Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2023

Eurozone flash PMI shows inflation pressures cooling in June as economic upturn fades

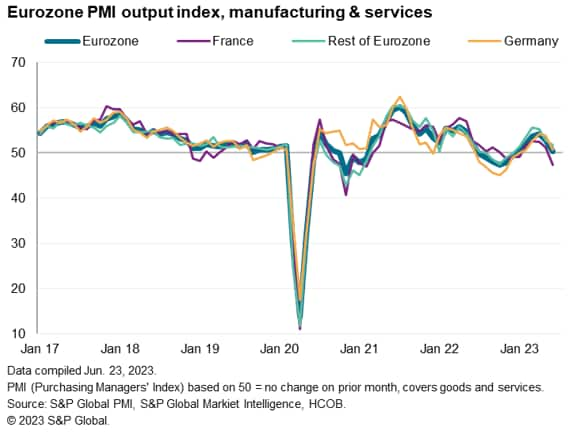

Eurozone business output growth came close to stalling in June, according to the latest HCOB flash PMI survey data produced by S&P Global, pointing to renewed weakness in the economy after the brief growth revival recorded in the spring.

Inflows of new orders fell for the first time since January, employment growth slowed and future output expectations also deteriorated.

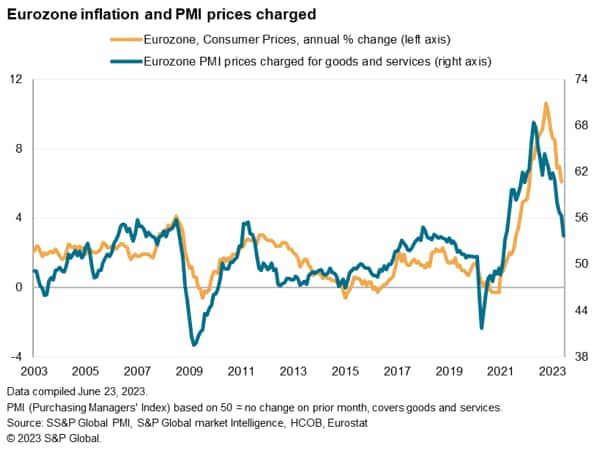

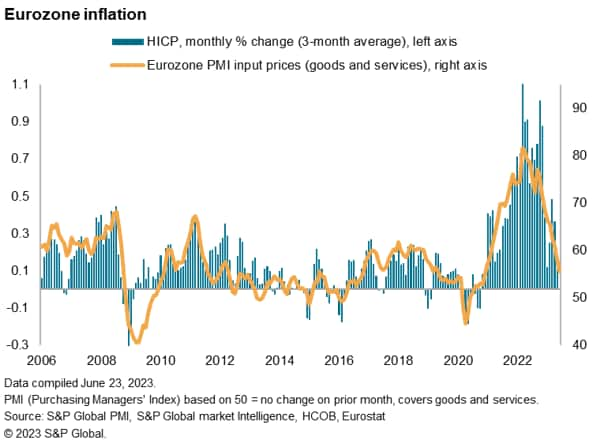

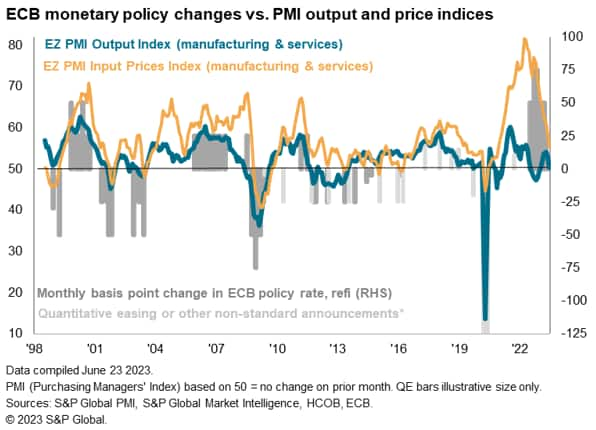

More encouragingly, the slowdown was accompanied by a marked cooling of inflationary pressures. Input costs rose at the slowest rate since December 2020 and average selling prices for goods and services rose at the weakest rate since March 2021.

The bottom line is that recent policy tightening appears to be having a material impact on inflation, though with the lagged impact of policy hikes yet to take full effect on demand, the cost is increasingly likely to be a renewed downturn - and possibly recession - in the second half of the year.

