Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 17, 2019

First deterioration in Quebec manufacturing business conditions since January 2017

- Production increases marginally, while total new orders decline in May

- Job creation solid but PMI signals slight easing in rate of employment growth

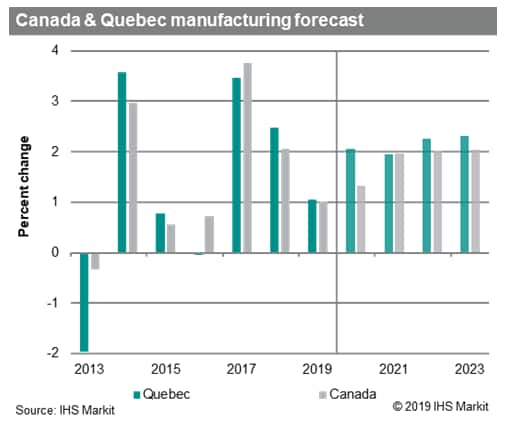

- IHS Markit forecast a 1.1% rise in Quebec manufacturing output in 2019, slower than the 2.5% growth recorded last year

Business conditions among Quebec manufacturers deteriorated in May for the first time since January 2017, amid a softer increase in output and the first contraction in new business in 28 months.

Slower output growth in May pushes Manufacturing PMI to 28-month low

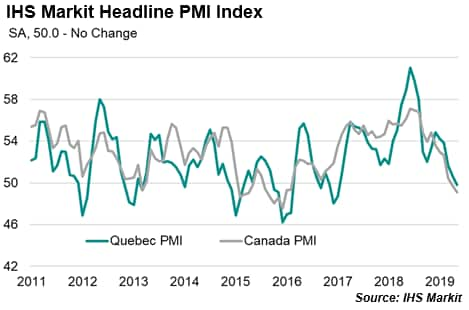

At 49.8 in May, the seasonally adjusted headline Quebec PMI dipped from 50.6 in April to signal the first deterioration in manufacturing business conditions since January 2017. A key factor in the weaker performance of Quebec manufacturers was softer output growth, which expanded only marginally during May.

The picture with regards to the national survey was even less rosy than for Quebec, with the national PMI signalling the second monthly deterioration in national manufacturing operating conditions and the fastest contraction of output since December 2015.

Softer demand, especially from overseas

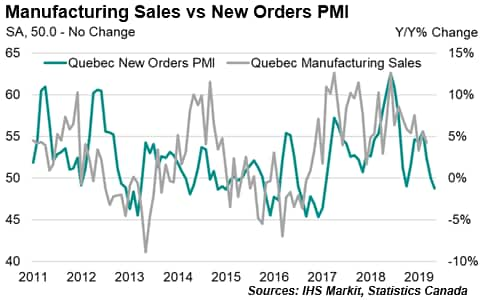

Demand conditions for Quebec's manufacturers have been on an easing path since the growth highs established in mid-2018. In fact May saw levels of overall new business among manufacturing firms decline for the first time since January 2017. Export sales meanwhile contracted for the third consecutive month, dropping at the sharpest pace for just over two years.

The weaker PMI readings imply a year-on-year rate of manufacturing sales growth around zero for Quebec manufacturing firms, markedly less than the strong rates of expansion recorded this time last year.

Employment outlook resilient for now

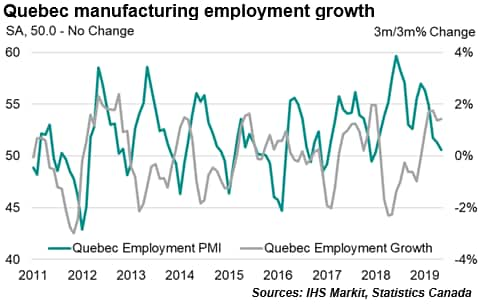

Official employment data for Quebec signal a solid expansion of manufacturing payrolls at the start of this year, rebounded from the soft patch observed in mid-2018, but the rate of job creation is now showing signs of fading.

The latest Employment PMI data points to a slower expansion of payrolls among Quebec manufacturers, comparable with official data signalling quarterly growth of around 2%. May's PMI data imply a slight easing of job creation, with the index recording the weakest expansion of staffing numbers since January 2018.

Export Performance Weakens

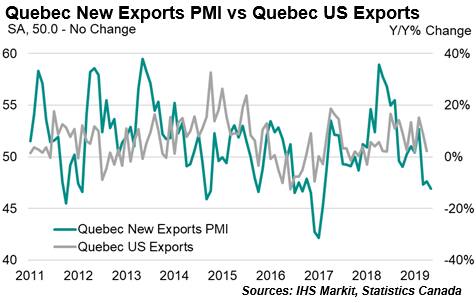

May PMI data also highlighted the persistent weakness in foreign demand conditions for Quebec manufacturers, registering the fastest contraction in export sales since February 2017. Moreover, the rate of decline was sharper than the downturn observed for Canadian manufacturers as a whole.

Some provincial manufacturing firms pointed to a softening of demand conditions among US customers as the principal factor behind the latest fall in overseas sales, and when looking at a comparison against provincial exports to the US we can see that the recent downturn in Quebec's manufacturing export performance has been linked to softer US demand conditions.

The latest data signal a broad stagnation of Quebec manufacturing exports to the US, with the New Export Orders PMI signalling a further deterioration in the coming months.

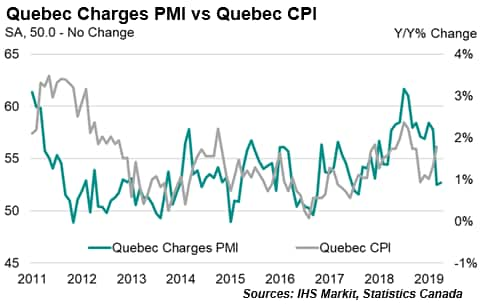

CPI eases from mid-2018 highs

In line with the picture for output and new orders, inflationary pressures have eased notably from a recent peak in mid-2018. The Quebec PMI prices charged index has tended to provide an advance indication of coming price pressures, and is currently signalling a CPI rate of around 1%.

Summary

The latest PMI data for Quebec points to the likelihood of a slight easing of business conditions for manufacturers continuing into June, with weaker trends for job creation, production growth, new business and purchasing activity recorded in May. Moreover, when looking at the relationship between the PMI and official data, there is a trend towards slower job creation. Headwinds look set to continue, following the softer rises in both overall manufacturing sales and overseas orders (especially US exports).

For manufacturing output across Quebec, IHS Markit forecasts an expansion of 1.1%, similar to the 1.0% forecast for the Canadian manufacturing sector as a whole.

Amritpal Virdee, Economist, IHS Markit

Tel: +44 207 064 6460

amritpal.virdee@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-deterioration-in-quebec-manufacturing-business-conditions-since-jan-2017-170619.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-deterioration-in-quebec-manufacturing-business-conditions-since-jan-2017-170619.html&text=First+deterioration+in+Quebec+manufacturing+business+conditions+since+January+2017+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-deterioration-in-quebec-manufacturing-business-conditions-since-jan-2017-170619.html","enabled":true},{"name":"email","url":"?subject=First deterioration in Quebec manufacturing business conditions since January 2017 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-deterioration-in-quebec-manufacturing-business-conditions-since-jan-2017-170619.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=First+deterioration+in+Quebec+manufacturing+business+conditions+since+January+2017+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-deterioration-in-quebec-manufacturing-business-conditions-since-jan-2017-170619.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}