Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 19, 2023

Global inflation and growth: what to watch for in the September PMI surveys

Will the global economy continue to lose growth momentum, and is inflation still sticky at the end of the third quarter? These are the key questions that we will look to answer with the upcoming September PMI releases.

To get to the bottom of these overarching issues, however, we also need to examine the variations between different economies and sectors. This can be done with the help of the PMI figures, due to their extensive coverage of around 90% of the global GDP, with national data consolidated using a consistent methodology to ensure international comparability.

We recap below the key messages from August's PMI and highlight the key themes to watch with the upcoming flash PMI release on Friday, September 22, ahead of worldwide national and sector PMI releases at the start of October.

Flash PMI to provide the earliest signals on September 22

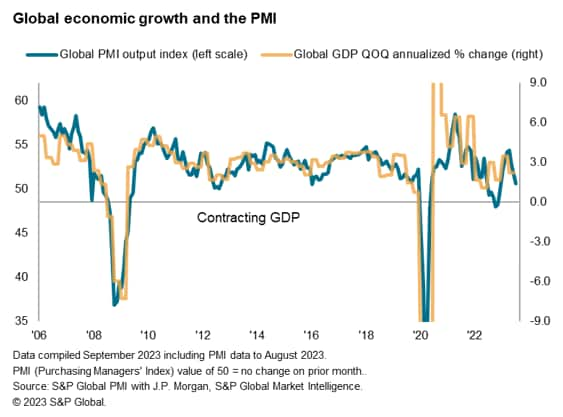

The global recovery further lost momentum according to the August global PMI data, compiled by S&P Global. The headline PMI, covering manufacturing and services across over 40 economies and sponsored by JPMorgan, fell from 51.6 in July to 50.6, the lowest reading since growth renewed in February. The latest reading is consistent with quarterly GDP growth of just under 1%, well below the pre-pandemic ten-year average of 3.0%.

When considering the new orders data and deteriorating backlogs conditions, the survey's sub-indices are pointing towards a further loss of growth momentum. It will therefore be of interest to study if more slack in global growth is accumulated during the final month of the third quarter, or if a turnaround might be seen with the PMI, which remains a reliable indicator for showing turning points in history.

The flash PMI, released for major developed economies including the US, UK, Eurozone, Japan and Australia, will provide the earliest indications on September 22. The flash surveys, which capture around 85% of survey responses prior to the month-end, typically exhibit little difference to their respective final readings and hence serve as accurate measures of the actual economic conditions of the economies in study.

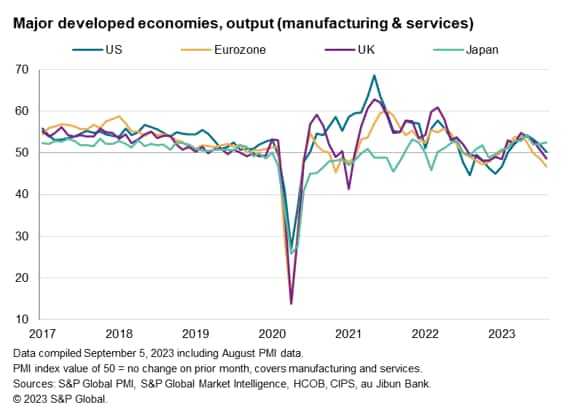

August's survey revealed that the UK joined the eurozone in contraction midway through the third quarter while the US near-stagnated. These three developed economies all share the same characteristics of still-elevated inflation, historically higher interest rates and weakening economic conditions to varying degrees, so it will be of interest to examine how the market should again respond to the flash numbers, especially if further disappointments might be observed.

Japan remained a bright spot, expanding at an increased pace in August. That said, the Bank of Japan faces its own set of challenges, with a market that is averse to changes of its long-held accommodative monetary policy stance, making these economic indicators important to watch in times of potential change.

Consensus expectations currently point to similar or weaker conditions for the majority of these economies with the flash releases. Any surprises either way may again lead to markets adjusting post release.

Regional divergences

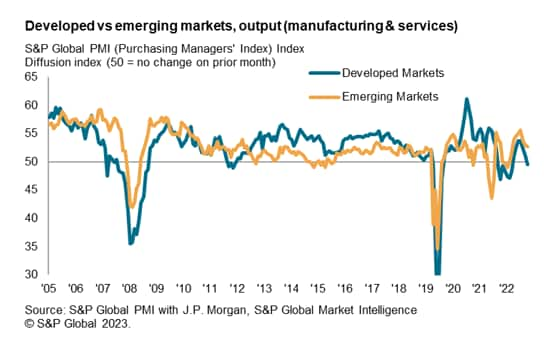

One of the key variations between regions had been that of emerging and developed markets in August. Despite both regions having seen trends deteriorate compared to July, emerging markets have remained encouragingly resilient, growing solidly at a pace above its long-run average as developed economies slipped into contraction for the first time since January.

Evidently, with global trade remaining a persistent negative factor for growth, and with developed economies being major trading partners for emerging markets, the latter are susceptible to the impact of further slowdowns in the developed world. The extent to which emerging markets' growth momentum may have further declined will therefore be of key interest. This is especially so with a strengthening greenback currently not boding well for the likes of emerging market equities.

Are prices still sticky?

