Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 25, 2018

Trade-led slowdown pushes flash Eurozone PMI to two-year low at start of fourth quarter

- Flash Eurozone PMI drops to lowest since September 2016

- Slowdown led by first fall in exports since 2013, but weakness spreads to services

- Forward-looking indicators point to likelihood of further slowing in coming months

The latest flash PMI survey data indicated that the eurozone economy grew at the slowest rate for over two years in October as an export-led slowdown continued to broaden-out to the service sector.

The IHS Markit Eurozone Composite PMI® fell to 52.7 in October, down from 54.1 in September and reaching its lowest since September 2016, according to the flash reading (which is based on approximately 85% of usual monthly replies).

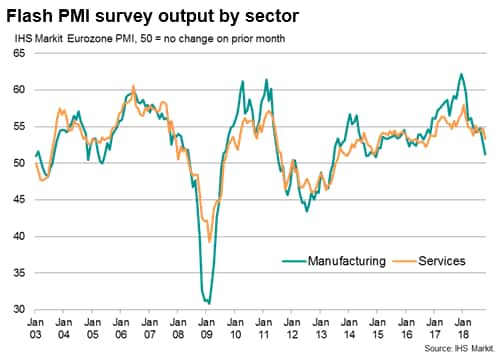

Manufacturing led the slowdown, with factory output rising only modestly to register the weakest monthly production gain since December 2014. Manufacturing orders fell (albeit only marginally) for the first time since November 2014, with new export orders for goods decreasing for the first time since June 2013.

The export downturn was linked by many survey respondents to trade wars and tariffs, which appear to have darkened the global economic environment and led to increased risk aversion. It was therefore not surprising to see the slowdown broadening out across the economy, hitting the service sector, which reported the smallest rise in business activity for two years in October.

Weaker fourth quarter

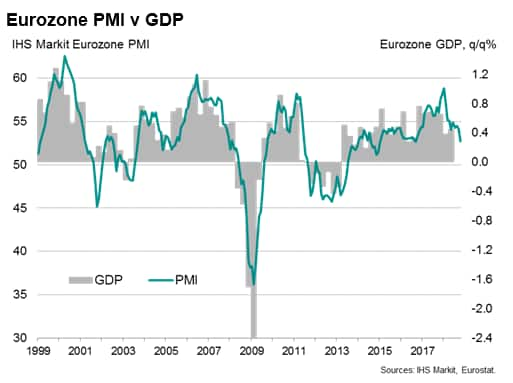

The PMI therefore sets the scene for a disappointing end to the year. The October survey is indicative of GDP growth waning to 0.3% in the fourth quarter, down from a signal of almost 0.5% growth in the third quarter.

Near-term risks also seem tilted to the downside. In a sign that the slowdown has further to run, companies' expectations of future growth slipped to the lowest for nearly four years, with a near six-year low seen in manufacturing.

Reduced optimism further dented hiring in October, hitting jobs growth. The employment gain was the second-lowest for just over a year, easing to a 22-month low in manufacturing.

Rising prices

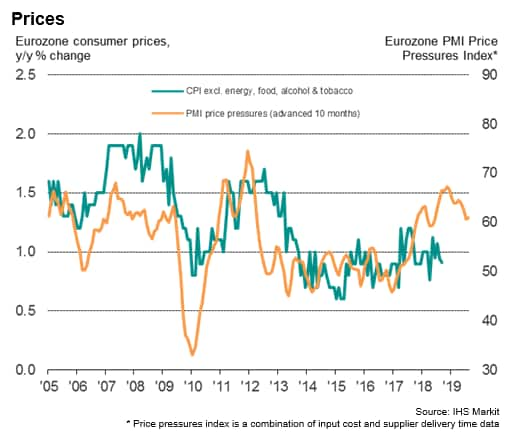

Price pressures meanwhile remained close to a seven-year high. Input price inflation edged up to a four-month high, registering the third-largest monthly rise in costs since May 2011. A steeper rate of increase in manufacturing costs was in part offset by a small moderation in service sector input cost inflation, albeit with both sectors continuing to see elevated levels of price pressures.

Output price inflation edged slightly lower but also remained among the highest seen over the past seven years. While factory gate prices showed the smallest increase for 14 months, service sector charges once again rose at one of the strongest rates seen since the global financial crisis.

Cause for concern at 'data dependent' ECB?

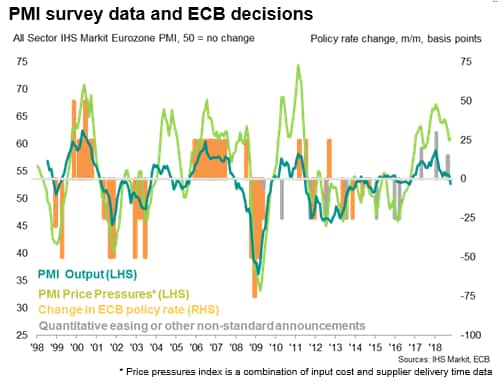

However, while still elevated, price pressures have fallen considerably since earlier in the year, accompanying the slower pace of expansion. As such, the survey will make for uncomfortable reading at the ECB, which intends to halt its asset purchases by the end of the year and has given guidance that the first interest rate hike is likely next September. That guidance is of course data dependent. The headline PMI has now fallen to a level that would historically be consistent with a bias towards loosening monetary policy in order to prevent any further deterioration of economic growth. Any guidance may therefore become increasingly vague should the survey data continue to deteriorate.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-at-twoyear-low-in-oct.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-at-twoyear-low-in-oct.html&text=Trade-led+slowdown+pushes+flash+Eurozone+PMI+to+two-year+low+at+start+of+fourth+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-at-twoyear-low-in-oct.html","enabled":true},{"name":"email","url":"?subject=Trade-led slowdown pushes flash Eurozone PMI to two-year low at start of fourth quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-at-twoyear-low-in-oct.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trade-led+slowdown+pushes+flash+Eurozone+PMI+to+two-year+low+at+start+of+fourth+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-at-twoyear-low-in-oct.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}