Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 09, 2022

Global employment trend softens in November but labour shortages and hiring challenges support continued jobs growth

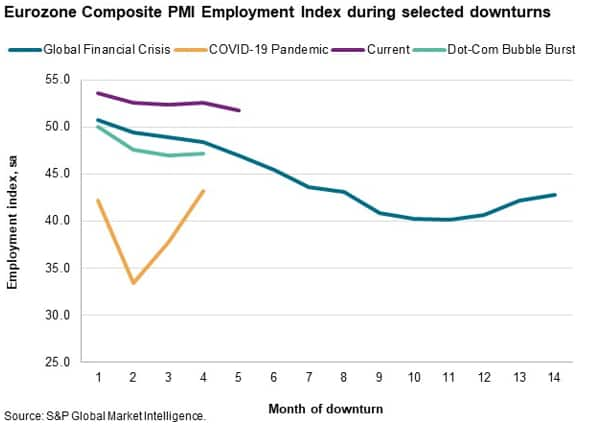

While the downturn in global private sector business activity entered its fourth month in November, employment continued to rise. The persistence of hiring, albeit at a reduced rate, amid a deteriorating economic backdrop contrasts markedly to this point in previous economic downturns. Our PMI Comment Trackers suggest companies are reluctant to lay off their workers due to the difficulties they anticipate in rehiring, a possible legacy of the pandemic. This may also tentatively indicate that any downturn in employment may be constrained by comparison to other downturns.

Regional trends show that resilience is particularly pronounced in the eurozone and other developed economies, where firms appear to have been hoarding labour, although in other parts of the world we see employment trends behaving more normally.

Composite PMI shows deepening downturn

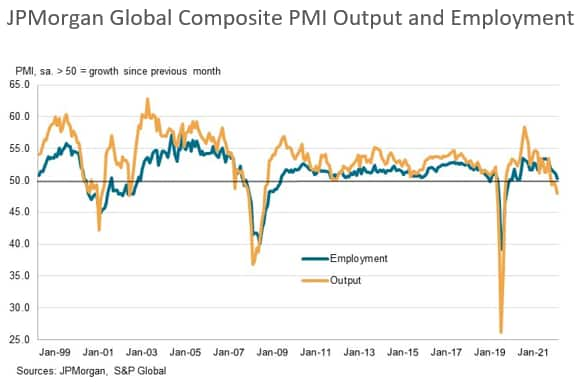

The JP Morgan Global Composite PMI survey, compiled by S&P Global, signalled a fourth successive contraction in economic activity during November. In fact, overall business output fell at the sharpest rate since the Global Financial Crisis in 2009 when excluding the months during 2020 that were hit the hardest by the pandemic. Meanwhile, new orders and backlogs both also declined at sharper rates, pointing to rising spare capacity as the demand environment deteriorated.

Global employment trends holding up better than past downturns

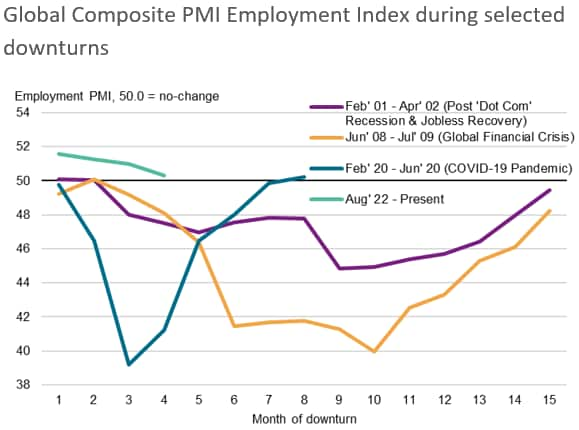

Contrary to this worsening economic growth picture, and despite another fall in backlogs of work (suggesting that capacities are sufficient to manage existing business requirements), the latest JP Morgan Global PMI surveys showed a twenty-seventh successive month of job creation in November. The trend in employment during the current downturn has been a departure from the picture seen in others that have occurred over the past 25 years for which composite PMI data are available at the global level.

The JP Morgan Global Composite Employment PMI did come down in November, to its lowest since February 2021 and was only marginally in growth territory, but we've typically seen global workforce numbers contracting, not growing, by this stage in previous downturns.

