Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 06, 2023

Global economic growth accelerates to eight-month high in February

Global business activity grew at its strongest rate for eight months in February, reviving further from the low seen last October, according to the S&P Global PMI surveys based on data provided by over 30,000 companies. Growth was led by the service sector but was also buoyed by a return to growth of manufacturing output.

Companies cited reduced recession risks, a peaking of price pressures, improved supply chains and a reopening of the Chinese economy to all have helped spur demand, notably among consumers, and to have boosted business confidence and hiring.

Both the US and Europe showed signs of pulling out of downturns, while growth picked up sharply in mainland China. However, it was India that continued to record the strongest expansion of the world's major economies.

Global business activity grows at fastest rate for eight months in February

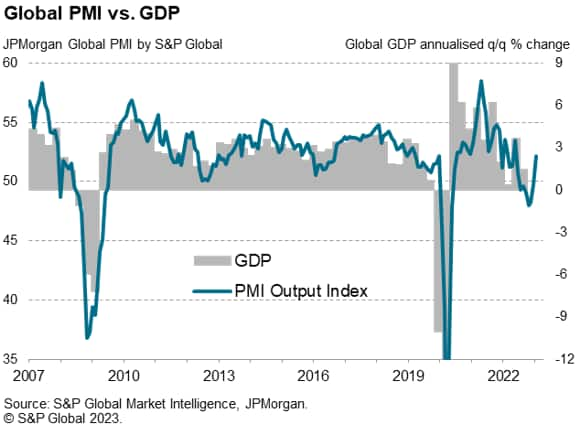

A third successive monthly rise in the global PMI's headline output index pushed the survey gauge well into expansion territory in February, helping to further allay worries of an imminent worldwide recession. At 52.1, up from 49.7 in January, the Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan -signaled the first increase in output for seven months. The rise was the largest recorded since last June and indicative of GDP rising at a quarterly annualized rate of approximately 2.5%.

The return to growth marks an encouraging reversal of the downturn recorded late last year, which had seen output fall globally at the steepest rate recorded since the global financial crisis, if the initial pandemic lockdown months of early 2020 are excluded.

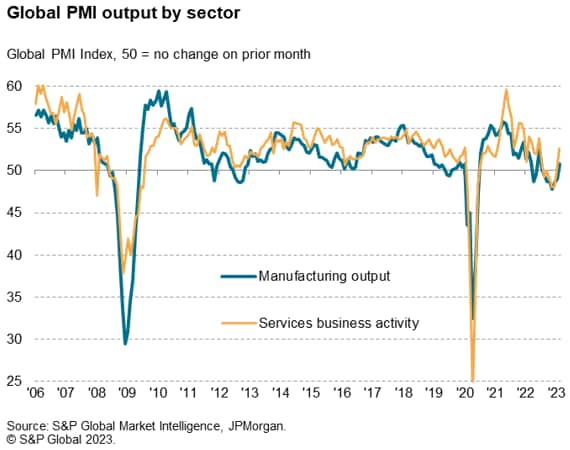

The recovery was led in February by the service sector, where - having steadied in January - business activity grew at the strongest rate since last June. The manufacturing sector meanwhile reported the first expansion of output for seven months, albeit only recording very modest growth. The factory expansion was nevertheless the strongest since last June.

Demand revives for services

There was a similar sectoral picture for new orders, with services enjoying an especially robust expansion of incoming new business, growth of which struck an eight-month high. Global exports of services stabilized after eight months of decline. New orders continued to fall in manufacturing, though the decline was only modest and the smallest recorded in the current eight-month downturn. Global goods exports likewise fell at the slowest rate for eight months.

Consumer-facing services reported particularly strong and accelerating demand growth, though there were also welcome signs of an improving trend in demand for financial services.

While manufacturers reported rising demand for consumer goods and investment goods, such as machinery and equipment, destocking of manufactured inputs remained a drag on the overall order book situation.

Europe and US see brighter economic pictures

Looking at the major developed economies, there was encouraging news from the US and Europe, where economies showed signs of resilience in the face of recent rate hikes and the increased cost of living.

In the US, output rose marginally after seven months of decline, as a modest improvement in service sector activity helped offset a further marked manufacturing downturn.

