Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 14, 2020

Dry Bulk Trade: China's record low coal imports in December, a signal for a record high in January 2020?

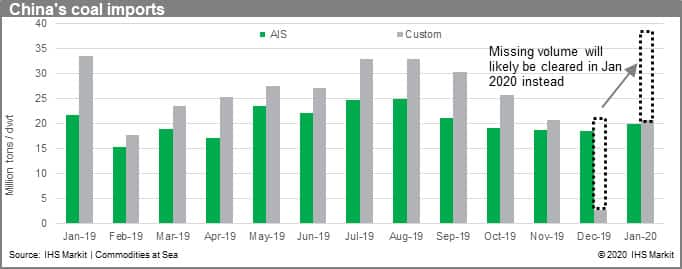

China's coal imports rose to 299.7 million tonnes in 2019, customs data showed on Tuesday, despite a government control to cap coal shipments at the 2018 level.

China's 2019 coal imports were up 6.3% compared with 2018 levels, while December's imports tumbled nearly 73% to 2.77 million tonnes, marking the lowest monthly level in more than a decade after customs stopped clearance at nearly all ports in the final month of 2019.

China coal imports to increase in January with eased import control

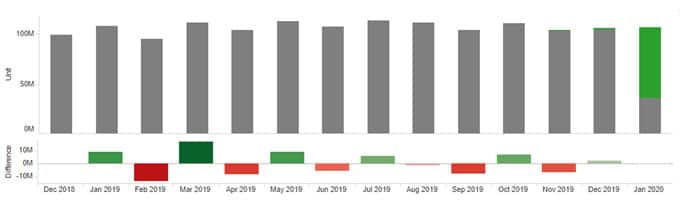

Source: IHS Markit Commodities at Sea

In reality, around 18 million tonnes of coal arrived in December 2019 based on commodities trade flow intelligence, IHS Markit Commodities at Sea.

Even considering land transported volume from Mongolia and Russia, understood to have around a 20% market share in China's coal imports, the custom clearance figure in December 2019 indicates the large missing volume will be pushed into 2020.

In our view, January's coal imports in China might be a record volume with December's missing cargo included. However, actual coal shipments to China will not jump significantly as major coal exporters including Indonesia and Australia usually have a seasonal decline in production over the first quarter of the year with weather disruption including heavy rain and cyclones.

IHS Markit Freight Rate Forecast for dry bulk is currently taking the following view for the Chinese coal trade outlook:

- We are likely to see a record clearance volume in January 2020, with December's missing cargo included, as happened last year.

- China's coal imports are projected to recover in the next few months, with expectations that controls will be eased at major receiving ports at the beginning of January.

- Furthermore, there will be speculative demand from traders as international prices remain attractive compared with Chinese domestic prices.

- However, coal import growth over the first quarter will be limited with major coal exporters experiencing a seasonal decline in production and Chinese New Year approaching at the end of January.

- China's total import quota is expected to be capped at around 300 million tonnes this year.

- Upside risk:

- The China-US trade relations have stablized

- The Chinese central government introduced further stimulus measures to maintain a healthy economic growth for next year

- International coal prices remain attractive enough for traders to continue to speculate

- Downside risk:

- Tougher coal import controls introduced by the Chinese government

- Lower than expected coal consumption with higher alternative energy production including hydro and renewables

- Chinese domestic coal production increased significantly

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-chinas-record-low-coal-imports-in-december.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-chinas-record-low-coal-imports-in-december.html&text=Dry+Bulk+Trade%3a+China%27s+record+low+coal+imports+in+December%2c+a+signal+for+a+record+high+in+January+2020%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-chinas-record-low-coal-imports-in-december.html","enabled":true},{"name":"email","url":"?subject=Dry Bulk Trade: China's record low coal imports in December, a signal for a record high in January 2020? | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-chinas-record-low-coal-imports-in-december.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dry+Bulk+Trade%3a+China%27s+record+low+coal+imports+in+December%2c+a+signal+for+a+record+high+in+January+2020%3f+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-chinas-record-low-coal-imports-in-december.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}