PMI Comment Trackers provide some insight

Our new PMI Comment Trackers dataset can provide some insight at the global level into what is driving these resilient labour market trends.

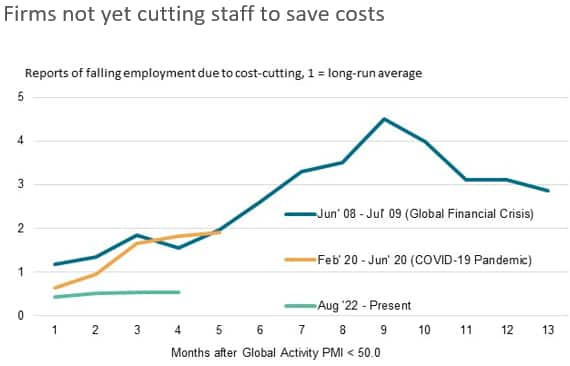

We think one explanation of this resilience has been a reluctance among companies to sanction job cuts due to the immense challenges they faced in rehiring post-pandemic. If the downturn is only short-lived, companies will likely need their staff once economic conditions begin improving and may only be willing to fire staff to retrench as a last resort. According to the PMI Comment Trackers, reports of staffing levels being cut to reduce costs were around half of their typical levels in November, which is out of kilter compared with previous downturns, as lay-offs tend to be more prevalent by this point.

Those companies that are still hiring are also remarking on the challenges in finding staff, with the PMI Comment Trackers showing reports of labour shortages globally running at twice its long-run average during November. This indicates that businesses may be discouraged from cutting headcounts as they are worried of not being able to find the right staff in the limited pool of labour available.

Nevertheless, it is clear that the global labour market is losing steam. At a sector level, manufacturing employment fell for the first time in just over two years during November, indicating that total jobs growth was exclusively services-driven. The goods-producing sector tends to lead the services economy, therefore hinting that a further softening in the labour market here may be on the horizon. That said, had labour shortages not been as prevalent, the downturn in employment may have been a lot more advanced by this point, and this may help keep more people in jobs and ensure that any labour market downturn is relatively shallow.

Eurozone economies main sources of jobs resilience

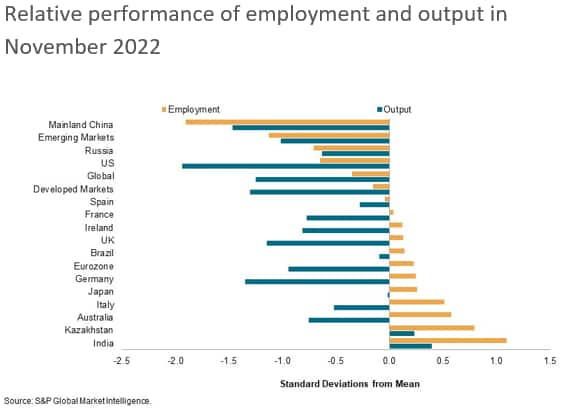

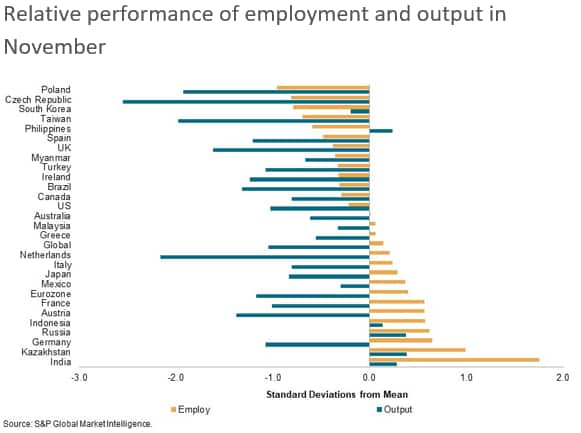

Looking at the performance of PMI output and employment indices compared to respective series averages suggests that the eurozone is a key source of the unusually strong employment data. Germany, Italy, Ireland and France are all seeing employment readings above average despite below-average output index figures. Spain is the only eurozone economy not to follow this pattern. Elsewhere, the output and employment mismatch is also seen in other developed economies such as the UK and Australia, but other countries such as Russia, the US, Brazil and India are displaying a more traditional relationship.

