Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 13, 2023

GDP flatlines in February, but private sector activity revives - albeit with uncertain outlook

The UK economy stagnated in February but once allowance is made for public sector strikes, the official data add to survey evidence to suggest that private sector economic activity has revived so far this year after a difficult end to 2022. However, the official data also corroborate some of the concerns flagged by the PMI data, which suggests that growth could falter again in the coming months.

Economy flatlines

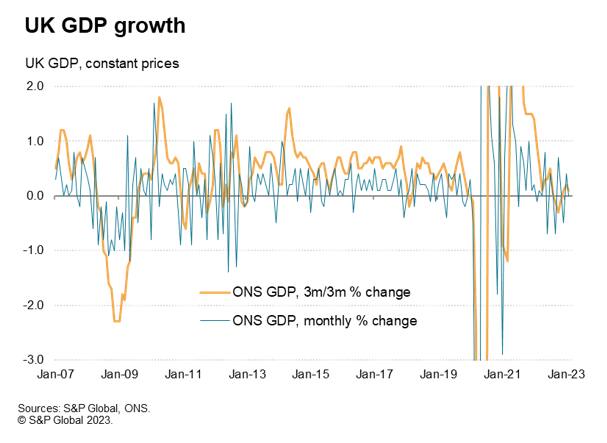

Official GDP data from the Office for National Statistics showed the UK economy flatlining in February after a stronger than previously recorded 0.4% gain in January. That follows a 0.5% contraction in December. Clearly the data are extremely volatile at the moment, meaning discerning any trend is very difficult.

A better idea of the underlying growth pattern can be ascertained from looking at the latest three months compared to the prior three months. this irons out some of the volatility in the monthly changes. Using this metric, we can see that the economy is expanding at a sluggish quarterly rate of 0.1% in the three months to February. Although modest, any growth is a welcome improvement on the 0.3% rate of contraction seen back in October.

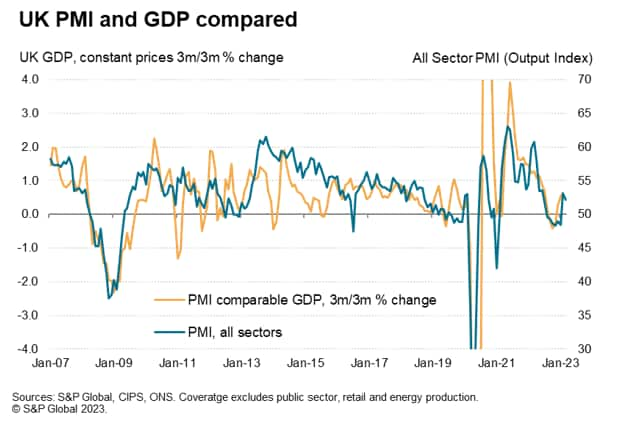

Hence the official data corroborate the recent trends signaled by the PMI surveys, which have indicated that the economy fell into a slump in the aftermath of the Truss-Kwarteng mini budget last autumn, but has since shown signs of reviving somewhat in the early months of 2023.

Improving private sector

However, the underlying picture is better than these headline ONS data suggest. Recent months have seen strike action disrupt many services in the UK, which has subdued the overall pace of economic growth by driving a 0.1% fall in services output in February.

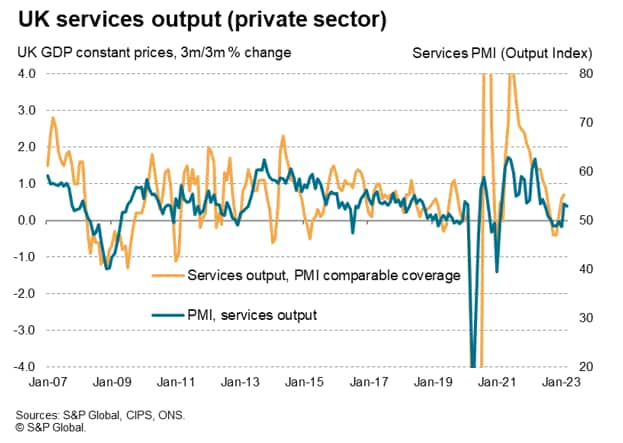

We can strip out government services, taking the GDP coverage closer to that of the PMI (also excluding retail and the volatile energy producing industries). Here we get a better picture of how private sector businesses have fared in recent months, and the picture is more encouraging. On this basis, economic output was 0.6% higher in the three months to February than in the prior three months, reviving further from a 0.4% rate of contraction last October. This is very similar to the rate of expansion signaled by the PMI surveys. Although the more up to date PMI surveys have pointed to a modest cooling in this rate of expansion in March, there's little doubt that the first quarter looks to have been a much better period for UK plc than the fourth quarter of last year.

