Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 14, 2023

Emerging markets PMI signals encouraging resilience in August

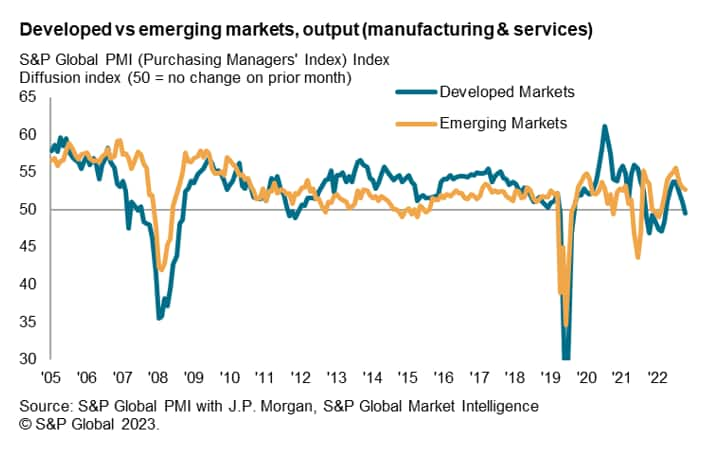

The slowdown in global growth in August was underpinned by a renewed developed market contraction, but growth across the emerging markets remained more resilient midway into the third quarter. Although the impact from rising borrowing costs, weakening trade conditions and inflation continued to weigh on economic growth across the world, the effect was merely to dampen growth in the emerging markets. India's expansion remained especially robust amid the global headwinds.

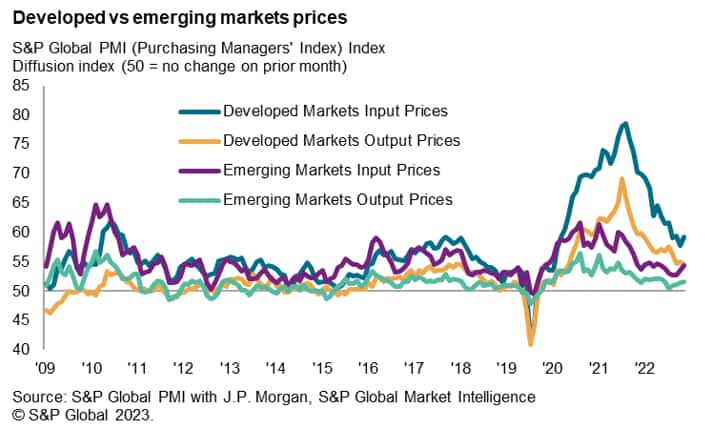

Consequent of the slowing growth momentum, price pressures remained subdued, but there were some signs of stickiness observed alongside a resurgence in input cost inflation pressures in both developed and emerging markets.

Emerging markets growth slows while developed market contraction renews

The latest PMI data outlined renewed a contraction in developed markets while emerging markets growth, across both manufacturing and service sectors, slowed for a third month in a row. The rate of expansion for emerging markets nevertheless remained marginally above the long-run average to indicate still-solid performance midway into the third quarter of 2023.

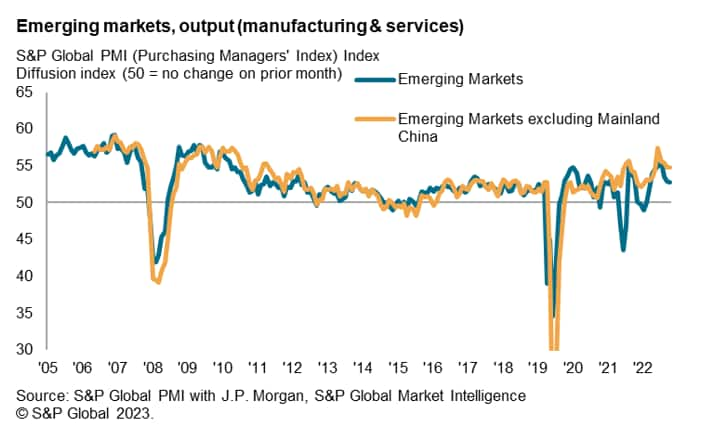

Moreover, much of the weakening growth trend in the emerging markets could be attributed to China, Notably, excluding mainland China, emerging market output growth accelerated in August and was well above the series long-run average to signal strong improvements in economic conditions.

PMI new export orders shrink faster among developed economies than in emerging markets

Once again, the paring of trade performance permeating both developed and emerging markets was underpinned to a large extent by deteriorating demand conditions globally.

A sharper decline in developed markets was however contrasted with shallower and only marginal deterioration in emerging markets trade in goods and services, though there may be limited room for celebration as new business inflows for emerging markets services from abroad fell for the first time in the year-to-date. Emerging market manufacturing new export orders meanwhile remained in contraction but at a markedly slower pace than July.

