Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 15, 2023

Flash PMI points to UK economy ending 2023 on a more positive note

The UK economy continues to dodge recession, according to the flash PMI data, with growth picking up some momentum at the end of the year to suggest that GDP stagnated over the fourth quarter as a whole.

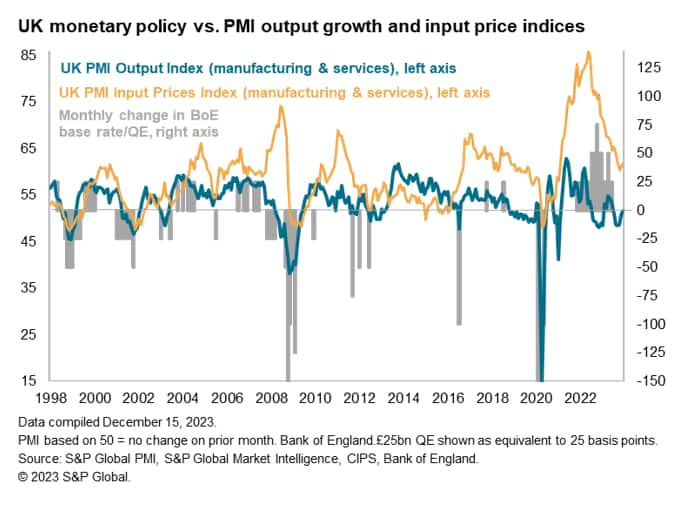

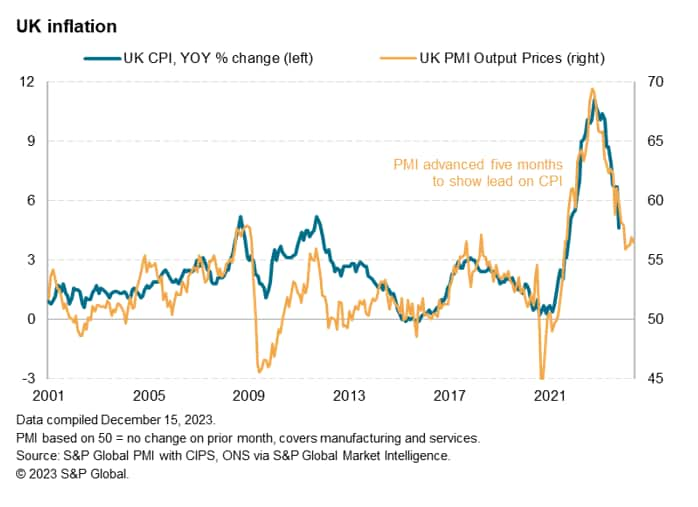

The economy's resilience, combined with a sticky inflation picture in the December PMI data, will add to speculation that it's too early for the Bank of England to be talking about cutting interest rates, and will add fuel to some policymakers' calls for further rate hikes.

However, the fear is that the tentative nature of growth in December, and in particular the impetus the economy has received from looser financial conditions, means that fears of further policy tightening could tip the economy back into decline.

Economy picks up further momentum

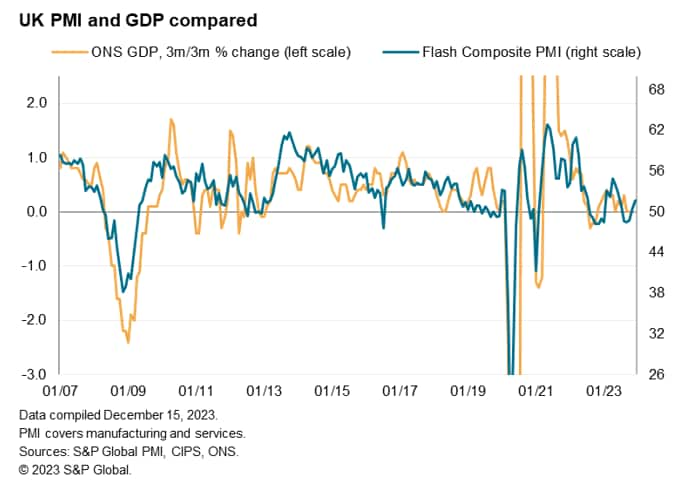

The headline economic growth indicator from the flash PMI surveys, the seasonally adjusted S&P Global / CIPS UK Composite Output Index, rose from 50.7 in November to a six-month high of 51.7 in December. The rise signals increased output for a second month running after three months of decline.

