Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 14, 2020

Daily Global Market Summary - 14 April 2020

US equity markets had a particularly good day, as the roadmap and the timing of the reopening of the US continues to become a bit clearer every day. Most APAC equity markets closed modestly higher, while European markets returned from the extended holiday weekend closing mixed. It's worth noting that the US credit markets did not follow the positive sentiment in the US equity markets today and US government bonds closed slightly higher on the day.

Americas

- US equity markets closed higher across the region; Nasdaq +4.0%, S&P +3.1%, DJIA +2.4%, and Russell 2000 +2.1%.

- 10yr US govt bonds closed -1bp/0.75% yield.

- MarketAxess will begin to expand its electronic trading platform to U.S. taxable municipal bonds through its trading venues in the U.K., European Union and Singapore in an effort to streamline buying and selling of taxable municipal bonds for foreign buyers. The company is providing liquidity through its electronic platform, which in addition to its electronic trading capabilities will also support regulatory reporting obligations for international investors under the MiFID II rules. (Bond Buyer)

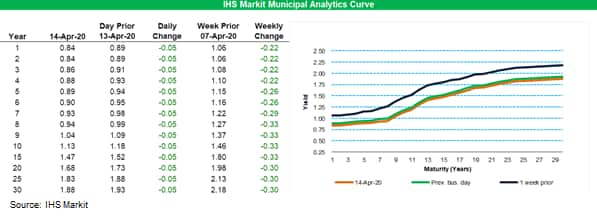

- IHS Markit's AAA Municipal Analytics Curve rallied 5bps across

the curve today and is 22-33bps tighter across the curve

week-over-week:

- Ford has released preliminary, selected financial information on its first-quarter 2020 performance. Ford expects a loss of USD600 million in the first quarter and reports revenue of USD34 billion in its preliminary results, with wholesale deliveries down 21%. Separately, Ford revealed its further efforts to assist in addressing the spread of the COVID-19 virus through the production of personal protection equipment. In Ford's announcement, the company said it expects to have enough cash to get through the third quarter of 2020, if its production were to remain idled that long, without having to resort to further borrowing or other financial measures to raise cash. Ford stated that the preliminary data on its first-quarter financial results had not been subject to review, and the company had not completed the closure of its first-quarter books; therefore, the preliminary results may be subject to change. (IHS Markit AutoIntelligence's Stephanie Brinley)

- JPMorgan set aside an additional $6.8 billion in the quarter for potentially bad loans, largely in its consumer bank. Wells Fargo said it set aside an additional roughly $3 billion in the quarter for potentially bad loans, both in the consumer and commercial divisions. JPMorgan said the provision was based, in part, on the assumption that U.S. gross domestic product would fall 25% and unemployment would rise to more than 10% in the second quarter. However, JPMorgan economists have recently amended their forecast to a 40% decline in GDP in the quarter and a 20% unemployment rate. (WSJ)

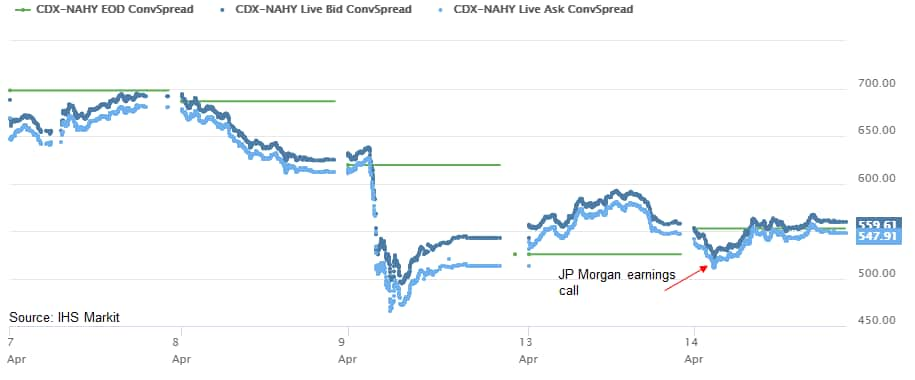

- IHS Markit CDX North America Investment grade closed

-1bp/82bps. CDX NA HY started the European trading day by

tightening as much as 32bps by 8:30am ET (time of JP Morgan's

earnings release) and then immediately began to sell off and close

at +1bp/553bps:

- Crude oil closed -11.4%/$20.11 per barrel.

