Eurozone flash PMI hit by weaker services, masks manufacturing strength

- Flash Eurozone PMI edges up from 47.8 in January to 48.1 in February

- Manufacturing expansion gains momentum, helping offset further service sector weakness

- Germany outperforms amid factory strength

- Prices jump amid supply constraints

Ongoing COVID-19 lockdown measures dealt a further blow to the eurozone's service sector in February, adding to the likelihood of GDP falling again in the first quarter. However, the impact was alleviated by a strengthening upturn in manufacturing, hinting at a far milder economic downturn than suffered in the first half of last year.

The headline flash IHS Markit Eurozone Composite PMI® edged higher from 47.8 in January to 48.1 in February. By remaining below 50.0, the latest reading indicated a fourth consecutive monthly contraction of business activity, but also registered a slight easing in the rate of decline compared to January.

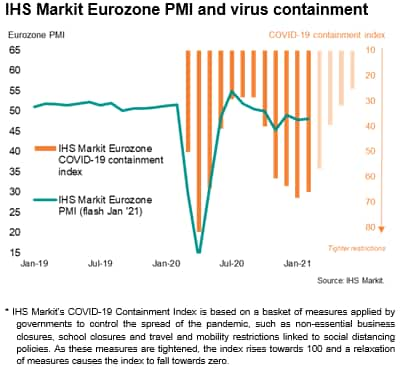

Despite the rise in the PMI, the average reading of 47.9 for the first quarter so far is marginally lower than the average of 48.1 seen in the fourth quarter of last year. The sustained downturn therefore hints at a further deterioration in the economy - and a double-dip recession - as measures to control the coronavirus disease 2019 (COVID-19) pandemic continued to disrupt business activity across the region.

Importantly, however, the last four months have seen the PMI remain far higher than during the initial months of the pandemic in the spring of last year, suggesting that the economic impact of the second wave of virus infections has so far been much less severe than during the first wave.

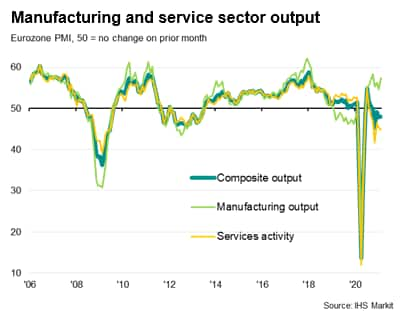

The deterioration in output was driven by the service sector, where activity fell at the fastest rate since November, registering the second-steepest fall since last May, largely in response to COVID-19 related restrictions. In contrast, manufacturing output growth accelerated to the fastest since October, and the second-fastest in three years.

Germany outperforms

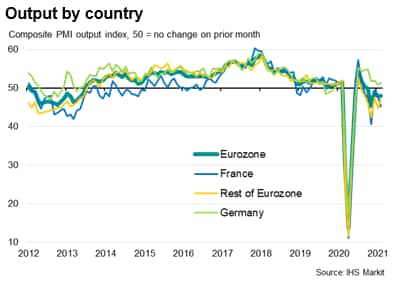

Particularly strong manufacturing growth meant Germany once again outperformed, However, at 51.3 (up only modestly from 50.8 in January) the composite index registered only a marginal expansion due to the offsetting impact of weaker services.

At 45.2, down from 47.7, the equivalent composite index for France meanwhile signalled the steepest deterioration since November due to the faster service sector downturn. Business activity also declined across the rest of the eurozone as a whole, albeit at a reduced rate.

Greater optimism

Vaccine developments meanwhile helped business confidence to revive, with firms across the eurozone becoming increasingly upbeat about recovery prospects. Sentiment regarding output in the coming 12 months rose to the highest since March 2018, improving in both manufacturing and services. Assuming vaccine roll-outs can boost service sector growth alongside a sustained strong manufacturing sector, the second half of the year should see a robust recovery take hold.

Higher inflation

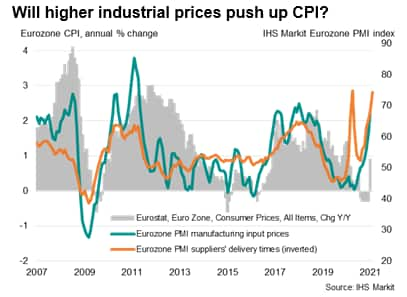

One concern is the further intensification of supply shortages, which have pushed raw material prices higher. Supply delays have risen to near-record levels, leading to near-decade high producer input cost inflation. At the moment, weak consumer demand - notably for services - is limiting overall price pressures, but it seems likely that inflation will pick up in coming months.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.