Output growth close to stalling as demand conditions worsen

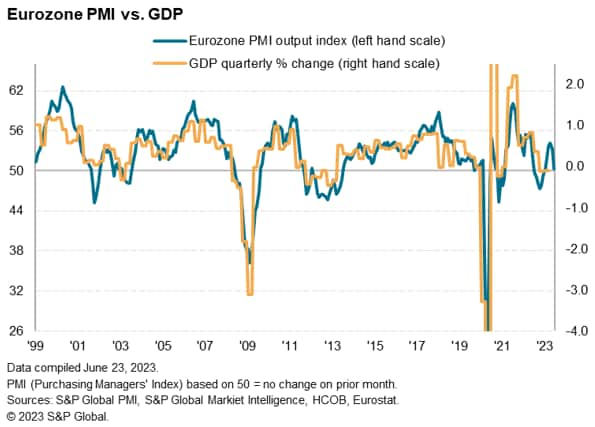

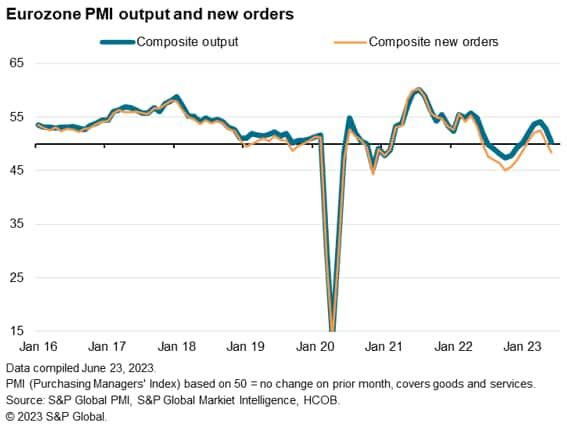

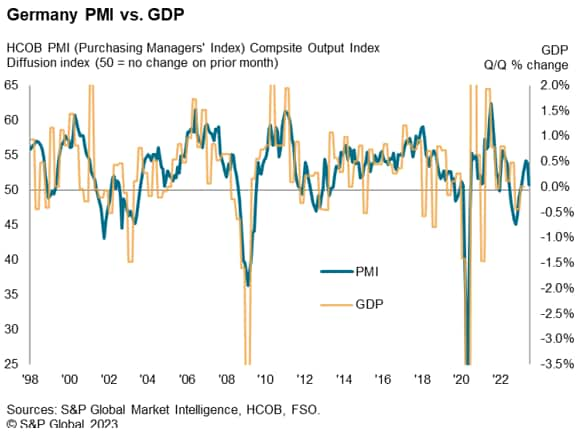

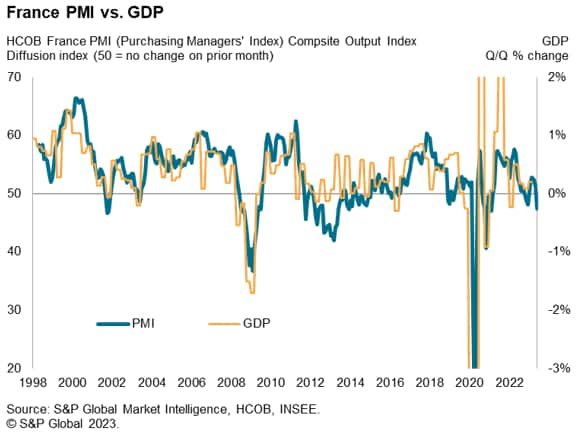

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses, fell from 52.8 in May to 50.3 in June, its lowest since January. Although recording an expansion of output for a sixth consecutive month in June, the latest increase was only marginal and far weaker than the gains seen in the previous four months to signal a considerable loss of growth momentum. The 2.5 point drop in the index was the largest recorded for a year.

The latest data are indicative of GDP stagnating in June, though for the second quarter as a whole the PMI points to a 0.3% quarterly expansion.

The slowdown had been signalled in advance by a near-stagnation of new business inflows in May. With the new business trend measured across goods and services worsening further in June, as new orders dropped for the first time since January, the deteriorating demand environment signals downside risks to output in July.

