Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 22, 2023

Eurozone flash PMI fuels further downturn worries as demand weakness intensifies

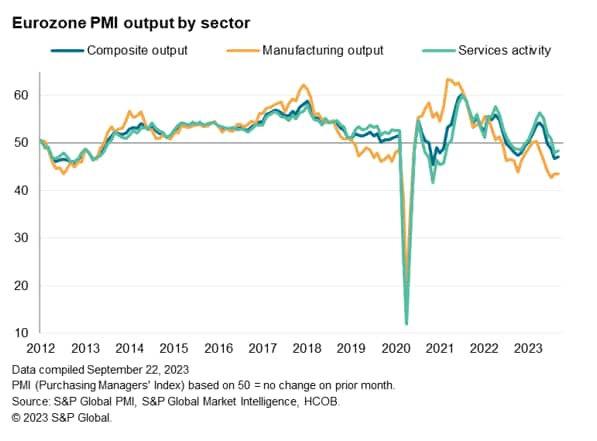

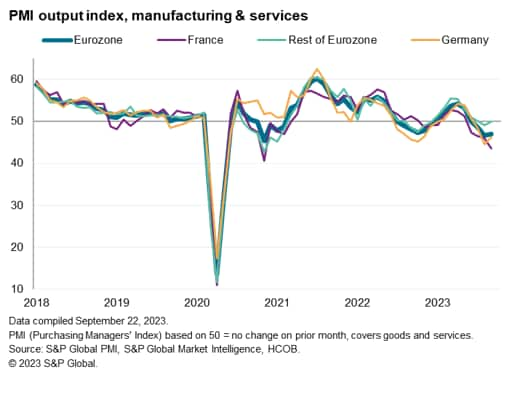

Eurozone business activity remained in contraction at the end of the third quarter of the year as an increased rate of loss of orders led to a further decline in activity. The overall reduction in output was again led by manufacturing, but the service sector saw activity decrease for the second month running.

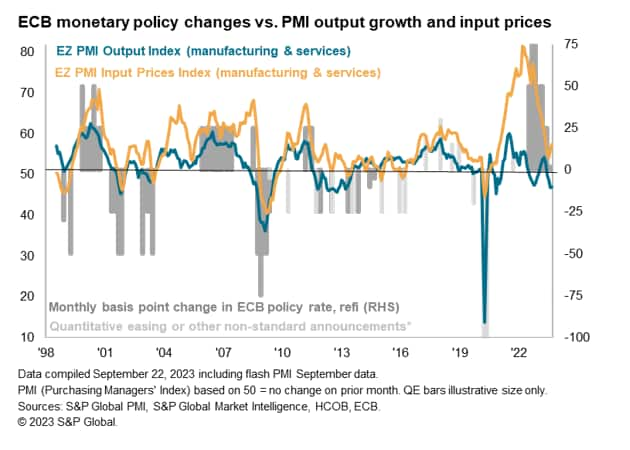

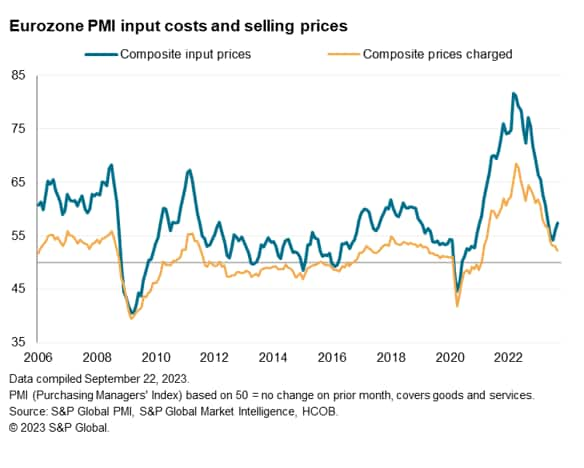

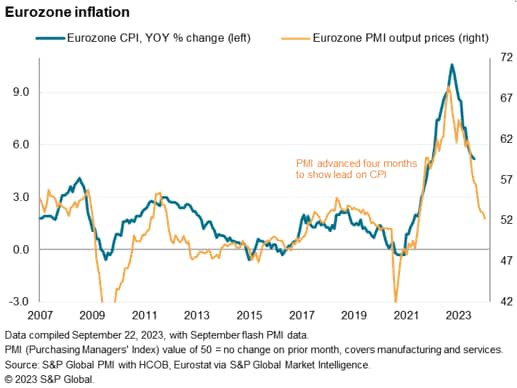

Input costs continued to rise sharply, and the rate of inflation even picked up from that seen in August, in part due to higher oil prices. Output prices, however, increased at the softest pace in over two-and-a-half years amid muted pricing power.

