Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 02, 2019

Global manufacturing PMI at 27-month low as business conditions worsen in one-in-three countries

- Global PMI slips to 51.5 in December, lowest since September 2016

- Export orders fall for fourth month in a row; business optimism lowest since at least 2012; hiring fades

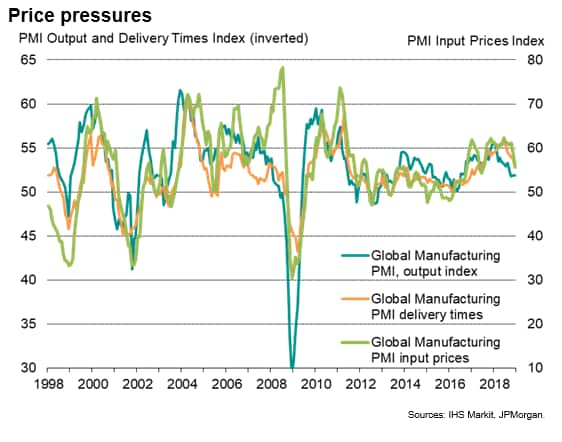

- Price pressures ease

- Ten of 30 countries report deteriorating manufacturing conditions

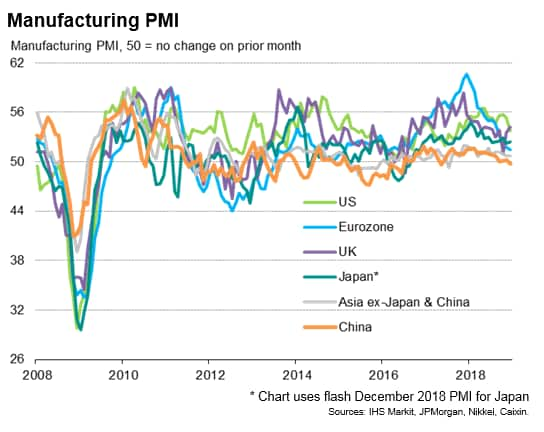

Global manufacturing growth fell to its weakest for over two years at the end of 2018 as the number of countries reporting deteriorating business conditions rose to one-in-three.

Weakened optimism about the year ahead and reduced growth of orders books meanwhile bode ill for output in coming months, and contributed to the weakest rate of job creation for over two years.

Factory gate price inflation meanwhile cooled sharply, reflecting the falling cost of oil and slower demand growth for commodities.

Manufacturing PMI at 27-month low

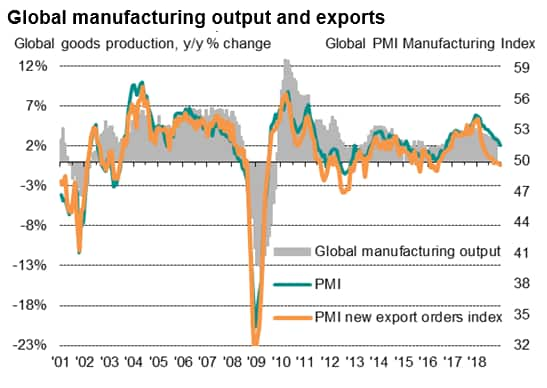

The JPMorgan Global Manufacturing PMI, compiled by IHS Markit, fell to a 27-month low of 51.5 in December, down from 52.0 in November. The survey is indicative of worldwide goods production growing at a modest annual rate of approximately 2%.

The PMI indicated a steady easing in the rate of expansion over the course of 2018 as trade war worries in particular subdued global trade. The December surveys showed global export orders falling for a fourth straight month, dropping at the fastest rate since May 2016. In contrast, exports had been growing at the fastest rate for almost seven years at the beginning of 2018.

The reduction in export orders contributed to a deterioration in overall order book growth to the lowest since August 2016, suggesting the rate of expansion of production could weaken further in January.

Companies have also scaled back their optimism for the year ahead, with business expectations down to the lowest since comparable data were first available in 2012.