Upturn built on sand?

The big question of course is whether this private sector upturn can be sustained.

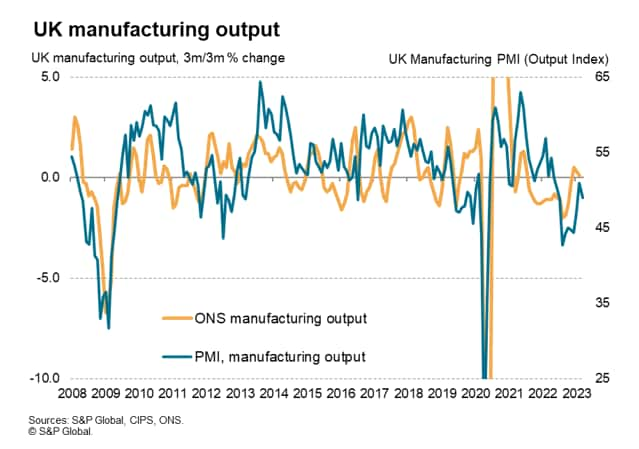

From the PMI data, we have noted how the manufacturing sector remains especially vulnerable as current output is being driven by improving supply, which has facilitated the fulfilment of orders that had accumulated due to component shortages during the pandemic. New orders for factory goods, and in particular exports, remain in contraction. A flat manufacturing output picture in February matched a similarly sluggish PMI reading of 50.9, with a March PMI reading signalling renewed contraction.

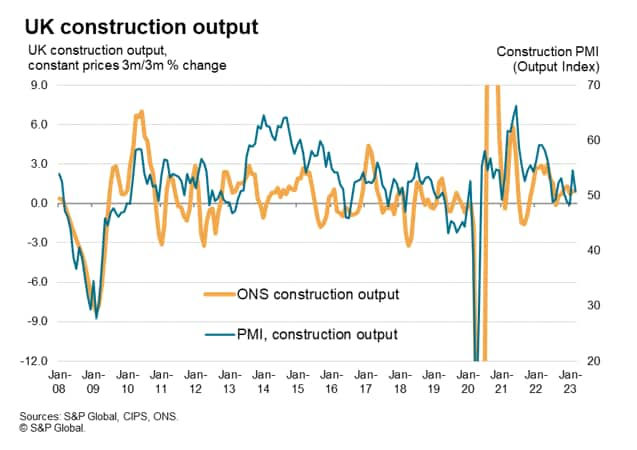

A major boost in February meanwhile came from construction, with a 2.4% monthly surge in output accompanied by a jump in the construction PMI output index to 54.6. However, this largely reflected unseasonable weather (one of the driest February's on record), and the survey data hint at a renewed slowing in March.

In the service sector, output excluding retail and government activities fell by 0.2% in February but that came after a 0.6% gain in January, which means that - on a three-month basis - trend growth has reached a solid 0.7%, which is broadly in line with the signal from the PMI.

However, in line with the PMI analysis, the ONS's GDP report underscores how services growth is being driven by consumer spending on hotels and restaurants and by financial services activity. The good weather for the time of year no doubt helped the former, and financial services appear to be merely pulling out of a steep slump late last year caused by the shock of the mini budget. Both of these sectors therefore seem especially vulnerable to the further recent tightening of monetary policy, which means - like manufacturing and construction - this pillar of growth also appears to be built on soft foundations.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgdp-flatlines-in-february-but-private-sector-activity-revives--albeit-with-uncertain-outlook-Apr23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgdp-flatlines-in-february-but-private-sector-activity-revives--albeit-with-uncertain-outlook-Apr23.html&text=GDP+flatlines+in+February%2c+but+private+sector+activity+revives+-+albeit+with+uncertain+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgdp-flatlines-in-february-but-private-sector-activity-revives--albeit-with-uncertain-outlook-Apr23.html","enabled":true},{"name":"email","url":"?subject=GDP flatlines in February, but private sector activity revives - albeit with uncertain outlook | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgdp-flatlines-in-february-but-private-sector-activity-revives--albeit-with-uncertain-outlook-Apr23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=GDP+flatlines+in+February%2c+but+private+sector+activity+revives+-+albeit+with+uncertain+outlook+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgdp-flatlines-in-february-but-private-sector-activity-revives--albeit-with-uncertain-outlook-Apr23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}