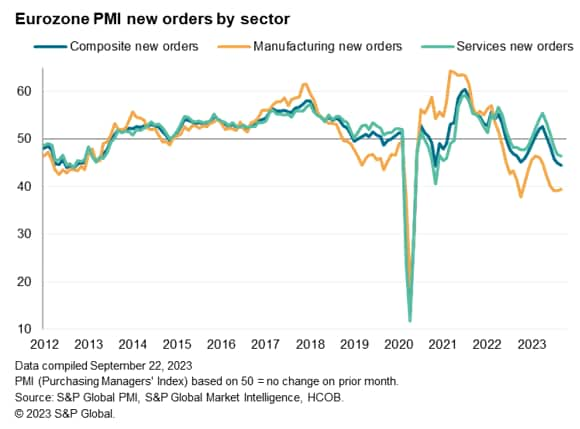

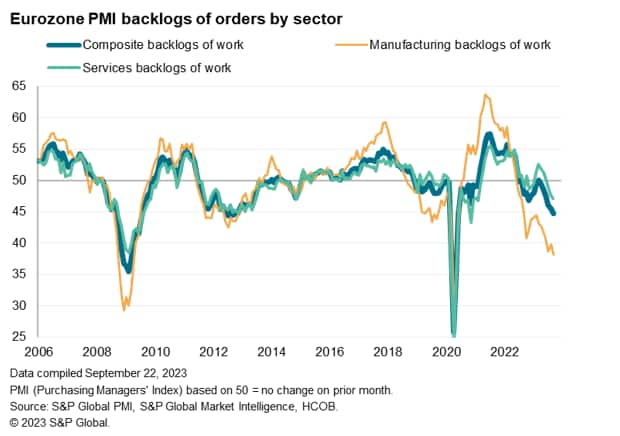

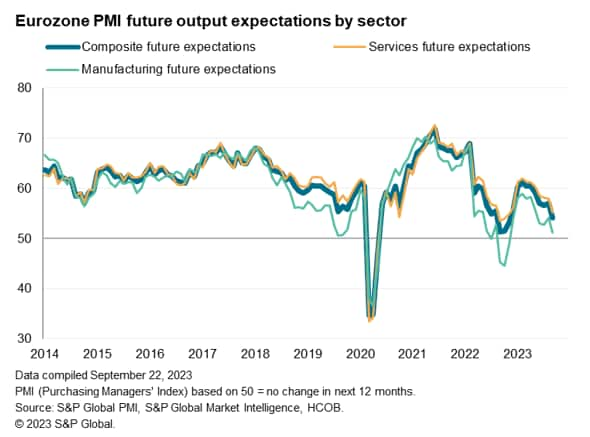

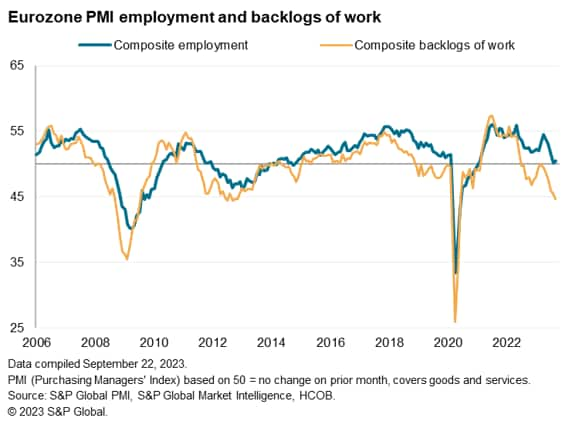

Forward-looking indicators suggest the economic contraction is likely to persist into the fourth quarter. Future business expectations fell sharply and are now running weak by historical standards to hint at an acceleration in the rate of decline in the months ahead. Similarly, new order inflows are falling at a faster rate than output in both manufacturing and services, suggesting companies will seek to reduce capacity in the months ahead. Likewise, backlogs of work are falling at an accelerating rate to hint at production cuts across goods and services in the months ahead. In the goods-producing sector, inventory reduction remains widespread, suggesting no immediate relief to the intense destocking cycle that has exacerbated the recent downturn in customer demand.

However, as well as subduing output growth as we head into 2024, these factors should also play a role in diminishing pricing power and inflationary pressures, both in manufacturing and services.

Output fall gathers pace

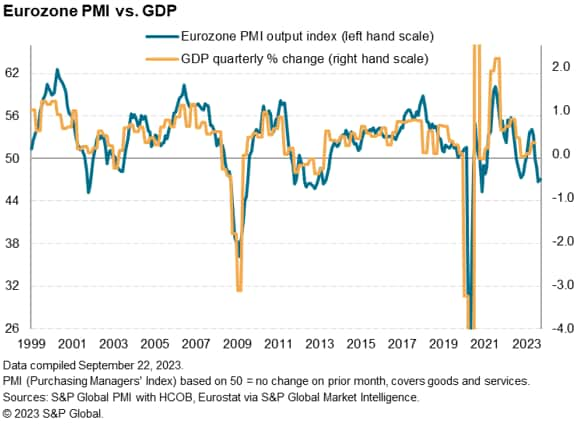

The HCOB Eurozone Composite PMI Output Index, compiled by S&P Global, recorded 47.1 in September according to the flash estimate, up marginally from 46.7 in August but still signalling a solid monthly decline in business activity. Output has now fallen for four consecutive months.

