Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 12, 2023

Emerging markets PMI signal growth momentum slowing at end of third quarter

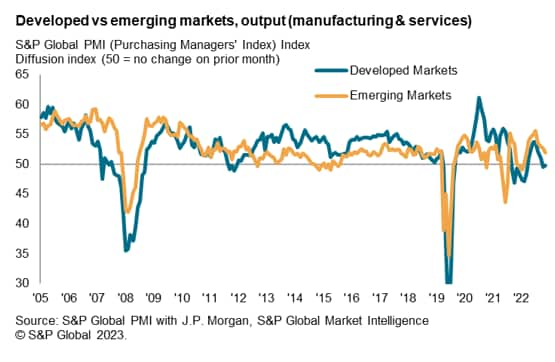

Global economic growth near-stalled for a second straight month in September amid a sustained contraction of developed market activity and an easing in the rate of emerging market expansion, according to the latest PMI indications. Slower expansions of both manufacturing and service sector activity caused overall emerging market output to expand at the weakest pace since January.

Although still relatively resilient, the latest PMI data extends the trend of slowing economic growth for emerging markets to a fourth month. This is while softening business optimism and a renewed contraction in backlogged work outline the possibility for a further easing of growth momentum as we head into the fourth quarter.

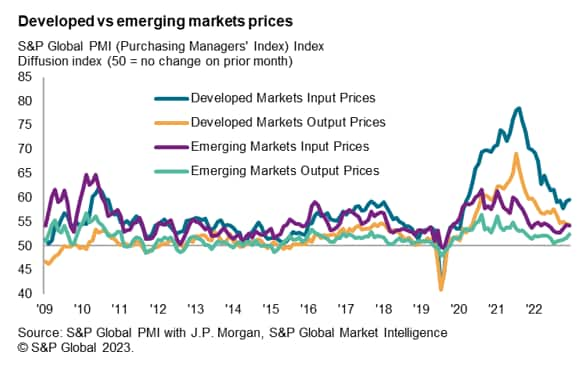

Amid softening demand conditions, cost pressures eased for emerging market firms. However, businesses passed on prior cost increases to result in the highest rate of selling price inflation in 14 months.

Emerging market expansion decelerates for fourth straight month

September's PMI data outlined a second consecutive month in which developed markets experienced a mild contraction in private sector output, measured across both manufacturing and services. This was accompanied by a fourth successive slowdown in emerging market growth, leading to the softest expansion in emerging market output in eight months.

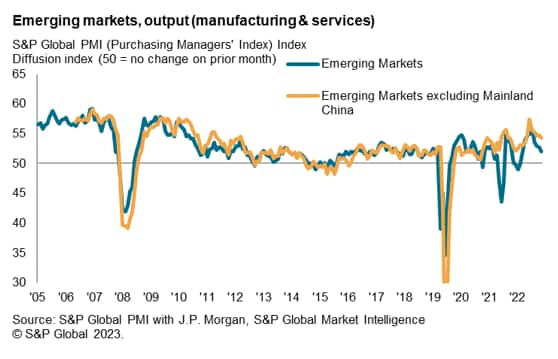

Once again, the slowdown in emerging market growth was less pronounced when mainland China is excluded. The emerging markets ex-China PMI declined only slightly from August, remaining well above the series long-run average to signal solid improvements in economic conditions. In contrast, mainland China's activity rose at the shallowest pace since renewed growth was seen at the start of the year.

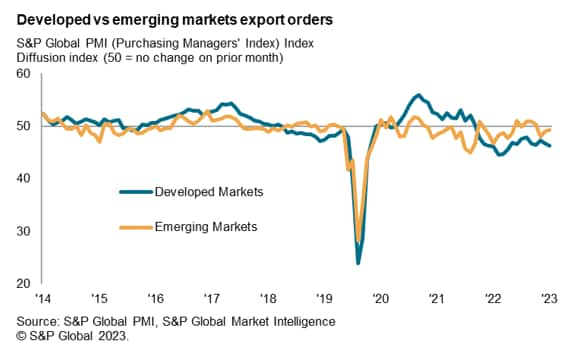

New orders performance diverge between developed and emerging markets

Underpinning the difference in output performance between emerging and developed markets was the divergence in new orders, including new export orders. While developed markets saw the sharpest contraction in overall new orders in nine months, emerging markets new business growth merely moderate. Meanwhile, new export orders fell at a slower and only marginal pace in emerging markets. In contrast, developed markets saw the sharpest fall in new export orders in nine months.

