Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2019

Flash Japan PMI shows manufacturing malaise continues into July

- Flash Japan Manufacturing PMI points to further deterioration in business conditions

- Falling exports remain a drag on manufacturing activity

- Optimism among lowest since 2012

- Good prices fall further in July

The start of the third quarter saw a further deterioration in Japanese manufacturing conditions, according to flash PMI, as new export sales continued to decline. Other survey indicators also added to the gloomy outlook, hinting that the sector is unlikely to see significant improvement in coming months.

Export-led manufacturing downturn

The 'flash' estimate of the Jibun Bank manufacturing PMI, compiled by IHS Markit, rose to 49.6 in July, up from 49.3 in June, but nonetheless indicated a deterioration in the health of the manufacturing sector, which marked the fifth decline over the past six months.

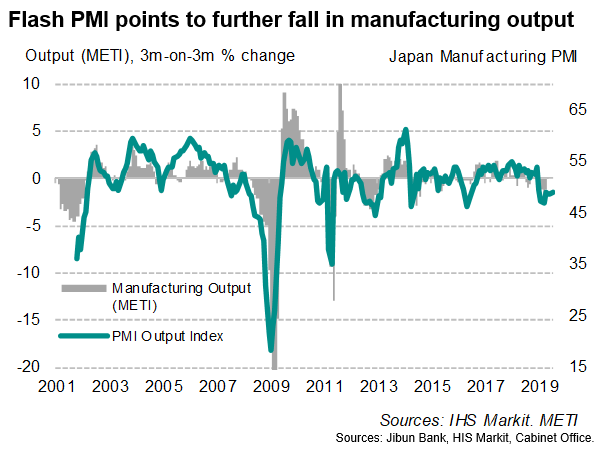

Factory output remained in decline for a seventh consecutive month in July, with signs of further downward pressure on production volumes in coming months. Most notably, the continued reduction in order book growth pushed companies to eat into previously-placed orders to keep output steady. As a consequence, backlogs of work fell sharply again in July, with the decline the joint-largest since the start of 2013.

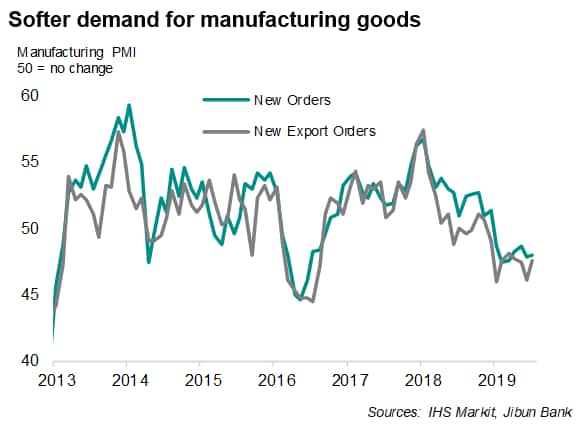

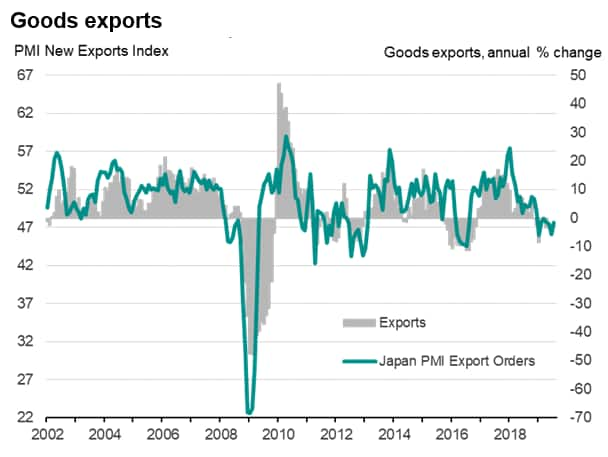

Falling exports were the main driver of the manufacturing downturn. New export orders have now fallen in each month since December as trade war tensions weighed heavily on international demand for Japanese goods. In addition to US-China trade dispute, the further drop in exports in July comes at a time of rising frictions between Japan and South Korea.

Other manufacturing survey indices corroborated the sombre outlook. Purchasing of inputs fell further in July, with the latest decline the steepest seen for three years. Manufacturers also continued to run down inventories amid greater uncertainty in demand, preferring not to have excessive stocks in order to keep costs low.

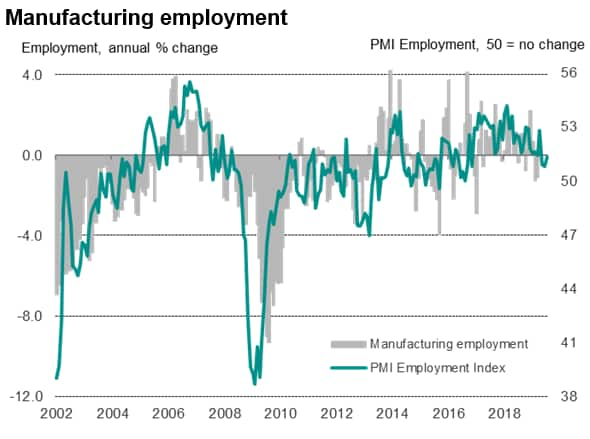

While recent economic growth continued to be supported by resilient service sector, as indicated by the composite flash PMI, there is increasing fear that an entrenched manufacturing downturn could spread into the broader economy in coming months, and ahead of the planned sales tax hike.

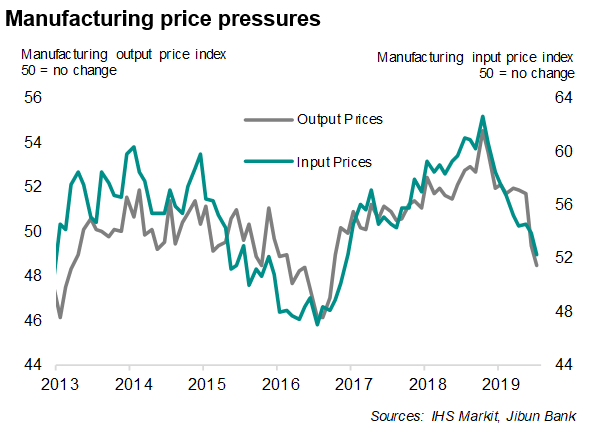

Good prices fall at fastest rate since 2016

Firms meanwhile cut selling prices further amid softer demand conditions, with average output charges dropping at the sharpest pace since September 2016. Cost pressures rose slightly, but at the slowest rate seen since the end of 2016, increasing the risk of deflationary pressures returning and confounding the central bank's efforts to stoke inflation.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-shows-manufacturing-malaise-continues-into-july-Jul19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-shows-manufacturing-malaise-continues-into-july-Jul19.html&text=Flash+Japan+PMI+shows+manufacturing+malaise+continues+into+July+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-shows-manufacturing-malaise-continues-into-july-Jul19.html","enabled":true},{"name":"email","url":"?subject=Flash Japan PMI shows manufacturing malaise continues into July | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-shows-manufacturing-malaise-continues-into-july-Jul19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Japan+PMI+shows+manufacturing+malaise+continues+into+July+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-pmi-shows-manufacturing-malaise-continues-into-july-Jul19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}