Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2025

Flash UK PMI signals stalled economy and steep job cuts amid further loss of confidence, while price pressures spike higher

The flash PMI data for January indicate that the UK economy remained largely stalled at the start of 2025, continuing to avoid recession by a narrow margin but with risks still tilted to the downside. The subdued business activity in January was accompanied by sustained downbeat business optimism about prospects for the year ahead and a further worsening of the demand environment, as reflected by a steeper reduction in new order book volumes.

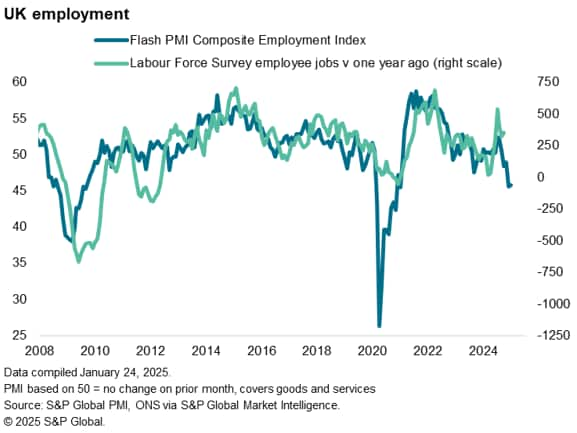

These gloomier forward-looking indicators, combined with widespread concerns over higher staff costs associated with the Budget changes to be implemented in April, pushed employment sharply lower again. Barring the job cutting seen during the pandemic, the rate of job losses signalled by the PMI over the past two months is the strongest since the global financial crisis in 2009.

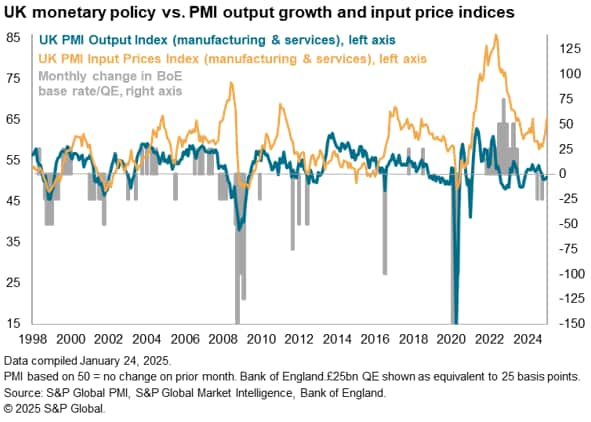

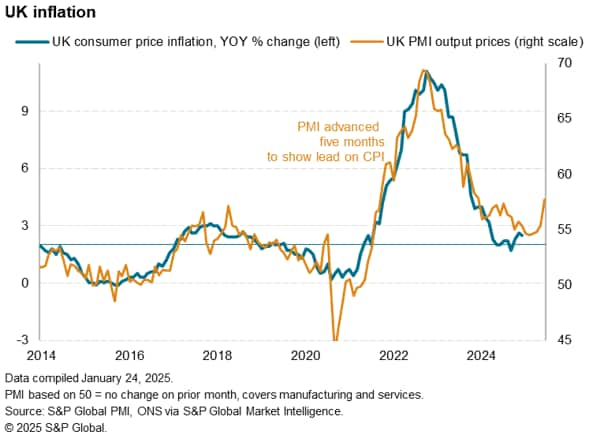

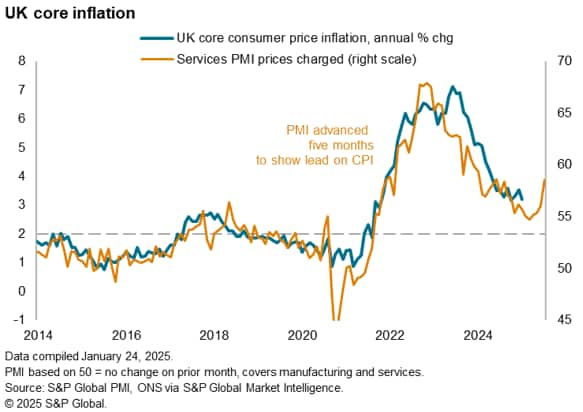

The survey's price indices are meanwhile indicating that inflation is turning higher again, presenting the Bank of England with a policy quandary. While the stalled economy and deteriorating job market suggest there's an increased need for rate cuts to stimulate growth, the rise in price pressures hints that the inflation genie is by no means back in its bottle.