The ongoing expansion of employment in the eurozone private sector contrasts with what has been seen in previous downturns, when job cuts began shortly after output started to contract. Eurozone business activity decreased for the fifth month running in November, but employment continued to increase, albeit to the least extent since February 2021.

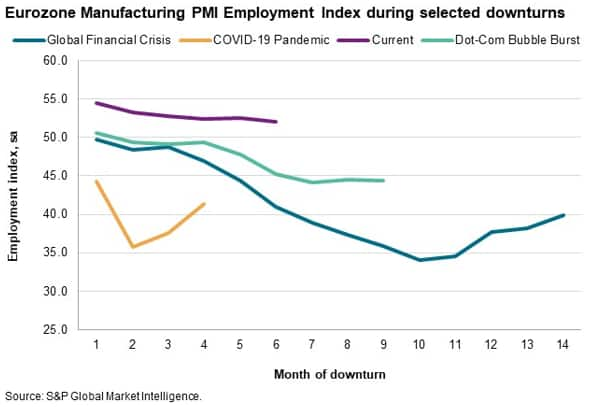

Even in the eurozone manufacturing sector, where production has been falling for six months and at a rapid pace, employment continued to increase in November.

Looking at manufacturing more widely, we see a similar picture as for the broader composite PMI indices, with a number of eurozone nations seeing wide divergences in trends between output and employment, including for economies where only manufacturing data are available such as Austria and the Netherlands.

Other areas see more normal trends

Elsewhere, trends in employment are more in line with what we would normally expect, either because continued job creation reflects ongoing output growth or because firms have started to scale back workforce numbers in line with lower activity. For example, US manufacturing employment is only rising marginally despite output having increased in two of the past three months, while in Asian economies such as Taiwan and South Korea employment is being scaled back in response to falling production.

Other reasons for divergent trends to be investigated

Over the months ahead we intend to see if these trends continue and attempt to investigate some of the reasons why this has been occurring.

As well as the aforementioned issue of staff shortages and concerns among firms of being able to rehire in the future, businesses will also consider the cost of firing now and hiring again in the near-term should a downturn be short-lived. This is particularly relevant in the eurozone, where the proximity of the Ukraine war and the energy crisis means that, in many cases, output has understandably come under pressure but companies see brighter prospects after the winter.

Company size could also be a factor. While medium- and large-sized enterprises are more likely to have healthy cashflows to be able to hoard labour, small firms would find it more challenging as relatively smaller budgets are substantially squeezed by an unhealthy combination of falling revenues, stretched margins and rising operating expenses.

Diverging trends for employment could also be found on a sector basis, and we suspect that the composition of the labour market has shifted in some developed nations since the onset of COVID-19 towards areas such as software & services, technology and healthcare. Hence, these segments could be the main sources of employment growth. It is also worth noting that the most striking divergence between output and employment is in financial services, suggesting that companies there have been caught out by the speed of the downturn.

Another field worth exploring consists of the types of contracts being offered, as an overall upturn in staff appointments could conceal that these are mainly fixed-term, part-time or even zero-hours roles.

Finally, while the PMI indices show monthly rates of change for a particular measure, the employment puzzle could be related to levels. We suspect that in some instances firms are still rebuilding workforces since the pandemic, while backlog volumes might still be elevated.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 1491 461 016

Joe Hayes, Senior Economist, S&P Global Market Intelligence

Tel: +44 1344 328 099

Pollyanna De Lima, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 075

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-trend-softens-in-november-but-labour-shortages-and-hiring-challenges-support-continued-jobs-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-trend-softens-in-november-but-labour-shortages-and-hiring-challenges-support-continued-jobs-growth.html&text=Global+employment+trend+softens+in+November+but+labour+shortages+and+hiring+challenges+support+continued+jobs+growth+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-trend-softens-in-november-but-labour-shortages-and-hiring-challenges-support-continued-jobs-growth.html","enabled":true},{"name":"email","url":"?subject=Global employment trend softens in November but labour shortages and hiring challenges support continued jobs growth | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-trend-softens-in-november-but-labour-shortages-and-hiring-challenges-support-continued-jobs-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+employment+trend+softens+in+November+but+labour+shortages+and+hiring+challenges+support+continued+jobs+growth+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-employment-trend-softens-in-november-but-labour-shortages-and-hiring-challenges-support-continued-jobs-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}