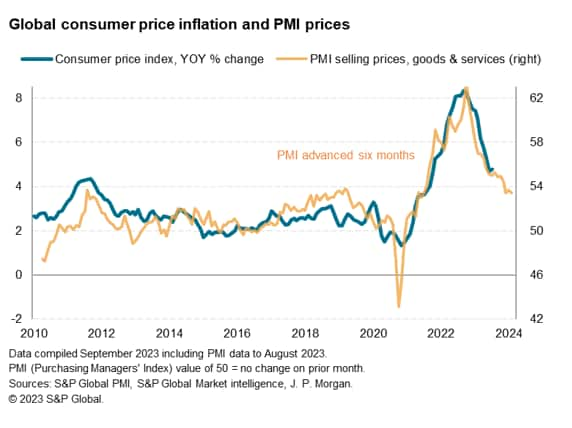

Central to the concerns over economic data of late has been the impact the figures hold in influencing monetary policy makers around the world in their ongoing fight with taming inflation. As it is, the global CPI stands elevated at 5.8% in July. Although indications from the global PMI selling prices index - the trend of which preludes the expected path for official CPI - points to a further easing of price pressures in the coming six months, it has also suggested that global CPI may not have too much room to fall past the 4.0% mark even into 2024. This outlines the remaining work to be done by central banks to get CPI to the ideal 2.0% level.

August's global PMI selling price index - compiled by S&P Global and covering prices charged for both goods and services in all major developed and emerging markets - was 53.4 in August, down only modestly from 53.7 in July. Whether any further significant progress would be made towards the 50.0 mark will be closely monitored with September PMI price indices.

Muted jobs market to help inflation fight?

To a large extent, wages remain one of the key reasons that inflation has been sticky even as global supply chains have healed. That said, the PMI backlogs of work index, an important sub-index alluding to capacity pressures, has painted a picture of possible flatlining or even contraction of payrolls in the developed market. This may offer some further reprieve for the relatively elevated price inflation conditions in the developed world.

How much of an energy shock?

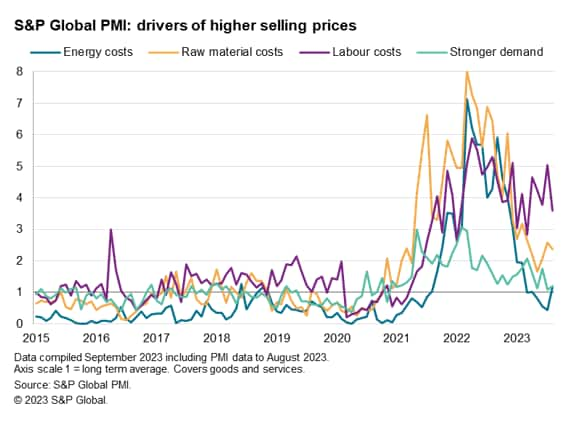

Meanwhile, our PMI Comment Tracker, offering a wealth of information to supplement PMI data, has shown some revival of energy costs as a driver of higher selling prices. Amid the scrutiny over the recent surge in oil prices, and the wide-ranging impact of higher energy costs on companies from all sectors, we have found that upward pressure from energy costs as a driver of higher selling prices were only just above their long run average in August. This suggests that the rise in oil prices have yet to become a significant issue compared to historical price rises.

That said, with the way that Brent Crude oil prices have trended in the past month, one can only expect energy costs to have become more significant an issue in September. Whether it has risen in importance markedly or even overtaken other key categories will be a key metric to look for with September's release.

Cooling consumer services sector to further help inflation?

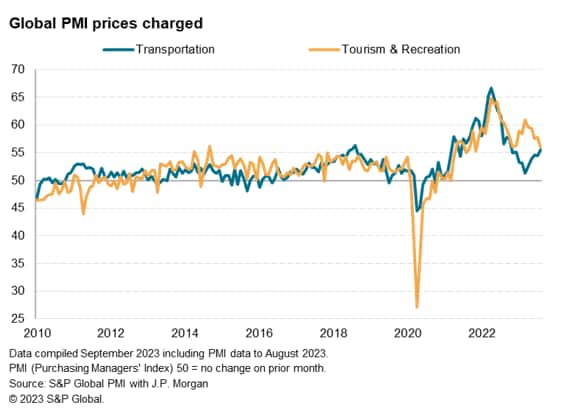

Finally, sector PMI will offer even more insights and clarity pertaining to the health of the global economy. Consumer services as a sector, driven by tourism and recreation demand, had performed exceptionally in the first half of 2023. While the pace of growth moderated into August, falling to the slowest since the upturn commenced in February, consumer services firms were found to have raised charges the fastest among the sector surveyed, outlining their resilient pricing power.

Whether the cooling of consumer services sector demand could bring about a further easing of inflation will be one key area to watch with the release of detailed sector data. Additionally, the aforementioned rise in energy costs have pushed up charges in transportation, hence the degree at which prices have further increased in this sector will be keenly tracked given its importance for both goods and service providers alike.

Refer to our release calendar here for the details of all PMI releases for September.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-september-pmi-sep23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-september-pmi-sep23.html&text=Global+inflation+and+growth%3a+what+to+watch+for+in+the+September+PMI+surveys+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-september-pmi-sep23.html","enabled":true},{"name":"email","url":"?subject=Global inflation and growth: what to watch for in the September PMI surveys | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-september-pmi-sep23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+inflation+and+growth%3a+what+to+watch+for+in+the+September+PMI+surveys+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-september-pmi-sep23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}