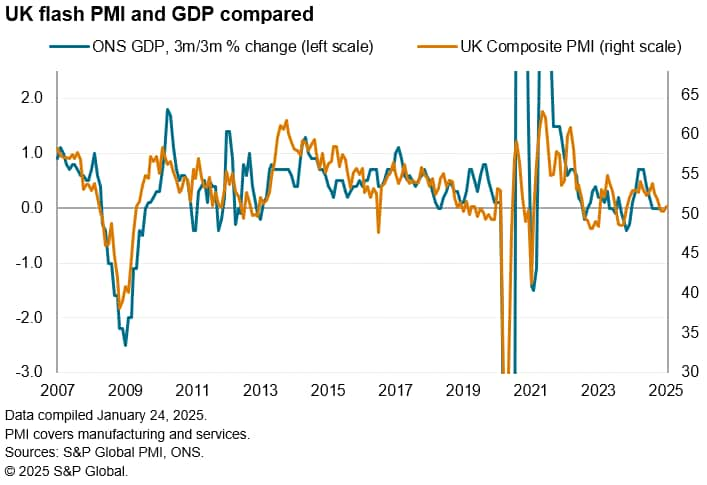

Economy still flat-lining in January

Business activity growth remained subdued in January. The headline indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK PMI Composite Output Index, rose from 50.4 in December to a three-month high of 50.9 in January, but has now been at such a low level as to signal zero GDP growth for three successive months, according to historical comparisons.

As such, the data suggest the economy has continued to broadly flat-line at the start of 2025 after seeing no growth in the fourth quarter of last year.

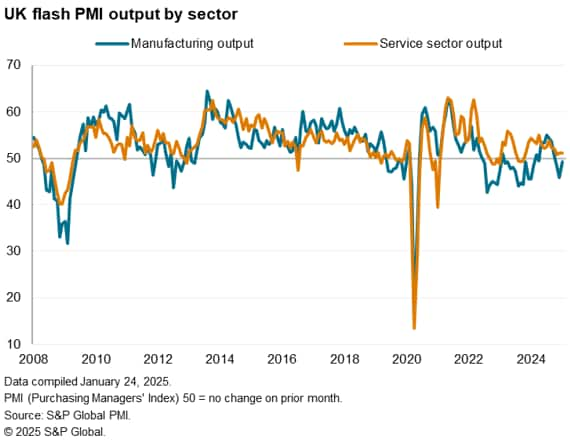

The malaise was broad-based by sector. Service sector business activity rose only very slightly, with growth edging up in January but still registering the third-smallest increase in output seen over the past 14 months. Particular weakness was again reported among consumer-facing service providers. Manufacturing output meanwhile contracted for a third successive month in January, albeit with the rate of decline moderating to register only a slight drop in production.

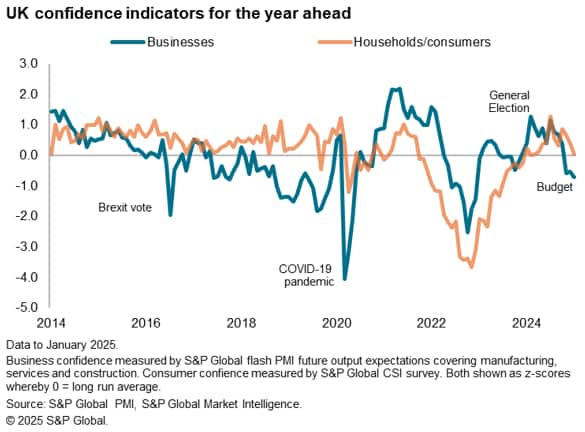

Confidence further wanes

Growth momentum has been lost since the robust expansion in the summer of last year, which saw business report solid growth and improved optimism ahead of the General Election. However, the new government has since seen businesses and households respond negatively to its rhetoric and policy implementation, with confidence indicators falling in recent months.