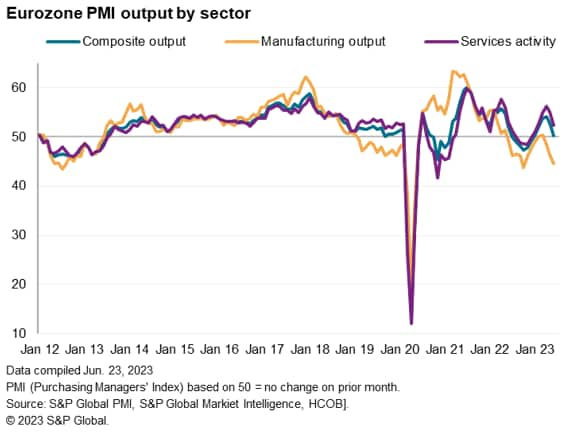

Manufacturing remained the principal area of weakness, with factory output falling for a third straight month and at the fastest rate since last October. The resulting steep production decline was driven by an increasingly sharp downturn in new orders for goods, which fell to the greatest extent since last October.

Growth of service sector output meanwhile slowed sharply as the recent resurgence in spending on services lost momentum. Business activity in the service sector grew at the slowest rate since January, down sharply from April's recent peak, with growth of new business dropping to register only a modest increase in demand, contrasting with the strong gains seen in the three months to May.

Employment trend deteriorates

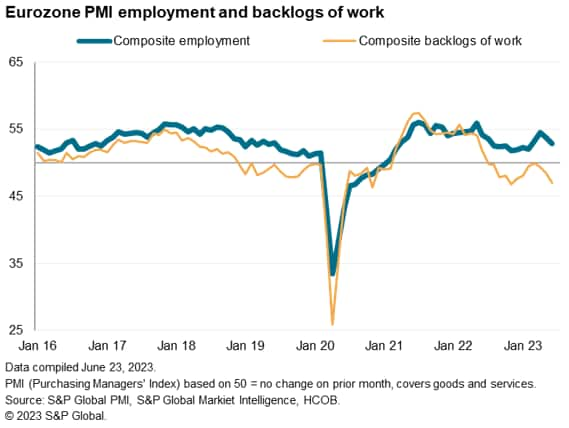

Backlogs of work fell at the steepest rate for seven months, reflecting the sustained (albeit moderating) output growth at a time of falling inflows of new work. Order backlogs have now fallen for three successive months. Backlogs fell at the sharpest rate for three years in manufacturing and slipped into decline in the service sector for the first time since January.

Falling backlogs tend to signal excess capacity, and are hence typically a precursor to downward pressure on payroll numbers. Hence employment growth slowed for a second consecutive month in June, with the rate of job creation down to its lowest since February. Manufacturing headcounts were cut for the first time since January 2021 and jobs growth in the service sector waned for a second month in a row to sit at the lowest since March, albeit remaining strong by historical standards.

Weak demand help supply improve

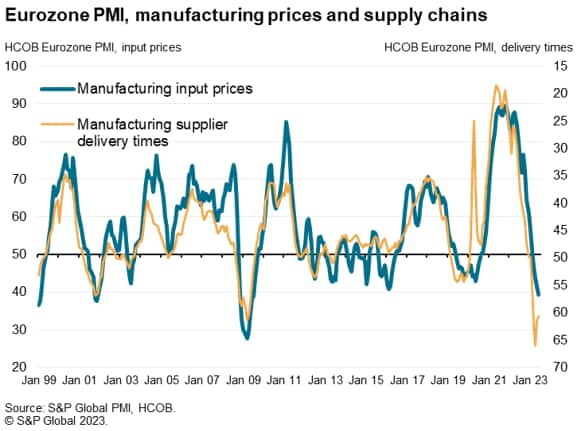

Manufacturers notably also adjusted to the prospect of lower production in the coming months by greatly reducing their purchases of inputs. Barring the COVID-19 lockdowns of early-2020, June saw the largest reduction in input buying by factories since 2009. Reduced purchasing of inputs by manufacturers took pressure off supply chains, which in turn led to faster supplier delivery times, which have improved in recent months to a degree not seen since 2009.