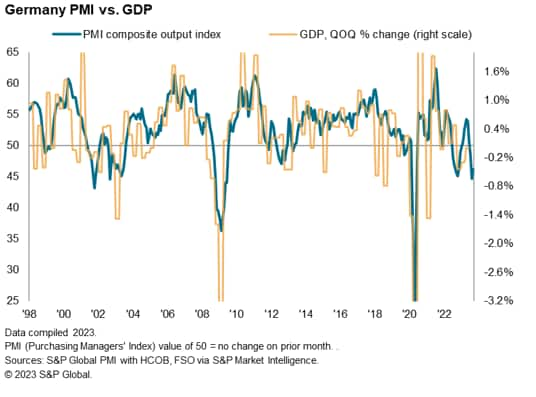

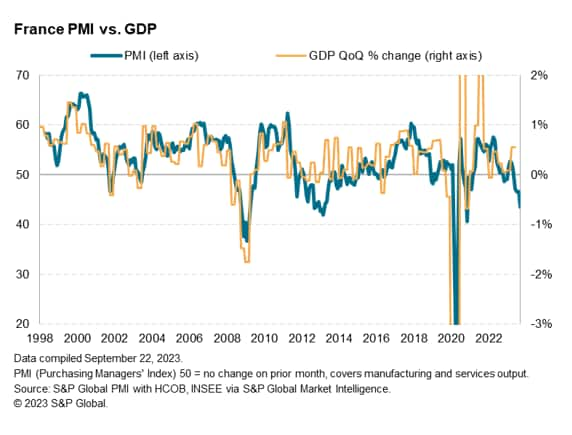

The August reading is indicative of GDP falling at a quarterly rate of 0.4%, but combined with the August and July readings means GDP likely contracted by 0.3% over the third quarter as a whole.

For the second successive month, output falls were seen in both manufacturing and services. That said, the rate of contraction in services eased slightly from August and was still much softer than that seen in manufacturing. The reduction in manufacturing production was unchanged from the rapid pace seen in August. Barring a brief period of growth during the opening quarter of the year, euro area manufacturing output has decreased continuously since the middle of 2022 with recent declines being the steepest recorded since the global financial crisis.

Central to the latest reduction in business activity was a further deterioration in demand, as highlighted by a fourth successive monthly decrease in new orders. Moreover, the fall in September was the most pronounced since November 2020 and - baring pandemic months - the steepest since September 2012.

Manufacturing new orders contracted rapidly again, but the acceleration in the overall rate of decline was centred on the service sector, where the drop in new business was the sharpest since the pandemic. In fact, excluding months affected by COVID-19 restrictions, the fall in services new orders was the largest since May 2013.

The data therefore continue to signal a marked cooling of the demand revival seen in the spring for consumer-oriented services such as travel and tourism, which had boomed in early 2023 amid loosened COVID-19 containment measures compared to the prior three years. Note also that new orders continued to fall at a sharper rate than output is currently being reduced, which - in the absence of a sudden revival of demand - suggests firms will come under pressure to reducing operating capacity in the months ahead.

Job market remains largely stalled

Sharp falls in new orders meant that companies often turned to work on outstanding business in order to maintain activity levels. As such, backlogs of work decreased markedly again during September, with the latest depletion the most pronounced since June 2020. Barring pandemic months, the decline was the steepest since 2012, reflecting the steepest fall in services backlogs since 2012 and the largest falling manufacturing backlogs since the global financial crisis.

Eurozone businesses also signalled a waning of confidence in the year-ahead outlook at the end of the third quarter. Future sentiment dipped sharply to the lowest since November last year. Optimism waned across both monitored sectors, with manufacturing sentiment only just in positive territory.

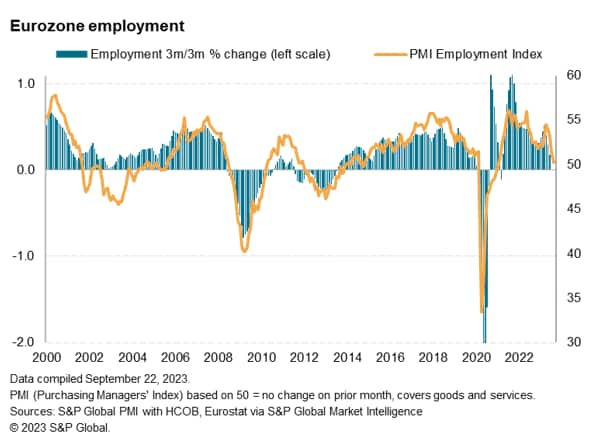

The combination of spare capacity and reduced confidence in the outlook meant that companies were again cautious in their approach to hiring. Although employment rose marginally in September, the rate of job creation was the joint-second slowest in the current 32-month run of growth.

