Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 24, 2019

Flash US PMI lifts higher but still signals weak growth at start of fourth quarter

- Flash composite PMI™ rises to 51.2, highest since July

- Jobs cut at steepest rate since 2009

- Manufacturing continues to pull out of downturn, but service sector sees new orders fail to rise for first time since 2009

While an upturn in the headline flash PMI for October might add to hopes that GDP growth could accelerate in the final quarter of the year, the survey also brought plenty of warning signs.

Adjusted for seasonal influences, the headline IHS Markit Flash US PMI, measuring changes in output across both manufacturing and services, reached 51.2 in October, up from 51.0 during September, to signal the sharpest increase in business activity since July. The latest reading points to a further modest recovery in output growth from the three-and-a-half year low seen in August.

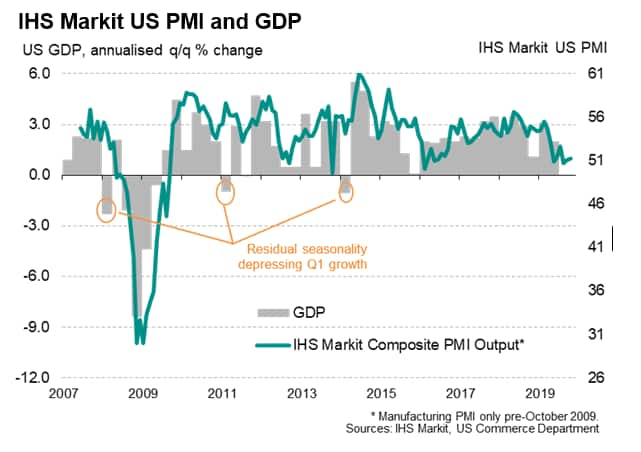

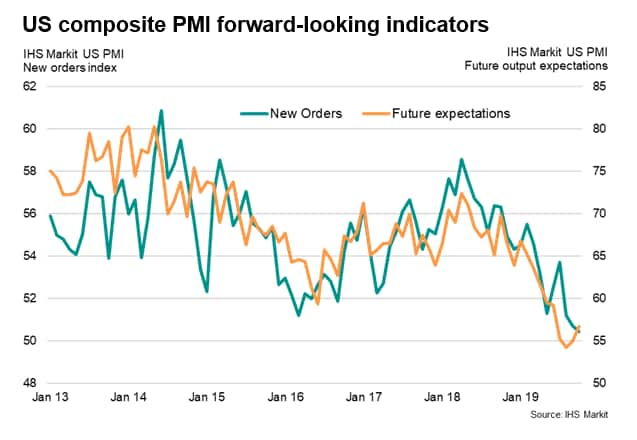

However, despite business activity lifting from recent lows, the composite PMI is still running at a level that is indicative of annualised GDP growth of just under 1.5% at the start of the fourth quarter. Moreover, a near-stalling of new orders growth in October to the lowest for a decade suggests that risks are tilted toward growth remaining below trend in coming months.

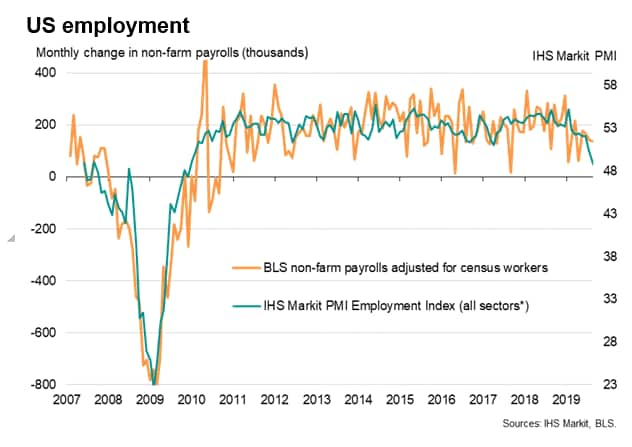

An increased rate of job culling adds to the gloomy picture, with jobs being lost among surveyed companies at a rate not seen since 2009. At current levels, the survey's employment gauge indicates non-farm payroll growth slipping below 100,000. Although manufacturing employment increased to the greatest extent for five months, service sector jobs were cut at the sharpest rate since 2009.

