Ireland. The US moved up into fourth place, having displayed more resilience in terms of factory growth than other major economies. The US has in fact seen factory growth accelerate in the latest three months, widening the gap with other major manufacturing economies. In contrast, weakening trends have been recorded in the eurozone, UK, China and Japan.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-holds-at-twoyear-low-031218.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-holds-at-twoyear-low-031218.html&text=Global+manufacturing+PMI+holds+at+two-year+low+as+world+exports+fall+for+third+month+running+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-holds-at-twoyear-low-031218.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI holds at two-year low as world exports fall for third month running | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-holds-at-twoyear-low-031218.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+holds+at+two-year+low+as+world+exports+fall+for+third+month+running+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-holds-at-twoyear-low-031218.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}