Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 09, 2019

Global economy gains momentum for second month running in March but manufacturing malaise deepens

The following is an extract from IHS Markit's monthly PMI overview presentation. For the full report please click on the link at the bottom of the article.

Global economy gains momentum but sentiment grows gloomier

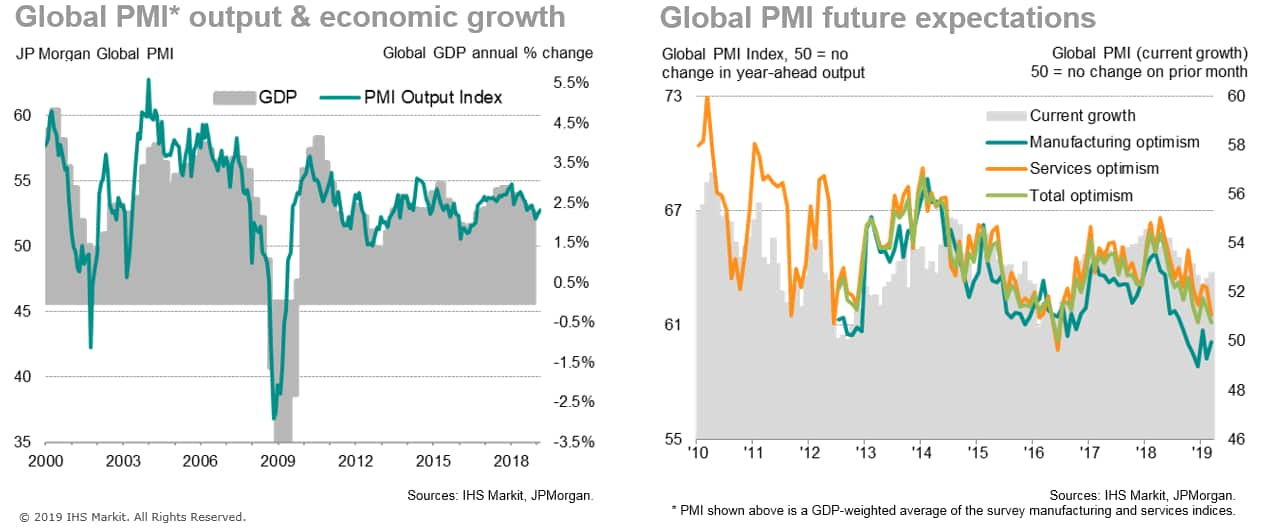

The pace of global economic growth picked up again in March from a near two-and-a-half year low seen at the start of the year, but remained among the weakest since 2016. At 52.8 in March compared to 52.6 in February, the JPMorgan Global PMI, compiled by IHS Markit, rose for a second successive month to signal the strongest expansion of global output since November. The first quarter average PMI reading is indicative of worldwide GDP rising at an annual pace of just over 2% (at market prices).

Business sentiment meanwhile sank lower, however, casting doubt over whether the current improvement in growth momentum can be sustained. The current level of business confidence is now one of the lowest seen since comparable data were first available in 2012, down to the joint-lowest since June 2016. Furthermore, inflows of new business continued to run at one of the slowest rates seen for two-and-a-half years, contributing to a stagnation of backlogs of work and leading to a slowdown in the overall pace of hiring.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-gains-momentum-for-second-month-running-090419.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-gains-momentum-for-second-month-running-090419.html&text=Global+economy+gains+momentum+for+second+month+running+in+March+but+manufacturing+malaise+deepens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-gains-momentum-for-second-month-running-090419.html","enabled":true},{"name":"email","url":"?subject=Global economy gains momentum for second month running in March but manufacturing malaise deepens | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-gains-momentum-for-second-month-running-090419.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+gains+momentum+for+second+month+running+in+March+but+manufacturing+malaise+deepens+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-gains-momentum-for-second-month-running-090419.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}