While the job losses in part reflected current weak order book growth, caution with regard to payroll numbers also reflected still-gloomy expectations for the year ahead. Although optimism hit a four-month high, it remained among the gloomiest seen since the global financial crisis.

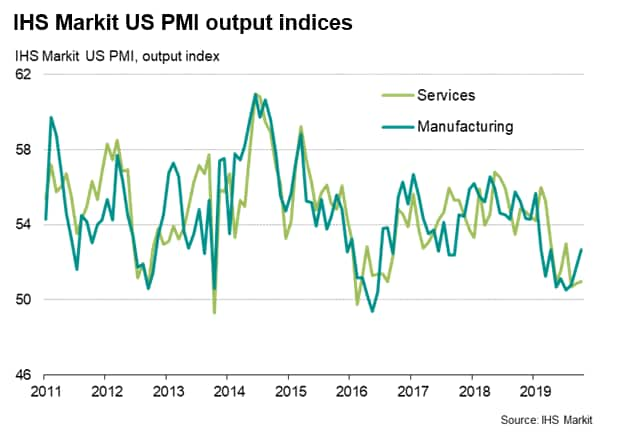

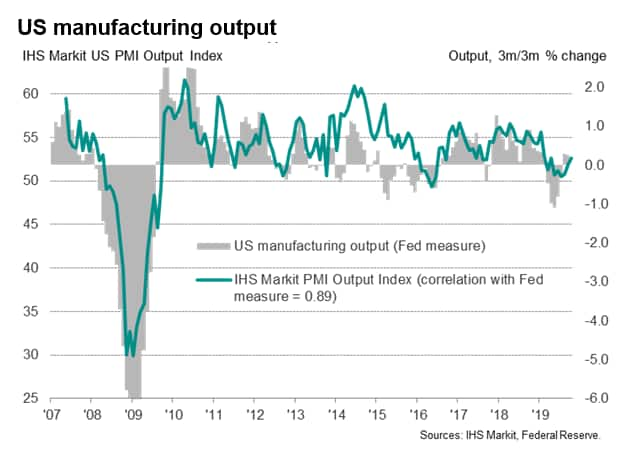

The overall subdued picture reflects a spreading of economic weakness from manufacturing to services in the third quarter, but encouragingly we are now seeing some signs of manufacturing pulling out of its downturn, in part reflecting a return to growth for exports and improved sentiment about the year ahead, linked to hopes that trade war tensions are starting to ease.

Manufacturing new orders grew at the fastest rate seen since April, with new export orders rising for the first time in four months. In contrast, new business across the service sector stagnated, failing to grow for the first time since data were first available in late-2009.

If manufacturing can continue to gain momentum this should hopefully feed through to stronger jobs growth and an improved service sector performance, translating into better GDP growth, but it remains too early to determine whether the economy has truly turned a corner.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-lifts-higher-but-still-signals-weak-growth-at-start-of-Q4-Oct19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-lifts-higher-but-still-signals-weak-growth-at-start-of-Q4-Oct19.html&text=Flash+US+PMI+lifts+higher+but+still+signals+weak+growth+at+start+of+fourth+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-lifts-higher-but-still-signals-weak-growth-at-start-of-Q4-Oct19.html","enabled":true},{"name":"email","url":"?subject=Flash US PMI lifts higher but still signals weak growth at start of fourth quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-lifts-higher-but-still-signals-weak-growth-at-start-of-Q4-Oct19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+US+PMI+lifts+higher+but+still+signals+weak+growth+at+start+of+fourth+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-lifts-higher-but-still-signals-weak-growth-at-start-of-Q4-Oct19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}