Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 26, 2023

Flash PMI signal unwelcome combination of economic contraction and rising prices

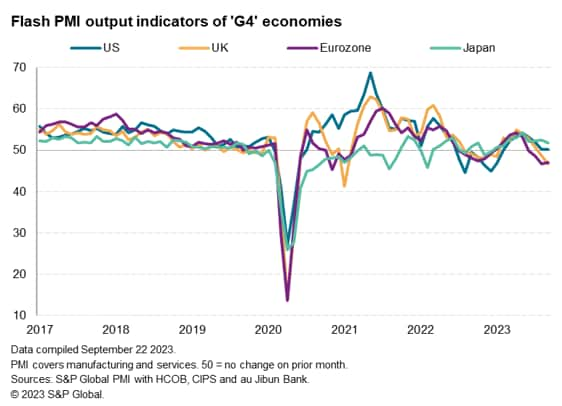

Early PMI survey data for September from S&P Global showed the major developed economies collectively contracting for a second month. Falling business activity in the Eurozone and a deepening downturn in the UK was accompanied by a second month of near-stalled business activity in the US, leaving Japan as the only major developed economy which continued to enjoy robust growth.

A key divergence between the four economies was the performance of the service sectors, which were especially hard hit in the eurozone and UK and to a lesser extent the US. In contrast, Japan's services economy remained resilient. Much of this divergence therefore likely reflects the varying monetary policy stances seen in the four economies on these interest-rate sensitive services economies. Forward-looking order book data suggest these divergences could widen further in the coming months, especially in relation to rising recession risks in Europe.

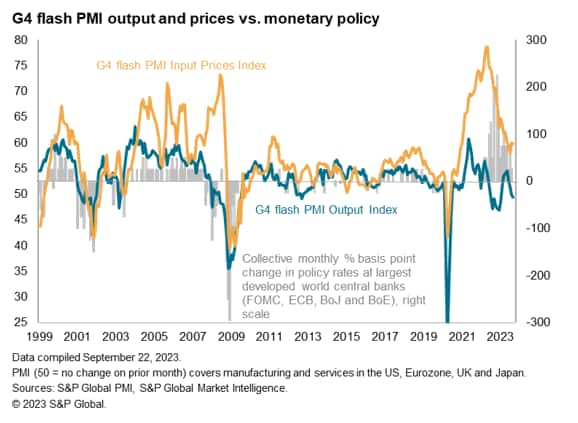

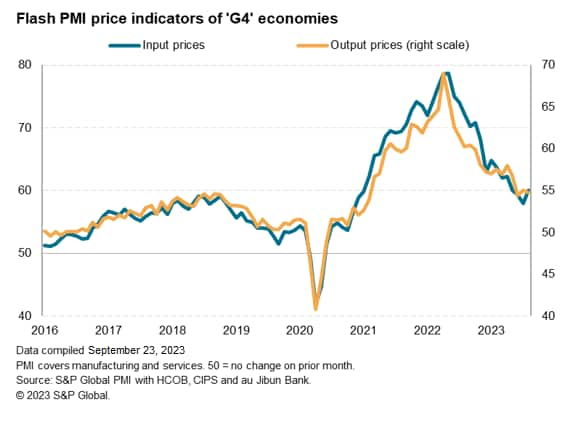

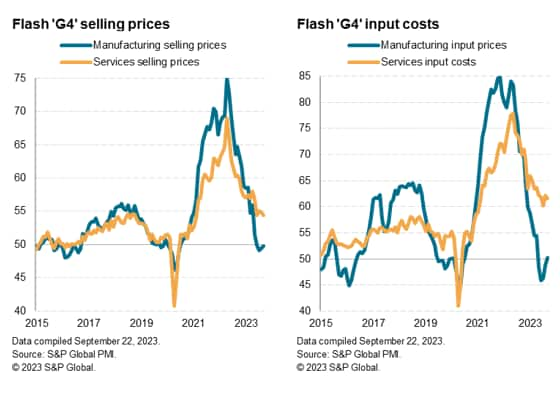

Price pressures meanwhile showed further signs of worrying stickiness, primarily in the service sector, adding to concerns that the battle to get inflation down to 2% remains a challenge to policymakers. Worryingly, a renewed rise in manufacturing input costs, linked to higher oil prices, poses an additional upside risk to inflation in the months ahead.

Overall, therefore, the survey data paint a concerning picture of rising recession risks in Europe alongside a potential sluggish growth profile in the US as we head towards the end of the year, while at the same time inflation pressures remain somewhat elevated by historical standards. These trends clearly represent a challenging environment for the world's major central banks to navigate.

