Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 23, 2018

Flash Japan manufacturing PMI signals export weakness and a fall in optimism

- Flash manufacturing PMI improves in August

- Exports falls, so does optimism

- Rising price pressures amid supply shortages

The August flash PMI data indicated that Japan's manufacturing sector continued to expand midway through the third quarter. However, the survey also brought further signs of shrinking overseas demand and sharply higher input prices.

Softer third quarter

The Nikkei Japan Manufacturing PMI™ rose to 52.5 from 52.3 in July, according to the preliminary flash reading. This took the third quarter average so far to 52.4, though still the weakest for a year.

Despite stronger growth of both output and new orders, the outlook appeared to have darkened. Factory job creation and business confidence were the weakest since late-2016, while export performance deteriorated.

Exports decline and prices rise

Export orders fell for the second time in three months in August, and have failed to show any growth since May. While rising export flows had powered the economic expansion since the final quarter of 2016, export growth has tapered off dramatically since peaking at the start of this year. The recent export trend has been the worst for two years. With the Japanese economy heavily reliant on trade as a growth driver, the recent fall in exports raises concerns for future growth.

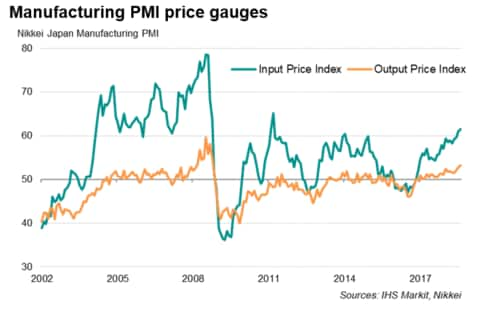

While exports have fallen, prices have risen. August saw the steepest rise in input prices since the 2011 earthquakes, which has in turn pushed firms to raise charges for manufactured goods by the greatest extent for nearly a decade.

What's more, supply chain delays remained severe amid rising shortages of key inputs, suggesting further price increases are on the horizon.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Bernard Aw, Principal Economist, IHS

Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-manufacturing-pmi-signals-export-weakness.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-manufacturing-pmi-signals-export-weakness.html&text=Flash+Japan+manufacturing+PMI+signals+export+weakness+and+a+fall+in+optimism++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-manufacturing-pmi-signals-export-weakness.html","enabled":true},{"name":"email","url":"?subject=Flash Japan manufacturing PMI signals export weakness and a fall in optimism | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-manufacturing-pmi-signals-export-weakness.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Japan+manufacturing+PMI+signals+export+weakness+and+a+fall+in+optimism++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-japan-manufacturing-pmi-signals-export-weakness.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}