Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 09, 2024

Emerging markets growth accelerates at the start of 2024

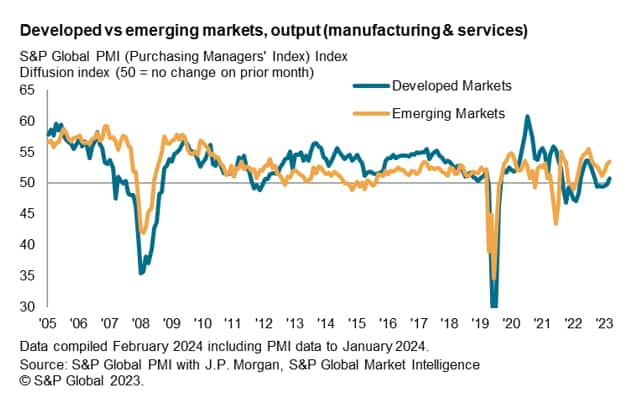

A third consecutive monthly acceleration in global output growth was supported by faster emerging market expansion while developed markets also returned to growth for the first time in six months. Overall, emerging markets continued to lead growth at the start of the year, with improvements seen in India and Brazil, while mainland China and Russia continued to see steady expansions.

Forward-looking indicators, including the Backlogs of Work and Future Output indices, further painted a positive picture for emerging markets output growth in the near-term. Additionally, price pressures abated for emerging markets in the latest survey period, boding well for the inflation trend at the start of the year.

Emerging markets expand at fastest pace since June 2023

The expansion of emerging markets continued at the start of 2024, according to PMI data, extending the sequence of growth to just over a year. Moreover, the pace of growth accelerated for a third straight month to the fastest since last June, playing a key role in supporting a faster expansion of global output at the start of the year, although developed markets output also helped by returning to expansion for the first time since July 2023.

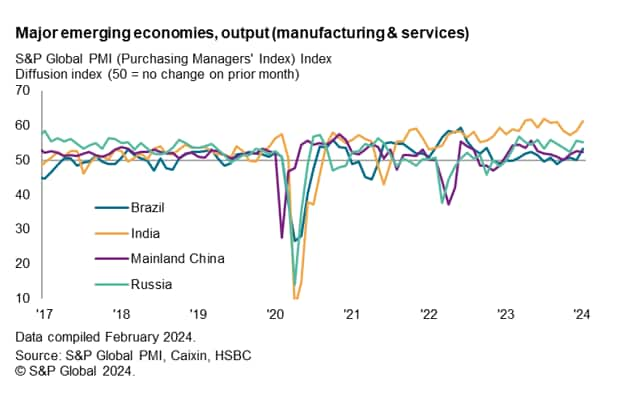

India continued to stand out at the start of the year with a further acceleration in the pace of growth to the fastest in six months, aided by improvements in both manufacturing and service sectors. Brazil meanwhile saw private sector activity return to growth in January after stagnating over December. Russia and mainland China's growth rates moderated slightly from December, but continued to reflect solid and modest rates of improvement respectively.

Emerging market expansion set to continue in near-term

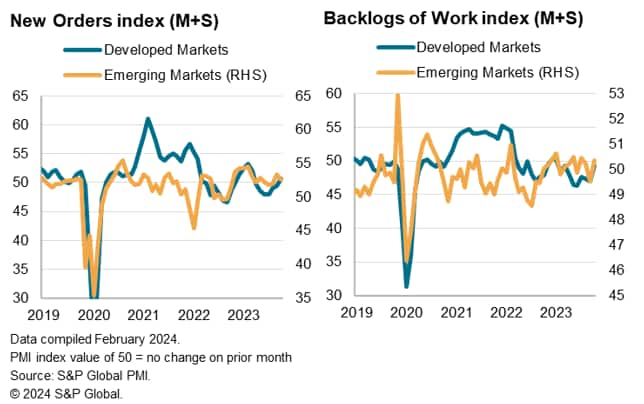

Forward-looking indicators meanwhile hint at the likelihood of the emerging market expansion sustaining further into the year. The seasonally adjusted Backlogs of Work index for emerging markets rose back above the 50.0 no-change mark to indicate that outstanding business had again accumulated in the emerging market space while new orders again expanded, albeit at a slightly softer rate.

In contrast, developed market firms continued to clear their backlogged work at the start of the year. Although, the rate of depletion slowed alongside a renewed rise in new orders, which may hint at further improvements in the near-term.

Broadly, the level of optimism among emerging markets firms remained unchanged from the three-month high in December and further rose in developed markets, suggesting that global businesses are generally positive with regards to output growth in the coming 12 months.

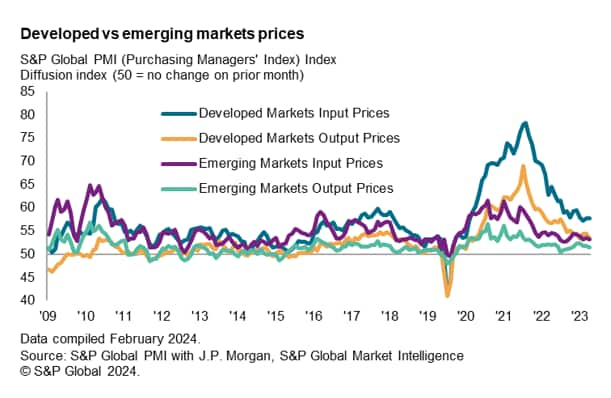

Inflation ease in emerging markets

While business activity expanded at a faster rate, inflationary pressures also eased for emerging markets in the beginning of the year, supporting sales. This was despite reports of higher shipping costs among global manufacturers. A closer look at where the delays for goods producers are concentrated point to developed market firms as the ones bearing the brunt of recent deteriorations in vendor performance, while emerging market manufacturers in fact saw lead times lengthen at a less pronounced rate in January. Indeed, given European economies being the ones most geographically affected by the disruption from the Red Sea crisis, most emerging markets appear mostly unscathed at the moment. In turn , emerging market also saw trade conditions improve for the first time in seven months, with renewed goods export order expansion helping to counter a marginal decline in services export trade.

Overall, however, it is worth highlighting that the easing of output price inflation was not exclusive to emerging markets as developed market output prices increased at the slowest pace since last October. This contributed to average prices charged for goods and services to rise at the slowest rate since October 2020 and signal that we may see further progress in inflation cooling in the coming months. With developed market central banks playing a key role in determining global interest rates, the latest data suggest prices are trending in the right direction for further loosening of financial conditions in the coming months which will be supportive for further output growth in both developed and emerging market economies.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-accelerates-at-the-start-of-2024-feb24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-accelerates-at-the-start-of-2024-feb24.html&text=Emerging+markets+growth+accelerates+at+the+start+of+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-accelerates-at-the-start-of-2024-feb24.html","enabled":true},{"name":"email","url":"?subject=Emerging markets growth accelerates at the start of 2024 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-accelerates-at-the-start-of-2024-feb24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+growth+accelerates+at+the+start+of+2024+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-accelerates-at-the-start-of-2024-feb24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}