Major developed economies contract as orders slump

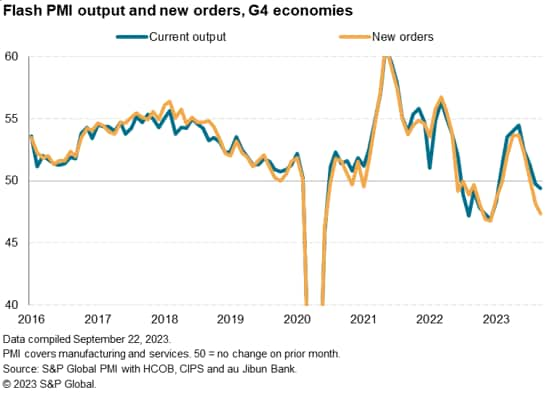

Business activity across the four largest developed world economies (the "G4") fell for a second successive month in September, according to the provisional 'flash' PMI data compiled by S&P Global Market Intelligence, suggesting a renewed weakening of the developed world economy in the third quarter after a solid second quarter.

Although the overall decline was only modest, worse looks set to come as demand is falling faster than output, meaning production capacity is likely to be curbed further in coming months. New orders for goods and services fell across the four economies for a second consecutive month in September, the pace of decline exceeded the rate of output deterioration to a degree seen only once since comparable data were available in 2009. The prior larger fall was witnessed in June of last year, just before output experienced a seven-month spell of contraction.

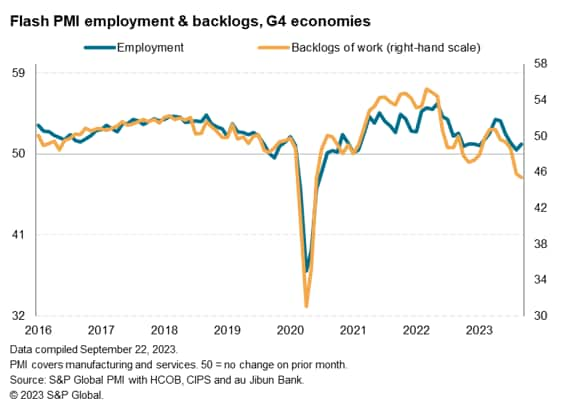

The spread between output and new orders growth resulted in an increasingly sharp depletion of firms' backlogs of work. In the absence of new orders, firms are occupying their workforces by fulfilling orders placed in prior months (in many cases, these are orders received during the pandemic). However, the increasingly severe depletion of these backlogs - which fell across the G4 in September at the steepest rate since data were available in 2009 barring only the initial pandemic lockdown months in early 2020 - suggest companies may soon need to reduce operating capacity.

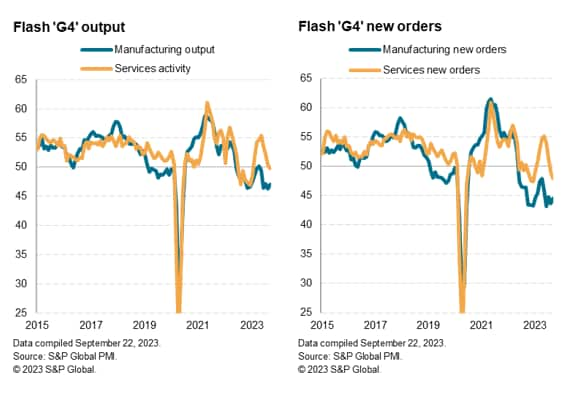

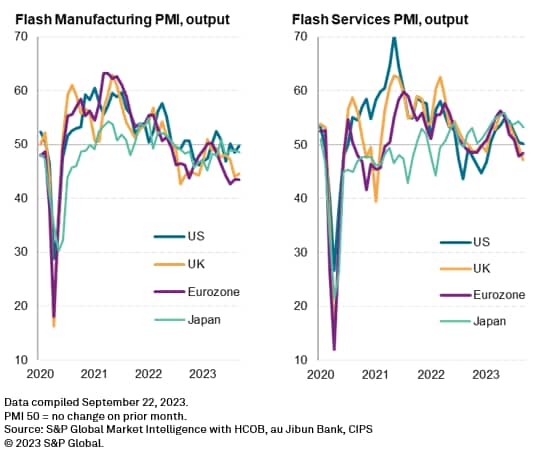

New orders fell faster than output in both manufacturing and services, driving backlogs of work down sharply again to hint at sustained downturns in both sectors as we head into the fourth quarter. Output has now declined in manufacturing across the G4 for 14 of the past 15 months, the rate of decline remaining steep in September - albeit easing slightly on August.

Service sector activity meanwhile contracted over the G4 for the first time since January, representing a notable faltering of a recent key area of support to the global economy. As with manufacturing, a steeper loss of new business relative to output growth resulted in an increasingly marked drop in backlogs of work across the G4 service sector.

Europe leads slowdown

The economic weakness was again most evident in Europe. Both the Eurozone and the UK reported falling output in September, the former reporting a fourth monthly decline and the latter seeing a second monthly fall.

