Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 13, 2020

Expanding our Short Squeeze Model to global markets

Research Signals - April 2020

In May 2015 we introduced the Research Signals Short Squeeze Model to systematically score US stocks based on their potential for a short squeeze event. We now expand coverage of the model globally to Developed Europe and Developed Pacific markets and expand our US universe size. Using IHS Markit Securities Finance unique short loan transaction data, our model incorporates capital constraint indicators, which identify names where short sellers have increased potential to cover positions, and events, identifying catalysts for short squeezes. The model can be used to control risk of short squeezes and enhance alpha forecasts based on short interest measures, which we demonstrate by measuring the improvement of our short sentiment factors in a Short Squeeze Model overlay strategy.

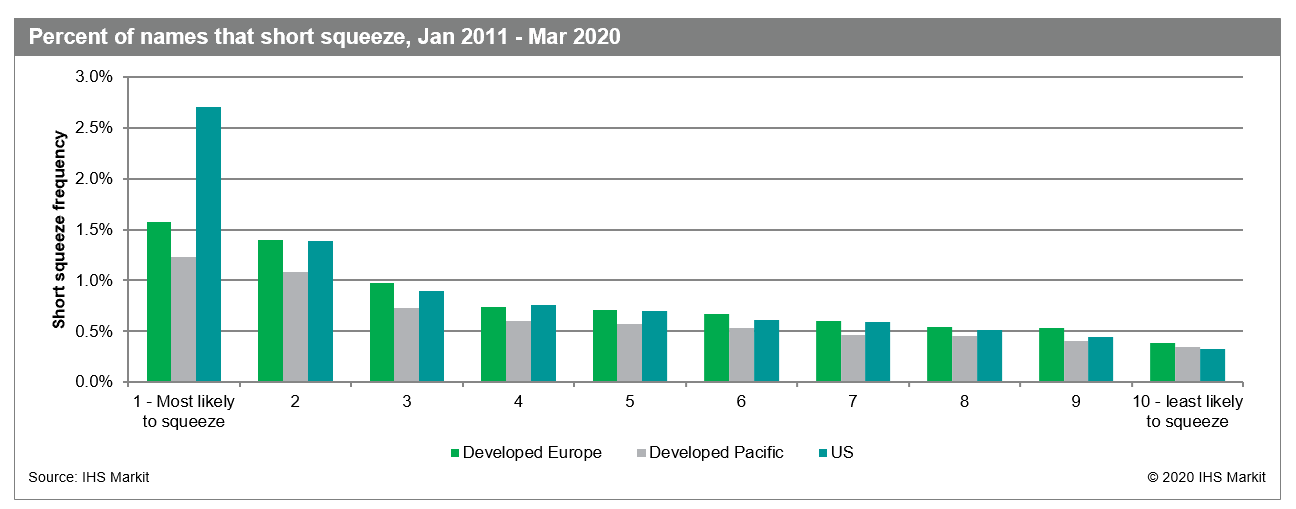

- Short squeeze candidates identified by the model within our highly shorted Developed Europe universe had a 59% greater likelihood of squeezing compared with the base universe

- In Developed Pacific, squeezes occurred 1.23% of the time among stocks that the model predicted to squeeze, compared with 0.77% for the universe

- The Short Squeeze Model had the highest hit rate in the US (2.70%) in isolating stocks most likely to squeeze, handily exceeding the universe rate of 1.29%

- US stocks with the highest probability to squeeze outperformed the universe for open-to-close returns, with an additional 4 bps of return on average and 13 bps versus names least likely to squeeze, persisting out to 1-month (6-month) holding periods with 22 bps (1.52%) and 71 bps (4.72%) of additional alpha, respectively, with similarly robust results to our expanded global coverage

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexpanding-our-short-squeeze-model-to-global-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexpanding-our-short-squeeze-model-to-global-markets.html&text=Expanding+our+Short+Squeeze+Model+to+global+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexpanding-our-short-squeeze-model-to-global-markets.html","enabled":true},{"name":"email","url":"?subject=Expanding our Short Squeeze Model to global markets | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexpanding-our-short-squeeze-model-to-global-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Expanding+our+Short+Squeeze+Model+to+global+markets+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fexpanding-our-short-squeeze-model-to-global-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}