Prices charged rise at slowest rate for 27 months

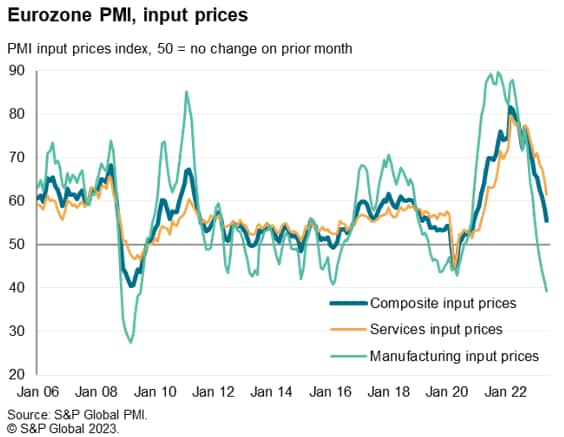

Falling demand led to increasing discounting in manufacturing, resulting in average input prices dropping in the factory sector for a fourth successive month and at the steepest rate since July 2009.

While service sector input costs continued to rise at a rate well above the survey's long-run average, buoyed in particular by wage pressures, the rate of increase moderated to the lowest since May 2021. Measured across both sectors, the rate of input cost inflation sank sharply in June, down for a ninth straight month to its lowest since December 2020.

Slower cost growth fed through to lower selling price inflation. Average prices charged for goods and services rose at the slowest rate for 27 months in June, having been on a broad easing trend over the past year but showing an especially large drop in momentum in June (one of the largest points falls in the index since 2008 excluding the early-2020 pandemic lockdown months). Prices charged for goods leaving the factory gate fell for a second successive month, showing the largest decline for three years. Average rates levied for services rose sharply again, though the rate of inflation cooled by the greatest extent since 2008 barring the early-2020 lockdown months.

Future expectations hit by growth concerns

Optimism about the year ahead fell in June to the greatest extent since last September, sliding to its lowest level so far this year. Expectations for the year ahead have deteriorated especially markedly in manufacturing, down to a seven-month low in June, but have also sunk to a six-month low in the service sector. The overall degree of confidence has dropped far below the long-run average in both sectors. Although energy and supply chain worries have eased since late last year, June has seen a further escalation of concerns over demand growth, and in particular the impact of higher interest rates, and the resulting possibilities of recessions both in domestic markets and further afield.

Outlook

June's flash PMI data come on the heels of the European Central Bank (ECB) hiking interest rates again at its June meeting. The deposit facility rate (DFR) has now risen to 3.5%, its highest since 2001, and the refinancing (refi) rate is up to 4%, its highest since 2008. This implies cumulative increases in both of 400 basis points in just 11 months.

The inflation fight has clearly switched from manufacturing to services, hence the sharp slowing in June's service sector PMI selling price gauge is a major encouragement in the ECB's plight. Inflation was down to 6.1% in May, and the PMI data point to a further moderation in the coming months, to perhaps as low as 3% by the fourth quarter. This would be far better than envisaged by the ECB in their projections. In the meantime, the lagged effect of rate hikes looks set to take an increasing toll on the economy via reduced demand, meaning a greater chance of a recession later in the year.

National trends

Looking at growth across the euro area, the weakness was led by France, where output fell for the first time since January as strikes reportedly added to the economy's headwinds. The resulting drop in output was the steepest since February 2021 and broad-based across manufacturing and services. However, growth also came close to a stand-still in Germany, contrasting with robust expansions in the three months to May, as an increasingly severe manufacturing downturn was accompanied by slower service sector growth. The rest of the region as a whole meanwhile reported the slowest output growth for five months, the expansion continuing to lose momentum from the solid gains seen in March and April due to a combination of marked factory output losses and weaker service sector growth.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-inflation-pressures-cooling-in-june-as-economic-upturn-fades-June23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-inflation-pressures-cooling-in-june-as-economic-upturn-fades-June23.html&text=Eurozone+flash+PMI+shows+inflation+pressures+cooling+in+June+as+economic+upturn+fades+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-inflation-pressures-cooling-in-june-as-economic-upturn-fades-June23.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI shows inflation pressures cooling in June as economic upturn fades | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-inflation-pressures-cooling-in-june-as-economic-upturn-fades-June23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+shows+inflation+pressures+cooling+in+June+as+economic+upturn+fades+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-shows-inflation-pressures-cooling-in-june-as-economic-upturn-fades-June23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}