Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 11, 2019

Enterprise Data Management: A year in review

As we close the first quarter of a new year, I wanted to take a moment to reflect on the key trends we've witnessed in the data management market over the past 12 months and reflect on some of the milestones achieved within our Enterprise Data Management (EDM) business.

As the data management market matures, we continue to experience good momentum with 23 new clients in 2018 and 38 go-lives over the past two years. We see data management use cases expanding from core reference data into account, position, product, legal entity, transaction and regulatory datasets. As use cases expand, we too have grown our remit from core data management to encompass data warehousing, data delivery and data governance.

Many of our clients are now adopting our Managed Service as the wrapper around our EDM solutions so that we can manage the infrastructure, applications and operations on their behalf. In fact, over 60% of our new clients are hosted which is enabling us to deliver faster implementations as our work with Coronation Fund Managers in South Africa last year shows. The firm went live on EDM in just 14 weeks! In 2018, we also started migrating some of our deployed clients, such as McKinley Capital, to the Managed Service.

On the buy-side, the ever-changing reporting landscape continues to drive demand for accurate data warehousing capabilities. Our clients are typically facing three reporting pressures: the need to leverage data within customer reporting applications; pressure to produce reports to support RFPs and RFIs; and, finally, regulatory or legal compliance reporting pressures. Our head of EDM Warehouse, Kieran Gallagher, talks about these challenges in a recent video below:

Figure 1: Video - Kieran Gallagher on reporting trends

For our sell-side clients, we are seeing a continued focus on data optimization initiatives. Banks have historically consumed more data than they need which can lead to unnecessary costs. As data vendors increasingly audit clients and clamp down on data usage outside of the strict license agreements, the new visualization tools within EDM, coupled with our audit and lineage capabilities, are enabling clients to view and analyze their data consumption and optimize its usage across the firm. Empowering banks to proactively approach data vendors about changes in their data consumption requirements is enabling them to better manage these relationships, reduce costs and avoid fines.

As we see greater demand for Independent Price Verification and Product Control on the sell-side, we have also developed pre-packaged solutions for these use cases, so that clients can receive a quicker ROI.

Last but certainly not least, one of the major developments from the past year has been our move into a new vertical - energy. We have expanded EDM to manage non-financial data and specifically geo-spatial datasets which provide details on oil well production, location of wells and well depth, among other factors. We now have 15 energy clients, including Apache Corporation and Centennial. These new datasets are also of interest to our financial services clients as buy-side firms increasingly use so-called 'alternative data' to support their investment decisions. Watch the below video interview with Andrew Eisen to find out more (Figure 2).

Figure 2: Video - Andrew Eisen explains how financial firms extract value from alternative data

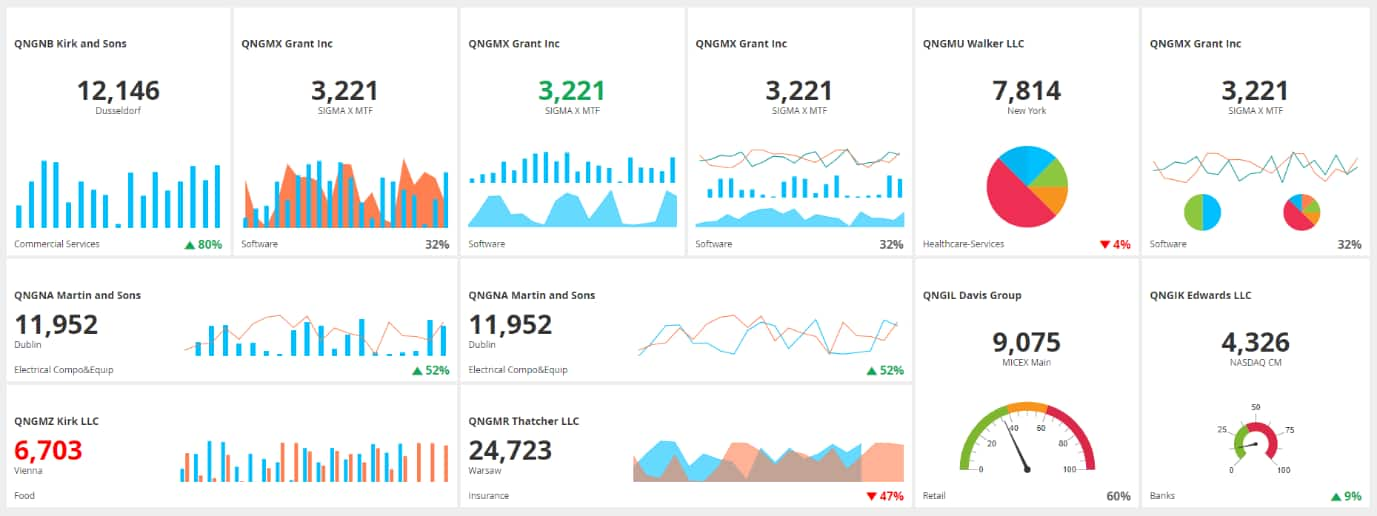

On the product side, one of the main developments in recent months has been the introduction of new data visualization tools to provide our clients with better insights into key metrics, drive workflows, and enable our users to easily access and query data through customizable dashboards, (see Figure 3).

Figure 3: User interface enhancements

Finally, we have also made good progress in integrating our investment management platform, thinkFolio, with our data management capabilities. The cross-app integration means that the client experience will be much improved with a single sign-on, cross application navigation bar and cross application favorites / bookmarks. We recently announced that Quilter Investors is implementing both EDM and thinkFolio as a managed service.

All in all, it's been a busy 12 months. Our drive to build on last year's successes and further enhance EDM remains unabated in FY19 as we focus on developing our data dictionary, moving to a next generation architecture and entering another new vertical. Watch this space for a further update mid-year!

For further information, please click here.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fenterprise-data-management-a-year-in-review.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fenterprise-data-management-a-year-in-review.html&text=Enterprise+Data+Management%3a+A+year+in+review+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fenterprise-data-management-a-year-in-review.html","enabled":true},{"name":"email","url":"?subject=Enterprise Data Management: A year in review | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fenterprise-data-management-a-year-in-review.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Enterprise+Data+Management%3a+A+year+in+review+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fenterprise-data-management-a-year-in-review.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}