Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 18, 2019

IHS Markit European GDP Nowcasts: Eurozone to grow by 0.1% in Q4, but contraction foreseen for stagnant Germany

Summary: 15th November 2019

PMI data aside, we are still waiting for new insightful information on economic conditions for the fourth quarter. That said, preliminary third quarter GDP estimates provide our dynamic factor model with key information to ascertain the likely trajectory of each country into year-end.

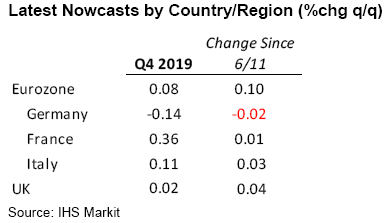

Starting with the eurozone, our nowcast here has been revised into growth territory, with an expansion of +0.08% forecast for the fourth quarter. A primary factor underpinning our +0.1 percentage point revision was industrial production data. Growth in September nudged up the outlook for the three months to December, although we note that manufacturing still looks set to negatively contribute to fourth quarter GDP based on current data and our models own forecasts.

Elsewhere, there is little material change to Germany, where, despite the surprising growth seen in the third quarter, our model is projecting a contraction in Q4 (-0.14%). The downward revision to second quarter GDP implies the economy here is in stagnation, (and a factor why the upside surprise in Q3 has had no material impact on the fourth quarter nowcast). We reiterate the signal from the October PMI surveys which showed manufacturing weakness remains prevalent and more tentative signs that spillover into the service sector have appeared.

Meanwhile, France's (relatively) impressive growth story so far this year looks set to continue in the fourth quarter (+0.36%q/q). Shelter from the external headwinds which have hit the likes of Germany has enabled a sustained upturn of the domestic economy. In Italy's case, our model implies that the country has clawed itself out from near-recession territory earlier in the year. Nevertheless, the growth potential here remains marginal at best (+0.11%q/q), with the economy particularly exposed to the performance of its German peer.

Across the channel, we have forecast stagnation for the UK economy in the fourth quarter (+0.02%q/q). Strong July data was a key factor behind the UK's third quarter expansion, but August and September data were disappointing and broadly flat. We anticipate this trend to persist over the final months of 2019.

Next Nowcast Update: November 22nd

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-to-grow-by-0.1-in-q4-nov19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-to-grow-by-0.1-in-q4-nov19.html&text=S%26P+Global+European+GDP+Nowcasts%3a+Eurozone+to+grow+by+0.1%25+in+Q4%2c+but+contraction+foreseen+for+stagnant+Germany+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-to-grow-by-0.1-in-q4-nov19.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts: Eurozone to grow by 0.1% in Q4, but contraction foreseen for stagnant Germany | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-to-grow-by-0.1-in-q4-nov19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts%3a+Eurozone+to+grow+by+0.1%25+in+Q4%2c+but+contraction+foreseen+for+stagnant+Germany+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-to-grow-by-0.1-in-q4-nov19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}