Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 09, 2019

Global growth lifts to four-month high

The following is an extract from IHS Markit's monthly PMI overview presentation. For the full report please click on the link at the bottom of the article.

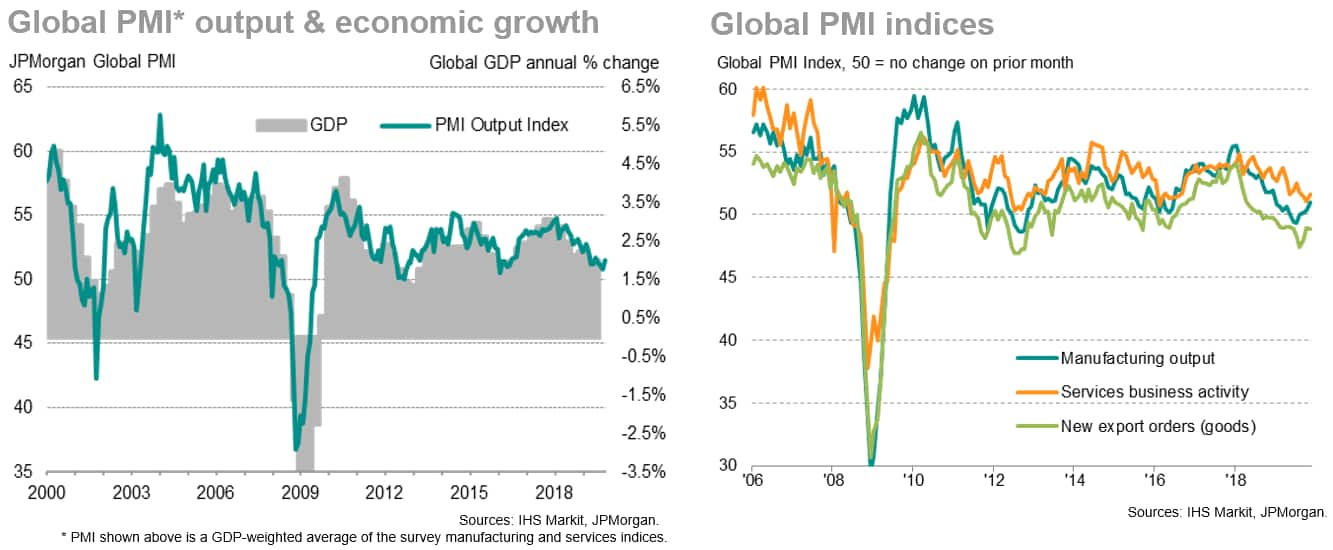

At 51.5 in November, the JPMorgan Global PMI™ (compiled by IHS Markit) rose to a four-month high, recovering some poise after slumping in October to its lowest since February 2016. The latest reading nevertheless remains one of the weakest recorded over the past four years, comparable with global GDP rising at an annual rate of just below 2% (at market prices) in the fourth quarter so far.

Manufacturing showed further tentative signs of improvement, with the global factory output index up for a fourth month in a row, accompanied by the first acceleration in service sector growth for four months. Both sectors nevertheless continue to grow at some of the weakest rates since early-2016. Global goods trade, which led the economic slowdown in 2018, meanwhile continued to deteriorate at a historically marked rate, acting as a drag on growth. Global service sector exports likewise fell. Total global new orders nonetheless expanded at the quickest rate for four months, hinting at improved domestic demand in key markets.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-lifts-to-fourmonth-high-dec19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-lifts-to-fourmonth-high-dec19.html&text=Global+growth+lifts+to+four-month+high+-+Nov%2719+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-lifts-to-fourmonth-high-dec19.html","enabled":true},{"name":"email","url":"?subject=Global growth lifts to four-month high - Nov'19 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-lifts-to-fourmonth-high-dec19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+growth+lifts+to+four-month+high+-+Nov%2719+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-lifts-to-fourmonth-high-dec19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}