At its current level, the PMI is broadly indicative of GDP growing at a quarterly rate of 0.1%, according to historical comparisons, though is consistent with GDP having largely stalled over the fourth quarter as a whole.

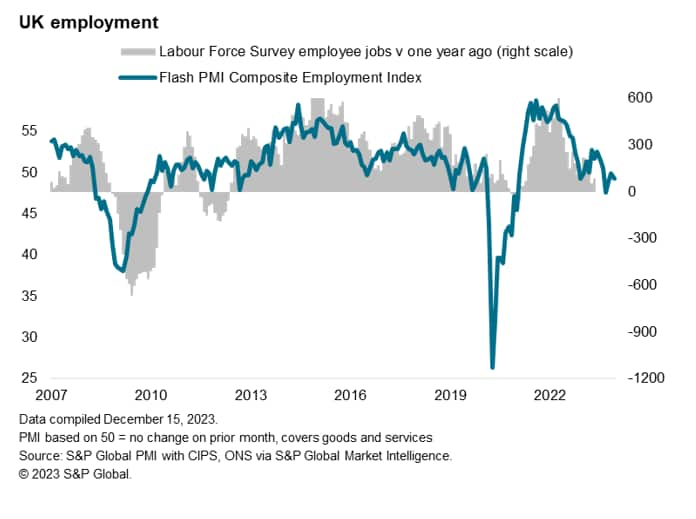

Jobs cut for fourth month running

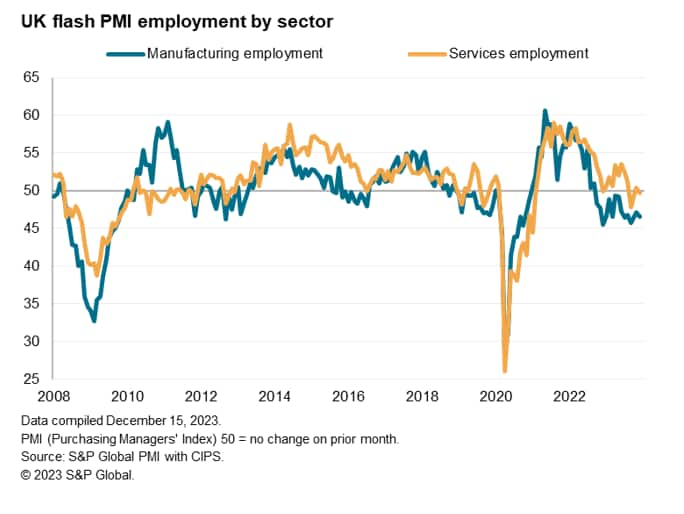

While employment meanwhile fell for a fourth month in December, the decline was only marginal and not indicative of any material rise in unemployment. The survey nevertheless indicates that the labour market has weakened in recent months, in terms of the overall hiring trend, to the softest since the pandemic lockdowns of early 2021.