Earlier-released data showed households' views on their future finances dropping in January to its lowest for a year, while the flash PMI showed business confidence in the 12-month outlook likewise deteriorating further in January. Companies' expectations of output in the year ahead have now fallen to their lowest since December 2022. The drop in business confidence since the Budget has taken sentiment well below its long-run average.

Job losses close to four-year highs

The loss of confidence, combined with a second consecutive month of falling new orders (the January decline was the largest recorded since October 2023), led firms to cut employment sharply again in January.

The PMI indicates that headcounts have now been cut for four straight months, with the rate of job losses in January moderating only very slightly from the near-four-year high recorded in December. Barring the pandemic, the rate of job losses signalled by the survey over the past two months have been the highest since the global financial crisis in 2009.

Steep job losses were reported across both manufacturing and services, the latter seeing broad-based payroll cuts across all main sub-sectors.

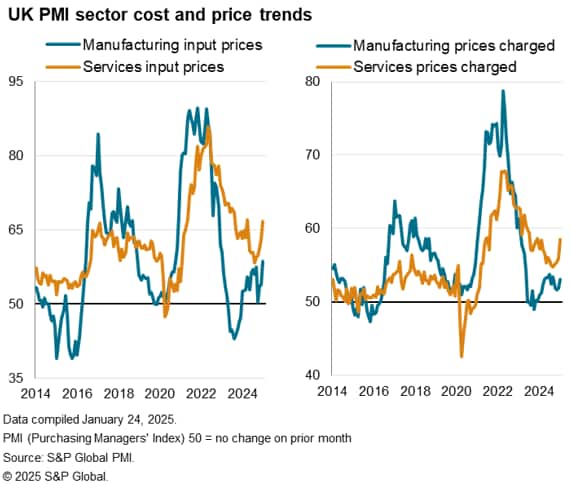

Inflation pressures rise sharply

Input costs meanwhile rose at sharply increased rates across both goods and services in January, often linked to suppliers pushing through price hikes. These hikes were in turn commonly blamed on higher wages as well as companies anticipating the impact of Budget-related policy changes on staffing costs. Higher energy costs and higher import prices (resulting from a weakened pound) were also widely reported. Measured across goods and services, input costs rose in January at the fastest rate for 20 months.

Average prices charged for goods and services also rose at an increased rate as firms passed higher costs on to customers. The latest rise in prices was the steepest for one and a half years. Worryingly, the rate of inflation of prices charged for services - which is being closely watched by policymakers due to its stubbornness since the pandemic - accelerated further to its highest for just over a year in January, running well above its long run average. However, average prices charged for goods also rose at an increased rate, the rate of inflation up to a four-month high.

The intensification of price pressures suggests that the rate of inflation in the UK could rise back further above the Bank of England's 2% target after edging down from 2.6% to 2.5% in December, according to official data.

While core inflation (which excludes volatile items such as energy, food, alcohol and tobacco) showed a welcome moderation from 3.5% in November to 3.2% in December, the upturn in the PMI's services price data suggest that this measure of inflation could remain somewhat elevated.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-stalled-economy-and-steep-job-cuts-amid-further-loss-of-confidence-while-price-pressures-spike-higher-jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-stalled-economy-and-steep-job-cuts-amid-further-loss-of-confidence-while-price-pressures-spike-higher-jan25.html&text=Flash+UK+PMI+signals+stalled+economy+and+steep+job+cuts+amid+further+loss+of+confidence%2c+while+price+pressures+spike+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-stalled-economy-and-steep-job-cuts-amid-further-loss-of-confidence-while-price-pressures-spike-higher-jan25.html","enabled":true},{"name":"email","url":"?subject=Flash UK PMI signals stalled economy and steep job cuts amid further loss of confidence, while price pressures spike higher | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-stalled-economy-and-steep-job-cuts-amid-further-loss-of-confidence-while-price-pressures-spike-higher-jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+UK+PMI+signals+stalled+economy+and+steep+job+cuts+amid+further+loss+of+confidence%2c+while+price+pressures+spike+higher+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-signals-stalled-economy-and-steep-job-cuts-amid-further-loss-of-confidence-while-price-pressures-spike-higher-jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}