In the eurozone, output rose for a second successive month, building on the minor gain seen in January to record the strongest expansion since last June thanks to faster service sector growth and a stabilization of the manufacturing sector after eight months of contraction.

In the UK, output grew especially strongly, notching up the best performance since last June on the back of reviving growth in both manufacturing and services, the latter enjoying the stronger gain of the two sectors.

Business activity growth in Japan meanwhile ticked higher, with output rising modestly for a second straight month. However, sector trends were marked in Japan, with the joint-largest expansion of service sector output since October 2013 contrasting with the steepest fall in manufacturing output since 2012, if COVID-19 lockdown months are excluded.

China revived but India still leads the major emerging markets

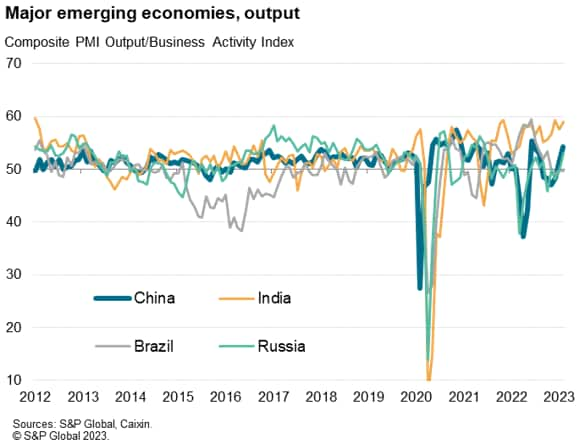

India meanwhile continued to lead the major emerging markets, with output growth re-accelerating after easing in January to record one of the strongest expansions seen over the past decade. Strong gains were seen in both manufacturing and services.

Faster growth was also reported in mainland China, where business activity rose for a second successive month and at the steepest rate since last June, commonly linked to reviving activity and spending after the reopening of the economy. Leading the upturn in China was the service sector, though the manufacturing sector also surged back into life.

Russia likewise saw output revive, with growth hitting a 20-month high despite exports continuing to fall sharply due to sanctions.

That left Brazil as the only major BRIC emerging economy in contraction during February, albeit with the pace of deterioration remaining only marginal.

Confidence boost

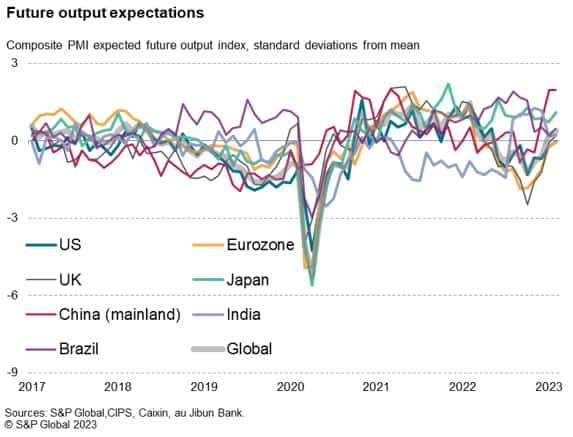

Looking ahead, prospects brightened globally in February, often linked to diminished recession fears, fewer energy market worries, signs of inflation peaking, improved supply conditions and China's reopening of its economy. The PMI survey's gauge of companies' expectations of their own output in the coming year rose for a fourth month in a row, hitting its highest for a year and climbing further above its long-run average.

The upturn in sentiment encouraged firms to take on more staff, with global employment growth reaching its highest since last August amid improved hiring in both manufacturing and services, albeit with rates of job creation remaining modest in both cases.

Of the major economies of the world, sentiment relative to long-run averages is running especially high in mainland China, where it continued to run at the joint-highest for a decade. However, confidence also improved in all other major emerging markets as well as in the US, Eurozone and UK.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-accelerates-to-eightmonth-high-in-february-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-accelerates-to-eightmonth-high-in-february-2023.html&text=Global+economic+growth+accelerates+to+eight-month+high+in+February+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-accelerates-to-eightmonth-high-in-february-2023.html","enabled":true},{"name":"email","url":"?subject=Global economic growth accelerates to eight-month high in February | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-accelerates-to-eightmonth-high-in-february-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+growth+accelerates+to+eight-month+high+in+February+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-accelerates-to-eightmonth-high-in-february-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}