- Alnylam Pharmaceuticals (US) has announced a strategic collaboration with private equity firm Blackstone (US) that will provide the biotechnology firm with up to USD2 billion to support development of new RNA interference (RNAi) therapeutics in exchange for 50% of the royalties owed to Alnylam on global sales of inclisiran, as well as corporate debt, and equity purchase. The promising candidate is being developed by The Medicines Company (now part of Novartis, Switzerland) under an agreement with Alnylam and has so far demonstrated significant reduction in low-density lipoprotein cholesterol (LDL-C) levels in late-stage testing. (IHS Markit Life Science's Margaret Labban)

- US import prices in March undergo largest monthly drop since

2015 as fuel prices dive. The index of US import prices fell 2.3%

in March, following a downwardly revised 0.7% drop in February. The

index's year-on-year (y/y) growth rate plunged 2.8 percentage

points to -4.1%. Flat nonfuel import prices outweighed by a plunge

in fuel prices. (IHS Markit Economist Gordon Greer)

a. The recent fall in fuel import price growth has accelerated into a nosedive, marking a 26.8% month-on-month (m/m) drop in March after a downwardly revised 9.0% February decline. The cost of imported fuel was down 36.2% y/y.

b. Import air passenger fares fell 11.3% y/y in March, the largest yearly drop since October 2009. This was driven by a steep drop in European fares, although Asian fares were also down markedly. Import air freight prices, meanwhile, were up 3.3% y/y.

c. The index of exported goods prices continued to drop in March, with the index's month-on-month change falling to -1.6%. Agricultural prices growth eased up to -1.4% m/m and marked a 2.2% y/y decrease, while nonagricultural commodities growth fell to -1.5% m/m and -3.7% y/y. - Toyota has announced the extension of its plant shutdown for another month in Brazil, reports Automotive Business. The restart of operations is scheduled for 22 June at the units of Indaiatuba and auto part plants in Porto Feliz and São Bernardo do Campo. Sorocaba will restart from 24 June. According to the source, the extension of the plant shutdowns is due to Toyota's adherence to Provisional Measure (PM) 936 wherein the employment contracts of the plant employees were suspended for two months from 22 April. (IHS Markit AutoIntelligence's Tarun Thakur)