Companies responded to the reduced growth of new work and gloomier outlook by taking a more cautious approach to hiring. Factory headcounts continued to increase in December, but to the smallest extent for 25 months.

Widening downturn

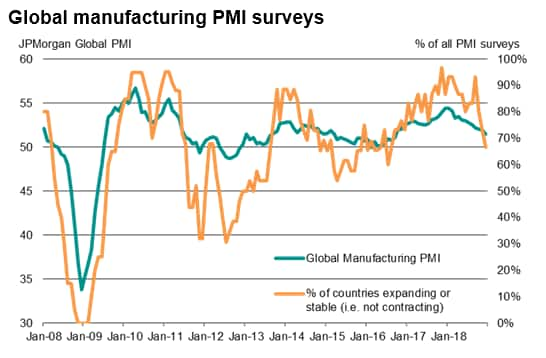

Not only did the rate of global manufacturing expansion fade at the end of 2018, but the number of countries reporting deteriorating business conditions also increased. The number of countries either expanding or stable has fallen from 97% in late-2017 to just two-thirds in December 2018.

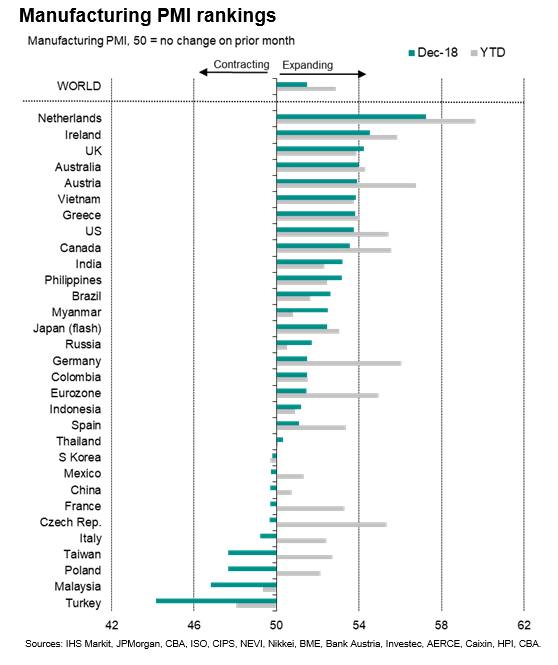

Ten of the 30 countries surveyed reported a sub-50 PMI reading in December. By comparison, in November 2017 only one country (Colombia) reported a deterioration of business conditions.

The worst performance was again seen in Turkey, but China, France, Italy, the Czech Republic, Poland, Taiwan, Malaysia, South Korea and Mexico all also reported sub-50 PMI readings.

Growth remained resilient in a number of countries, with the Netherlands rising to the top of the PMI rankings, followed by Ireland and the UK. However, the UK - and most likely its close trading partners - benefitted from increased orders and stock building as increasing numbers of companies and their customers stepped up preparations for a potentially disruptive Brexit.

Price pressures cool further

Price pressures also moderated considerably at the end of 2018. Average manufacturing input prices registered the smallest monthly rise since July 2017, cooling further from last June's peak, while prices charged at the factory gate registered the joint-smallest rise for 27 months.

Selling prices fell across the emerging markets for the first time since January 2016 and rose in the developed world at the slowest pace since August 2017.

Lower oil prices again contributed to the slower growth of costs, but December also saw signs of demand and supply coming more into line, meaning suppliers often struggled to raise prices.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-at-27-month-low-190102.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-at-27-month-low-190102.html&text=Global+manufacturing+PMI+at+27-month+low+as+business+conditions+worsen+in+one-in-three+countries+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-at-27-month-low-190102.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI at 27-month low as business conditions worsen in one-in-three countries | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-at-27-month-low-190102.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+at+27-month+low+as+business+conditions+worsen+in+one-in-three+countries+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-at-27-month-low-190102.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}