A fourth successive monthly reduction in manufacturing workforce numbers compared with a slight increase in services employment.

As well as scaling back staffing levels, manufacturers in the eurozone also cut their purchasing activity sharply and reduced their holdings of both purchases and finished goods. The fall in stocks of finished goods was the sharpest in two years.

Reduced demand for inputs meant that suppliers were able to speed up deliveries, with vendor lead times shortening for the eighth consecutive month. The rate at which deliveries quickened was marked, albeit the least pronounced since February.

Pricing power falls

There were differing trends in terms of inflation in September as a sharper rise in input costs contrasted with a weakened rate of output price inflation.

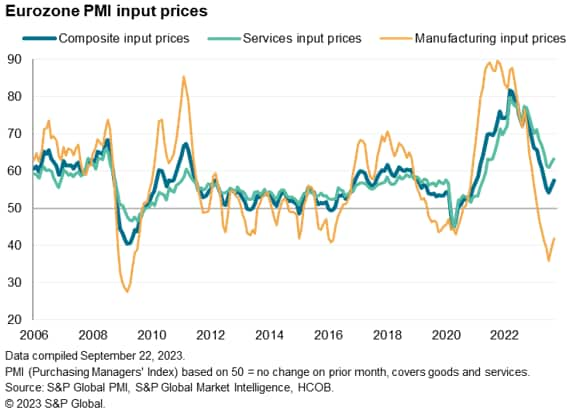

Input costs increased at the fastest pace in four months, albeit at a pace that remained well below the average seen over the past three years. Inflation was driven by the service sector, where prices were up sharply amid higher wages and rising fuel costs. Manufacturing, on the other hand, posted a seventh successive monthly drop in input costs.

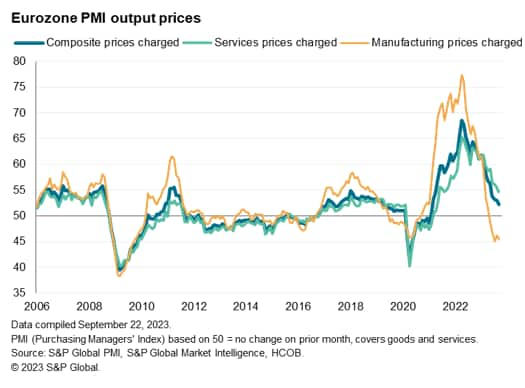

Despite the steeper pace of input cost inflation, a weakening demand environment meant that companies increased their selling prices to a lesser extent than in August. In fact, the latest rise in charges was only modest and the softest since February 2021. Manufacturing output prices fell at a marked and accelerated pace, while services charge inflation eased to a 25-month low.

Measured across both sectors, the overall rate of selling price inflation has now fallen to a level consistent with consumer prices rising at a rate below 3% in early 2024, down from the 5.2% rate seen in August.

National trends

Looking at growth across the euro area, the euro area's two largest economies - Germany and France - were the key drivers of the overall downturn in activity during September. Germany saw output decrease for the third month running and at a solid pace, albeit one that was slightly softer than seen in August. German manufacturing production declined at the fastest rate since the opening wave of the COVID-19 pandemic, while services activity was down marginally.

The contraction in France was more severe than in Germany, with activity decreasing to the largest extent since November 2020. Excluding pandemic affected months, the September contraction in output was the sharpest in over a decade. Rates of decrease quickened across both manufacturing and services.

The rest of theeurozone saw business activity remain broadly stable in September. Although manufacturing output decreased for a sixth month running, the fall was the softest since April. Meanwhile, services activity increased slightly, and to a greater extent than in August.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-fuels-further-downturn-worries-as-demand-weakness-intensifies-Sep23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-fuels-further-downturn-worries-as-demand-weakness-intensifies-Sep23.html&text=Eurozone+flash+PMI+fuels+further+downturn+worries+as+demand+weakness+intensifies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-fuels-further-downturn-worries-as-demand-weakness-intensifies-Sep23.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI fuels further downturn worries as demand weakness intensifies | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-fuels-further-downturn-worries-as-demand-weakness-intensifies-Sep23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+fuels+further+downturn+worries+as+demand+weakness+intensifies+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-fuels-further-downturn-worries-as-demand-weakness-intensifies-Sep23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}