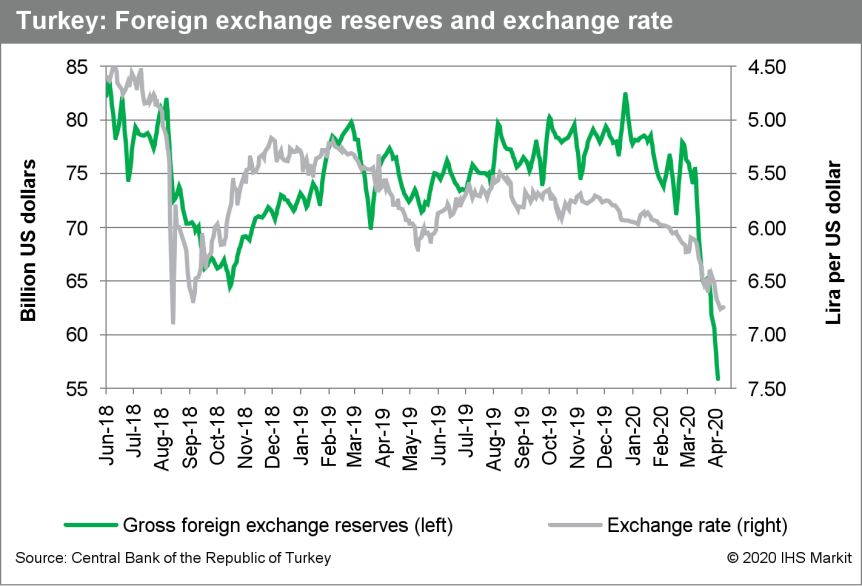

- Data for the first two months of 2020 showed that Turkey's

balance of payments position was putting strong downward pressure

on the lira. In March, portfolio investment will be strongly

outward, because of the collapse of the lira over the course of

that month. The inflow of FDI will have evaporated, with

international capital freezing in the face of the global pandemic.

As noted with the surge of other investment noted in February,

Turkey is building its reserves through short-term, forward swaps

that essentially spikes the country's short-term debt. These swaps

will likely have continued throughout March as well. (IHS Markit

Economist Andrew Birch)

- The agreement announced late last Thursday, before the Easter break, by eurozone countries to not proceed with the proposed issuance of common debt, called "coronabonds," to finance country's recovery from the COVID-19 pandemic had a direct impact on 10yr Italian govt bond yields, which closed at +19bps/1.78% yield today - highest yield since March 19. (WSJ)

- Saudi Arabia in making deep cuts to its latest official selling price (OSP) for buyers in Asia is signaling a return to its policy of ensuring its biggest customers are happy in the face of numerous challenges from competing supply sources while pulling back from the U.S. and Europe, market sources said. For buyers in Asia, Saudi Aramco slashed the price of its Arabian Extra Light, Light, Medium and Heavy crudes by $4.30/bbl, $4.20/bbl, $3.35/bbl and $2.95/bbl, respectively, from the April OSP, according to the list. This was well above the expected around $3.00/bbl drop to its main Arabian Light grade. Aramco is keeping its crude competitive so as not to lose out in a big way to incremental spot barrels especially since China is already committed to buying more U.S. cargoes as part of a trade agreement sealed earlier this year, they said. (IHS Markit Maritime and Trade's Rajendran Ramasamy)

- Immediate debt servicing relief in the amount of USD500 million will be awarded to low-income countries, including sub-Saharan African countries, under the International Monetary Fund (IMF)'s Catastrophe Containment and Relief Trust (CCRT), amid the COVID-19 pandemic. The low-income countries that will receive debt relief include a number in sub-Saharan African countries and comprise Afghanistan, Benin, Burkina Faso, Central African Republic, Chad, Comoros, the Democratic Republic of the Congo, the Gambia, Guinea, Guinea-Bissau, Haiti, Liberia, Madagascar, Malawi, Mali, Mozambique, Nepal, Niger, Rwanda, São Tomé and Príncipe, Sierra Leone, Solomon Islands, Tajikistan, Togo, and Yemen. (IHS Markit Economist Thea Fourie)

- Renault Group is said to be looking at up to EUR5 billion of state-backed loans, reports RTL. Its chairman Jean-Dominique Senard said in an interview that the company could seek between EUR4 billion and EUR5 billion of backing to see it through the COVID-19 virus outbreak. The comments come as the automaker has announced that it will scrap a planned dividend that was to be voted on at its upcoming annual general meeting (AGM). (IHS Markit AutoIntelligence's Ian Fletcher)

- Hyundai has announced that it has restarted production at its plant in St Petersburg (Russia) after a stoppage imposed by the company's and Russian government's response to the COVID-19 virus outbreak, according to a Yonhap News Agency report. Hyundai will lose 56,186 units of production across its European (including Russian) production operations as a result of COVID-19 virus-instigated stoppages according to the most recent IHS Markit production tracker. (IHS Markit AutoIntelligence's Tim Urquhart)

- Brent crude closed -7.4%/$31.78 per barrel.