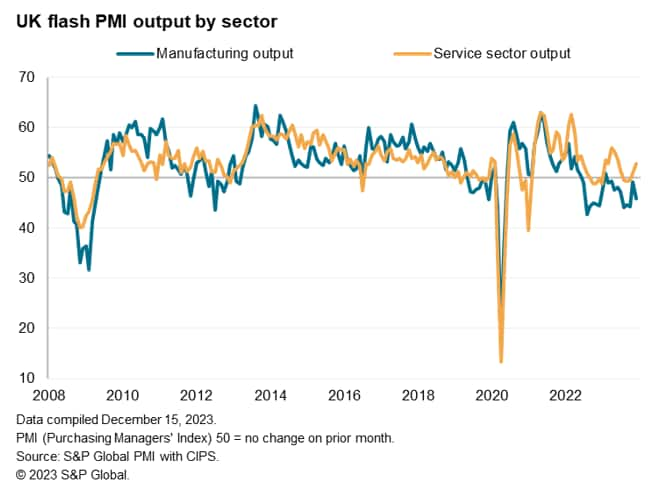

Dual-speed economy

The data underscore, however, a worrying dual-speed to the economy. Manufacturing output contracted sharply in December, down for the seventeenth time in the past 18 months, the rate of decline having picked up speed again. The data highlight how UK factories are undergoing one of their toughest spells since the global financial crisis in terms of the depth and length of the current downturn, resulting in further steep job losses in the factory sector.

Service sector activity meanwhile regained some poise, growing faster in December to see a second month of growth after mild declines in the three months to October. Growth nevertheless remains far weaker than seen earlier in the year, when consumer-facing services had been buoyed by a spring-summer revival in travel, leisure and tourism. The service sector growth in December was also far from broad-based, being led by tech spending and resurgent financial services activity, the latter having revived amid looser financial conditions linked to hopes of lower interest rates in 2024.

It's also worth noting that service sector employment fell, albeit marginally, for the third time in the past four months, with any job gains largely limited to the IT sector.

Stubborn inflation

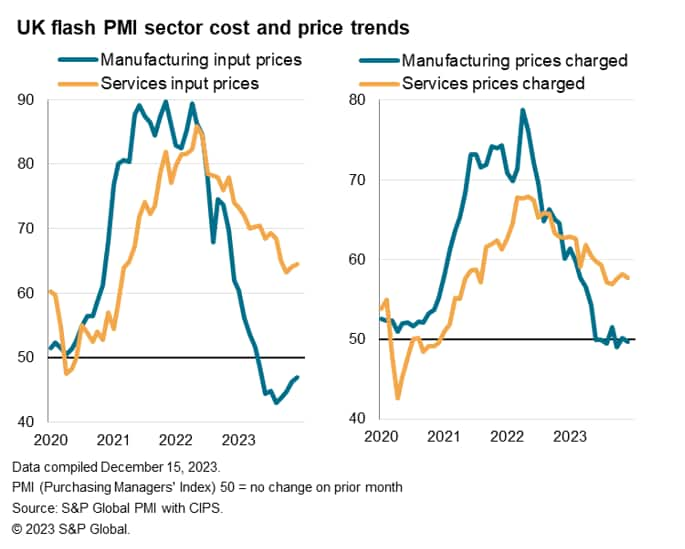

This sectoral divergence was also reflected in inflation pressures. Falling prices were again evident in the goods producing sector while service providers report persistent elevated inflationary pressures, often linked to wage growth.

The resulting signal is one of inflation slowing from the 4.6% rate seen in October but remaining stubbornly above 3% in the coming months.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-points-to-uk-economy-ending-2023-on-a-more-positive-note-Dec23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-points-to-uk-economy-ending-2023-on-a-more-positive-note-Dec23.html&text=Flash+PMI+points+to+UK+economy+ending+2023+on+a+more+positive+note+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-points-to-uk-economy-ending-2023-on-a-more-positive-note-Dec23.html","enabled":true},{"name":"email","url":"?subject=Flash PMI points to UK economy ending 2023 on a more positive note | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-points-to-uk-economy-ending-2023-on-a-more-positive-note-Dec23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+points+to+UK+economy+ending+2023+on+a+more+positive+note+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-points-to-uk-economy-ending-2023-on-a-more-positive-note-Dec23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}