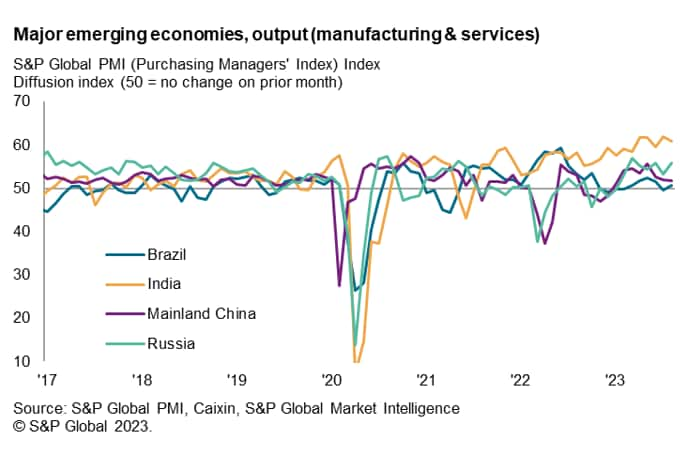

India remains a bright spot while Brazil returns to expansion

Focusing on the four major emerging economies' performance, India again stands out with exceptional growth momentum. Output growth, across both manufacturing and service sectors, in India continued to run at among the strongest rates in 13 years. Solid domestic activity coupled with improvements in foreign interests supported the latest expansion in output.

This was followed by an uptick in Russia's expansion as services activity improved at a quicker rate in August, more than making up for a slowdown in factory output.

Mainland China meanwhile saw the rate of growth ease for a third straight month in August, attributed mainly to further deceleration of services growth momentum as manufacturing output returned to expansion in August.

Finally, in Brazil, growth resumed in August after output fell in July with nascent improvements in the manufacturing sector as production rose for the first time in ten months while services activity held onto modest expansion.

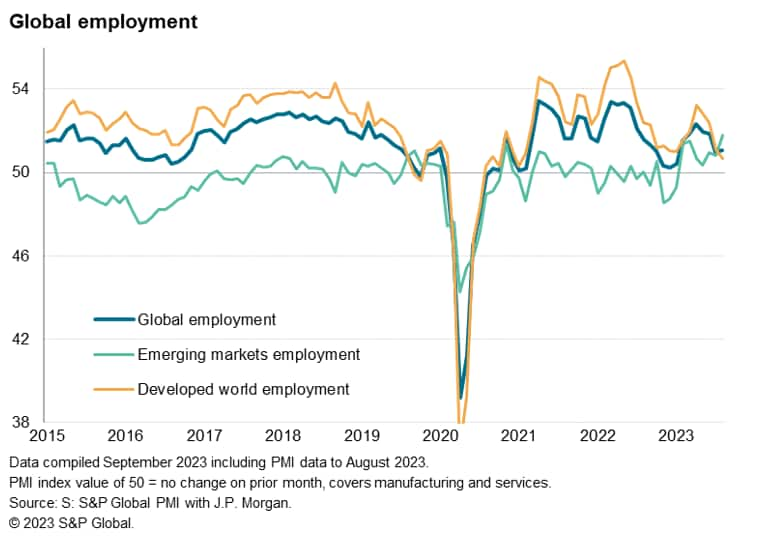

Emerging market inflation picks up amid rising employment in August

Despite softer conditions recorded in August for both emerging and developed economies, input cost inflation picked up in both regions. Input price inflation rose at a faster rate in August, still elevated above the series average while emerging market input cost inflation stayed relatively subdued, below the long-run average.

Some of the rising cost issues can be attributed to increased energy costs, according to anecdotal evidence in August. It will be of interest to examine if this persists in the coming months to cause greater stickiness in prices, even if it is unlikely to singlehanded spark a resurgence in inflation.

Meanwhile, the rate of input price inflation for emerging markets picked up for a third consecutive month in August. This led private sector companies in emerging markets to simultaneously raise their selling prices, though both input cost and output price inflation rates remain below their respective series averages, underscoring how inflation remains more of a concern in the developed world than in the emerging markets as a whole.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signals-encouraging-resilience-in-august-sep23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signals-encouraging-resilience-in-august-sep23.html&text=Emerging+markets+PMI+signals+encouraging+resilience+in+August+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signals-encouraging-resilience-in-august-sep23.html","enabled":true},{"name":"email","url":"?subject=Emerging markets PMI signals encouraging resilience in August | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signals-encouraging-resilience-in-august-sep23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+PMI+signals+encouraging+resilience+in+August+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signals-encouraging-resilience-in-august-sep23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}