To a large extent, the weakness in the goods producing sector has been driven by a sustained deterioration in trade conditions and this appeared to have disproportionately affected developed markets compared to emerging economies. That said, service providers in developed markets also saw the first deterioration in foreign demand since February and at a solid rate, hinting at a broadening out of the trade malaise.

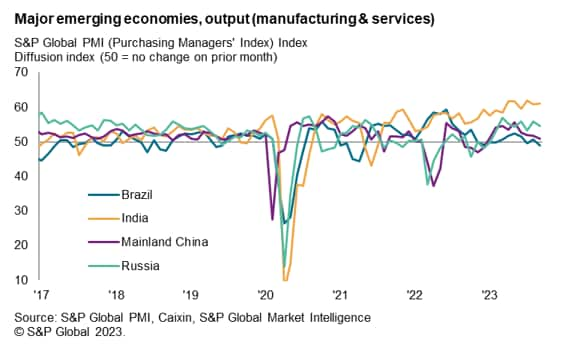

India continues to lead emerging market growth

Examining the growth of the four major emerging economies, India continued to stand out with exceptional growth momentum. Furthermore, India was the only one of the four to see growth accelerate from August, with output expanding at one of the strongest rates in just under 13 years. Supporting the strong expansion in India's output was the second-fastest rise in new business in over 13 years amid favourable demand conditions and positive market dynamics, according to surveyed companies. Manufacturing output and services activity rose at comparable strong paces in India over September.

India's growth surge was accompanied by more modest expansions in Russia and mainland China, both of which experienced a slowdown in growth from August. China (mainland) notably saw its services activity near-stall in September, after the sector had played a key role in supporting growth earlier in 2023. Manufacturing output consequently overtook services to rise at a faster rate in mainland China. Broadly, however, business confidence in the mainland weakened to the lowest since last November, hinting at reduced optimism regarding future output.

Finally, Brazil returned to contraction after eking out modest growth midway into the third quarter. Business activity in Brazil has now declined in half of the year-to-date , and with both manufacturing and services activity posting sub-50.0 (contraction) readings to signal a broad-based reduction in output.

Margins improve for emerging market firms

Price pressures slightly eased for emerging market firms after rising in August, helped by softer service sector cost inflation. That said, solid demand growth in emerging markets reportedly enabled businesses to pass on higher costs at a faster rate at the end of the third quarter. This led to a slight acceleration in emerging market selling price inflation, which hit the highest in 14 months to climb above the series average. This bodes well for emerging market firms' profits.

In contrast, developed market profit margins appear to be coming under pressure amid a faster, and still-elevated, rate of input cost increases, while selling price inflation dip in September. Overall developed market selling prices nevertheless continued to rise at a rate well above the long-run average, outlining the pressure of higher prices on clients' demand amidst an environment of high interest rates and softening global economic conditions.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signal-growth-momentum-slowing-at-end-of-third-quarter-oct23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signal-growth-momentum-slowing-at-end-of-third-quarter-oct23.html&text=Emerging+markets+PMI+signal+growth+momentum+slowing+at+end+of+third+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signal-growth-momentum-slowing-at-end-of-third-quarter-oct23.html","enabled":true},{"name":"email","url":"?subject=Emerging markets PMI signal growth momentum slowing at end of third quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signal-growth-momentum-slowing-at-end-of-third-quarter-oct23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+PMI+signal+growth+momentum+slowing+at+end+of+third+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-pmi-signal-growth-momentum-slowing-at-end-of-third-quarter-oct23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}