The UK's contraction was the steepest since the height of the global financial crisis in early 2009 barring only the pandemic lockdown months. The steep fall in output signalled by the flash PMI data is consistent with GDP contracting at a quarterly rate of over 0.4%, with a manufacturing downturn increasingly spreading to the services economy.

While the eurozone contracted at slightly weaker ratethan seen in August, the pace of decline was among the steepest seen since the debt crisis of 2021 and remained consistent with GDP falling at a quarterly rate of approximately 0.3%. Moreover, a steepening loss of new business, notably in the service sector, pointed to a broad-based decline persisting into the fourth quarter.

The US fared better than Europe, though nevertheless the flash US PMI signaled a broad-based stagnation of the private sector economy for a second month in a row. The low PMI readings in August and September point to a more subdued picture of the US economy in recent months than the robust expansion seen in the second quarter. The data are indicative of a moderation of annualized GDP growth from approximately 2% to 1% between the second and third quarters.

A common thread across Europe and the US was one of demand coming under pressure from the increased cost of living and higher interest rates, which have dampened service sector growth in particular after robust growth seen earlier in the summer. In contrast, Japan's overall expansion meanwhile remained relatively robust, losing only slight momentum compared to August, thanks to as ongoing expansion of service sector activity, which helped offset a sustained manufacturing downturn. The latest composite output index is Japan is broadly consistent with GDP growing at a solid annual rate of just under 2%.

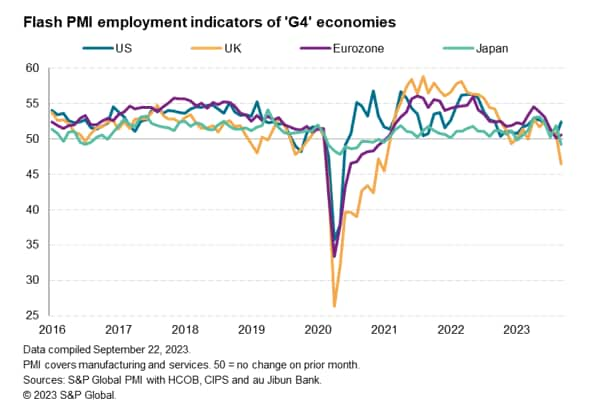

UK labor market slides into contraction

Employment trends also diverged markedly among the major economies, in part due to labor supply issues. In Japan, the tight labor market contributed to a fall in employment as firms struggled to source workers. In the US, in contrast, companies reported an increased ability to fill vacancies, leading to an upturn in employment growth. The eurozone job market meanwhile remained largely stalled, primarily due to a lack of demand for staff. In the UK, however, a marked drop in employment was recorded due to a combination of both falling demand for staff and low labor supply.

Inflation stickiness persists

On the inflation front, the surveys again signalled some stickiness of both input costs and average selling price inflation across the G4 on average. Although in both cases rates of increase remained substantially below the strong rates seen over the two years prior to mid-2023, rates remained higher by pre-pandemic standards, commonly linked to higher wage costs and recent upward pressure from increased oil prices.

The service sector continued to see the strongest inflationary pressures, though input costs in manufacturing ticked higher across the G4 on average for the first time in five months, often due to higher fuel prices.

Looking at average selling prices for goods and services, the weakest inflationary pressure was recorded in the eurozone, where prices rose at the slowest rate since February 2021. Price pressures also remained relatively muted in Japan, rising at the joint-slowest rate in one-and-a-half years. Selling price inflation remained more stubborn in the US and especially the UK, albeit the latter showing further signs of moderating.

In the US an annual CPI rate of around 3% is being indicated for the coming few months, while the eurozone looks set to see inflation also dip closer to 3% by the early months of 2024. The latest increase in UK average selling prices for goods and services is meanwhile broadly indicative of consumer price inflation dipping below 4% at the turn of the year, given the survey's approximate six-month lead on annual percent changes in consumer prices. In Japan, inflation is signalled to run just below the 2% mark.

Access the press releases for the Eurozone, Japan, UK and the US.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signal-unwelcome-combination-of-economic-contraction-and-rising-prices-Sep23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signal-unwelcome-combination-of-economic-contraction-and-rising-prices-Sep23.html&text=Flash+PMI+signal+unwelcome+combination+of+economic+contraction+and+rising+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signal-unwelcome-combination-of-economic-contraction-and-rising-prices-Sep23.html","enabled":true},{"name":"email","url":"?subject=Flash PMI signal unwelcome combination of economic contraction and rising prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signal-unwelcome-combination-of-economic-contraction-and-rising-prices-Sep23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+signal+unwelcome+combination+of+economic+contraction+and+rising+prices+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signal-unwelcome-combination-of-economic-contraction-and-rising-prices-Sep23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}