- 10yr European govt bonds closed mixed; Germany -3bps, France flat, and UK +4bps.

- European equity markets closed mixed; Germany +1.3%, Spain +0.5%, France +0.4%, Italy -0.4%, and UK -0.9%.

- In a speech at the IHS Markit World Petrochemical Conference (WPC) 2020 Online, Yubo Li, CFO and CEO at Jiahua Chemicals said chemical industry leaders, particularly those with long value chains extending from crude oil, could see their cost- and margin advantages shrink dramatically due to falling crude oil prices. Meanwhile, investments in building up infrastructure and logistics are expected to increase as the role of logistics gains importance going forward. "Logistics have been the main bottleneck during the crisis, so we will see more investments [in that area]," Li said. In a world post-COVID 19, the shift to digitization, automation, and globalization is inevitable, Li said. Companies growing and diversifying their businesses will not be able to rely solely on labor, which is increasingly costly and runs the risk of being disrupted.

- New vehicle sales in South Korea, including passenger-vehicle imports, grew by 8.7% year on year (y/y) during March to 169,966 units, up from 156,366 units in March 2019, according to reports by Yonhap News Agency and the Korea Automobile Importers and Distributors Association (KAIDA), as compiled by IHS Markit. During the first quarter, total vehicle sales in the country stood at 383,208 units, down by 7.0% y/y. In light of the COVID-19 outbreak, IHS Markit in its March forecast round has downgraded its 2020 light-vehicle sales forecast for South Korea by around 244,770 units. Vehicle sales in the country will fall drastically at least until the second quarter of 2020 because of the ongoing social distancing and confinement measures. (IHS Markit AutoIntelligence's Jamal Amir)

- SAIC Motor released its March sales results on 11 April; sales plunged 58.6% year on year (y/y) to 231,455 units during March. The slump in March volumes dragged SAIC's first-quarter sales down by 55.7% to 679,028 units. Sales of SAIC-VW, SAIC's joint venture (JV) with Volkswagen (VW), dropped by 64.0% y/y to 60,010 units last month, still taking the leading position in sales among the group's JV companies. SAIC-VW sales contracted by 60.9% y/y to 183,010 units during the first quarter. (IHS Markit AutoIntelligence's Abby Chun Tu)

- iSmartWays Technologies, a Canada-based vehicle-to-everything (V2X) hardware and software solutions provider, has announced a multi-million-dollar Pre Series-A funding round with investors SAIC Capital (a corporate venture capital firm of SAIC Motor) and ChinaEquity Group. V2X technology enables vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure, and facilitates the operations of automated vehicles. SAIC Motor is planning to launch Level 4 autonomy by 2020 and Level 5 fully autonomous vehicles by 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- India's headline consumer price index (CPI) inflationary pressures moderated to 5.9% year on year (y/y) in March 2020 from 6.6% y/y in February 2020, helped by lower food price rises. However, although food and beverages price inflation has moderated since January, the pace of increase is still high, at 7.8% y/y in March. The impact of the extension of lockdown measures until 3 May is expected to continue to disrupt agricultural supply chains throughout April, which is likely to keep food inflationary pressures elevated in the short term, although better food supplies are expected with the rabi (winter) harvest in coming weeks. (IHS Markit Economist Rajiv Biswas)

- Toyota Motor Thailand has announced that it is extending the temporary suspension of operations at its plants in Samrong, Ban Pho, and Gateway until 30 April, according to a company press release. It originally announced a suspension from 7 April to 17 April. (IHS Markit AutoIntelligence's Jamal Amir)

- Most APAC equity markets closed higher across the region; Japan +3.1%, Philippines +3.0%, South Korea +1.7%, China +1.6%, and Hong Kong +0.6%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-april-14-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-april-14-2020.html&text=Daily+Global+Market+Summary+-+14+April+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-april-14-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 April 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-april-14-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+April+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-april-14-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}