Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 15, 2019

Factor and style model performance: 2018 in review

Research Signals - December 2018

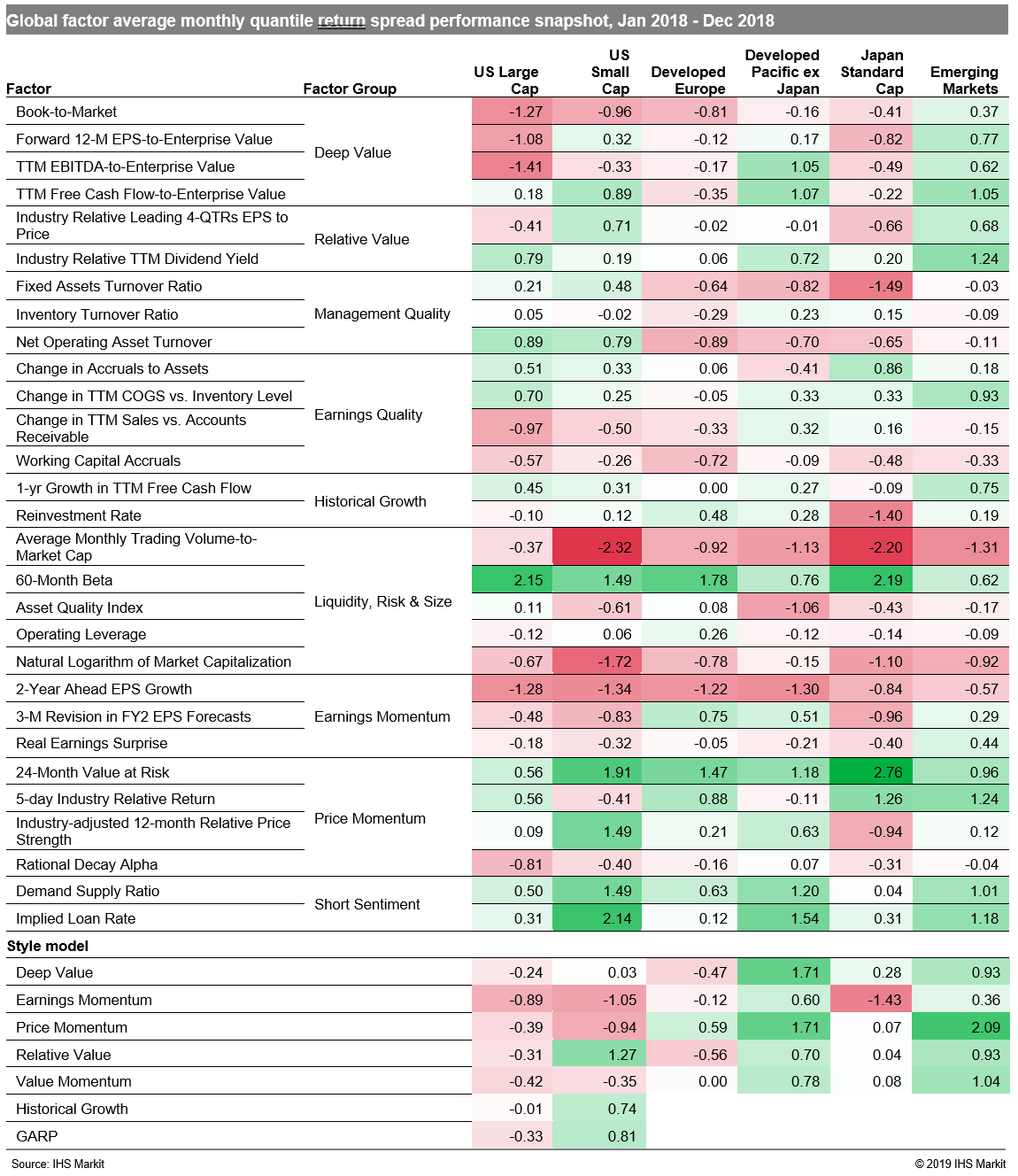

Major global equity markets came close to or entered bear territory in 2018, as many regional benchmarks posted their worst annual declines since the financial crisis or longer. Markets succumbed to slowing economic growth and trade tensions, especially between the US and China. The resulting increased volatility lent support to the risk-off trade, as demonstrated by outperformance of 60-Month Beta across all our coverage universes in 2018 (Table 1). The economic outlook for the coming year may well reflect divergent regional growth trends which developed over the course of 2018, undoing the strong, synchronized growth which the global economy began the year with. One major risk to the global economy in the coming year is further contraction in world trade, as manifested by the December J.P.Morgan Global Composite Index which eased to a 27-month low.

- US: 60-Month Beta outperformed in 2018, supported by a cumulative spread of 24.5% over the last three months, while Price Momentum measures such as Industry-adjusted 12-month Relative Price Strength were key among small caps

- Developed Europe: While risk-off was a dominant trade in European markets throughout 2018, the multifactor construction of the Price Momentum Model, combining price changes with several risk factors, supported a cumulative decile spread of 7.0% for the year

- Developed Pacific: In markets outside Japan, signals from the securities lending market were successful strategies for the year, as gauged by Demand Supply Ratio and Implied Loan Rate, proprietary measures categorizing stocks that are heavily borrowed in the market relative to the lendable inventory and the respective cost of borrowing which is indicative of the shorting flow

- Emerging markets: Our style models were particularly effective at distinguishing winners from losers, with strong cumulative spreads for year across each category, led by Price Momentum (25.0%)

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2018-in-review.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2018-in-review.html&text=Factor+and+style+model+performance%3a+2018+in+review+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2018-in-review.html","enabled":true},{"name":"email","url":"?subject=Factor and style model performance: 2018 in review | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2018-in-review.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Factor+and+style+model+performance%3a+2018+in+review+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2018-in-review.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}